In general you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between 12490 to 49960 or if. However youre probably eligible for Medicaid depending on your states rules.

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

If your household makes less than 100 of the federal poverty level you dont qualify for premium tax credits Obamacare subsidies.

2020 obamacare income limits. Remember the federally facilitated Affordable Care Act Marketplace savings are based on your expected household income for 2021 not last years income. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage. Less Than 100 of FPL.

Including the right people in your household. To learn more its important to apply directly to your states. I had significant income from unemployment in 2020.

You can be worth millions of dollars and still receive Obamacare subsidies if your income is below 45000 per individual or 95000 for a family of four for example. In addition to the maximum income to receive the premium subsidy theres also a minimum income to get accepted by the ACA marketplace. 1 For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan before marketplace subsidies.

They will attempt to send you to Medicaid instead. Here are the limits for 2018 plans for individuals and families. In states that didnt expand Medicaid the minimum income.

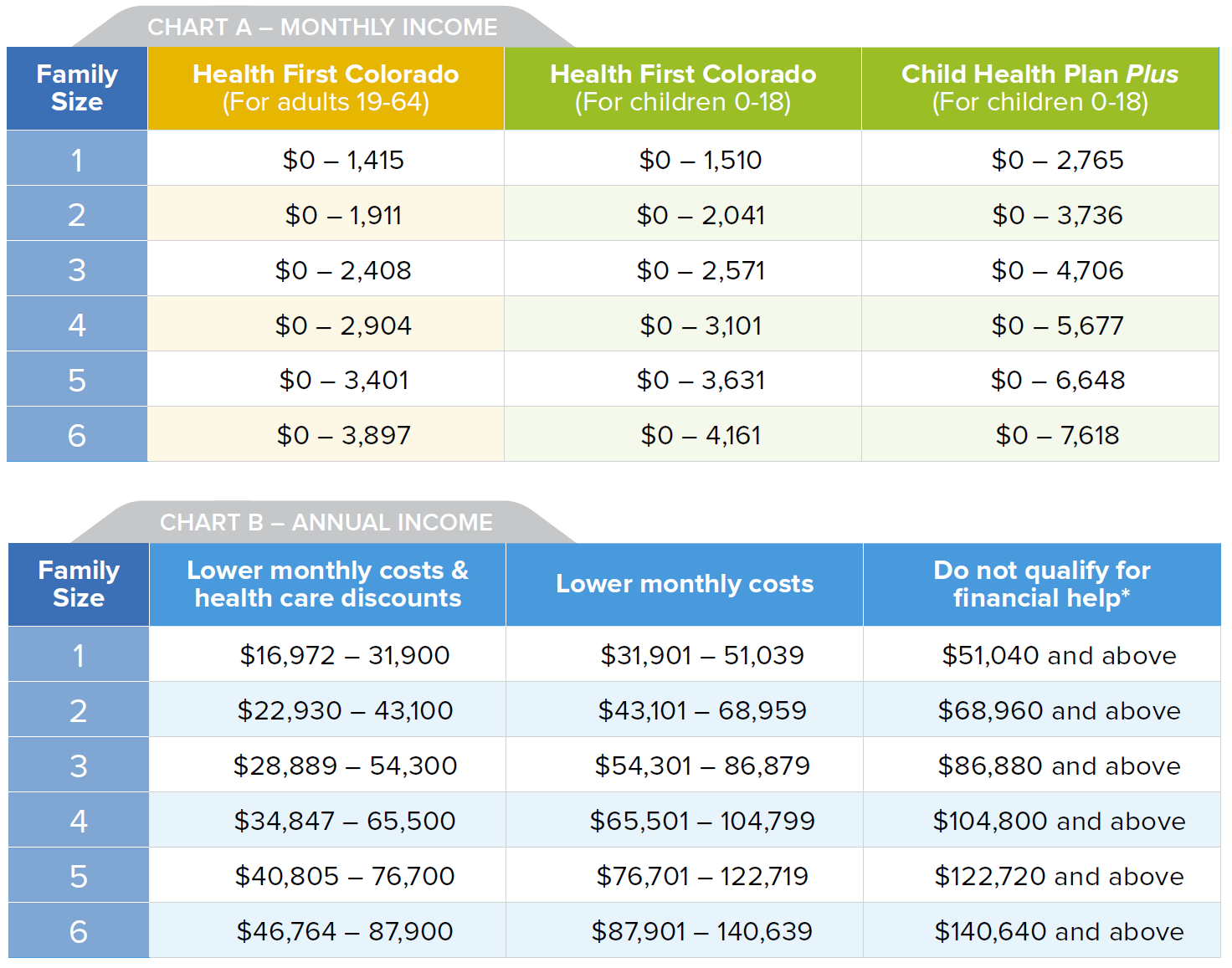

For 2020 your maximum deductible is the same as the out-of-pocket maximum. You may qualify for a 2020 premium subsidy if your yearly income is between. The upper cutoff to receive subsidies for 2021 plans is 51040 for a single person 68960 for a family of two 86880 for a family of three 104800 for a family of four 122720 for a.

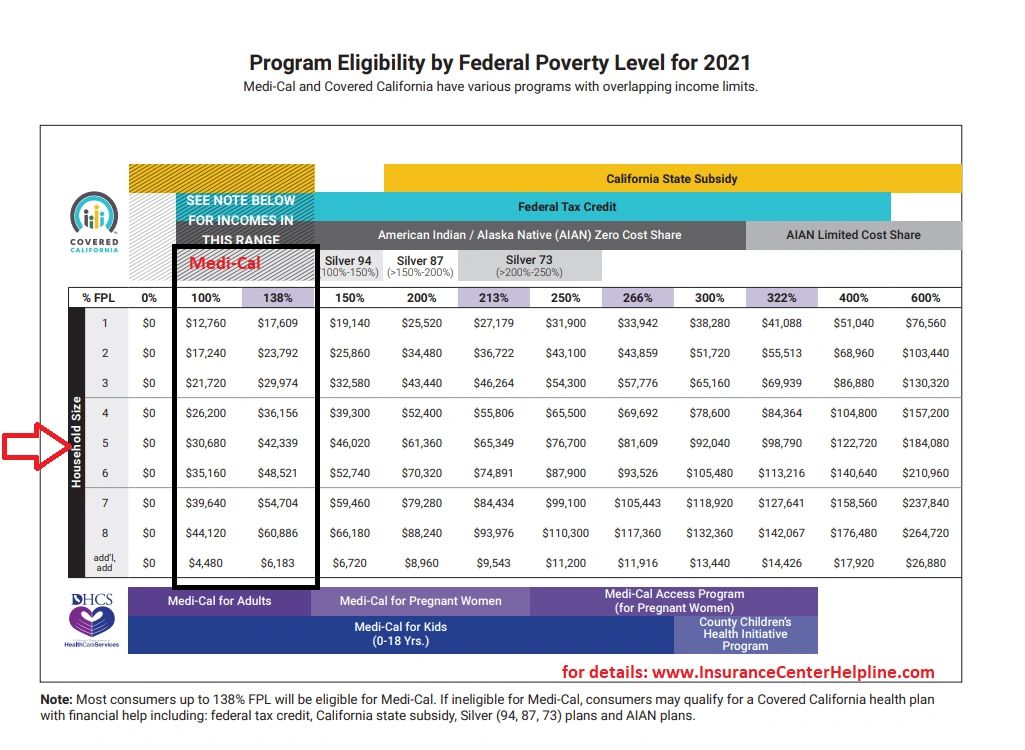

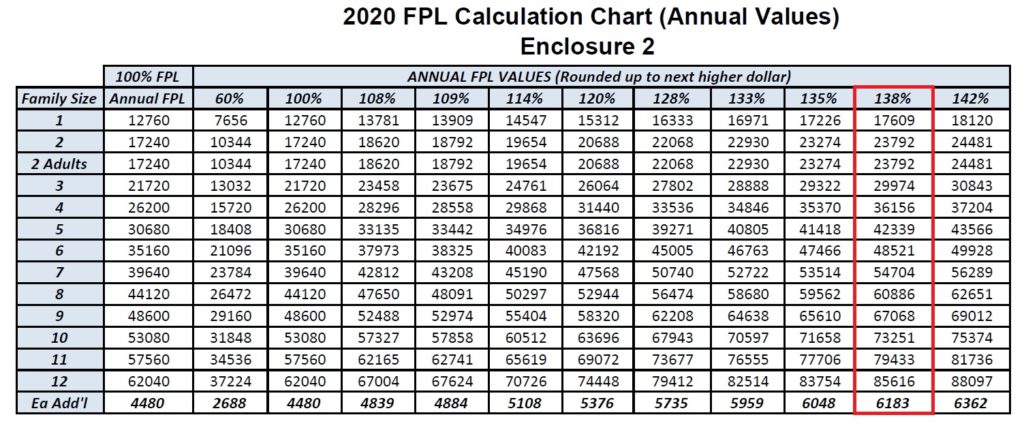

You may qualify for free or low-cost care for Medicaid based on income and family size if you make 138 of the poverty level or for example 17609 individual or 36156 for a family of four in 2020. If your estimated income is too low the ACA marketplace wont accept you. In 2020 for example thats a family of four with an income between 26200 and 104800 a year.

3 Americans in this income range are caught in the trap where they make too much for Medicaid but not enough to afford private health plans. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify. What are the Obamacare income limits for 2020.

SUBSCRIBE for good luck. Prior to passage of the American Rescue Plan in March 2021 I was at 166 of the FPL. As requirements vary by state reach out to your states Medicaid office or insurance office with eligibility questions.

You may qualify for a premium subsidy AND a cost share reduction if your yearly income is between 17236 -31225. Each year the ACA sets new limits for out-of-pocket maximums and deductibles. Glad for so many who were paid unemployment in 2020 that 10200 of unemployment is tax exempt but it appears to create a problem or at least confusion with 2020 ACA while doing 2020 taxes.

We take a deep look at the question. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. You might find however that your kids are eligible for Medicaid or CHIP which would mean that subsidies would only apply to adults in.

You simply wont qualify for monthly premium assistance if you make more than the income limit. Out-of-Pocket Maximums and Deductible Limits For 2020. What is the maximum income for ObamaCare.

In 32 states plus Washington DC that expanded Medicaid the minimum income is 138 FPL. Specifics may differ by state. Premium subsidies are available for a family of five in 2020 with a total annual income up to nearly 121000 and with an income of nearly 123000 in 2021.

With passage of the American rescue plan 10200 of my unemployment pay in 2020. So you should still be well within the subsidy-eligible range even if you end up getting extra unemployment benefits. 1 Find out how to estimate your expected income Healthcaregov.

Out-of-Pocket Maximums and Deductible Limits For 2020 For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan. This tool provides a quick view of income levels that qualify for savings. You might be surprised by the answer.

Learn more about who to include in your household.

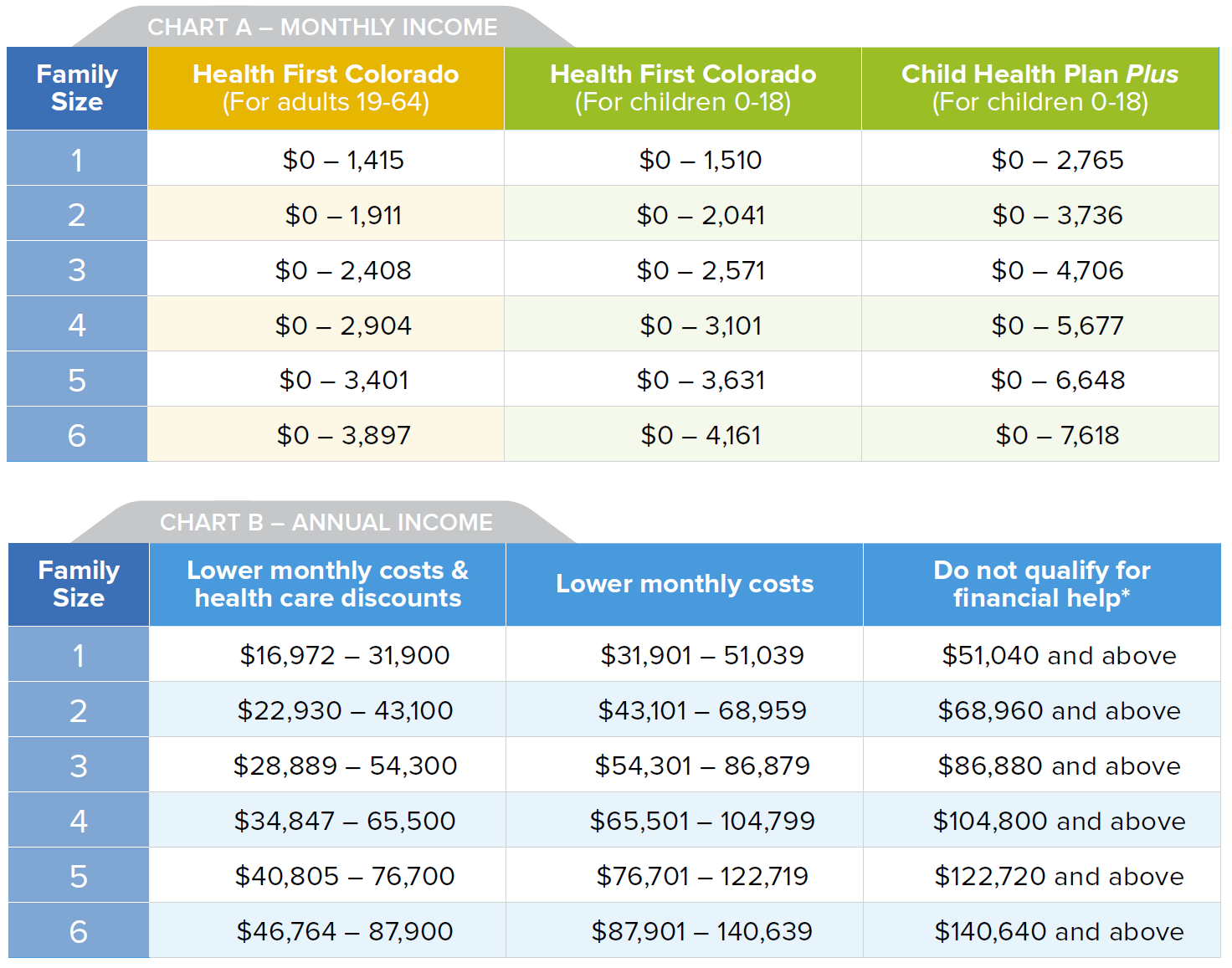

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

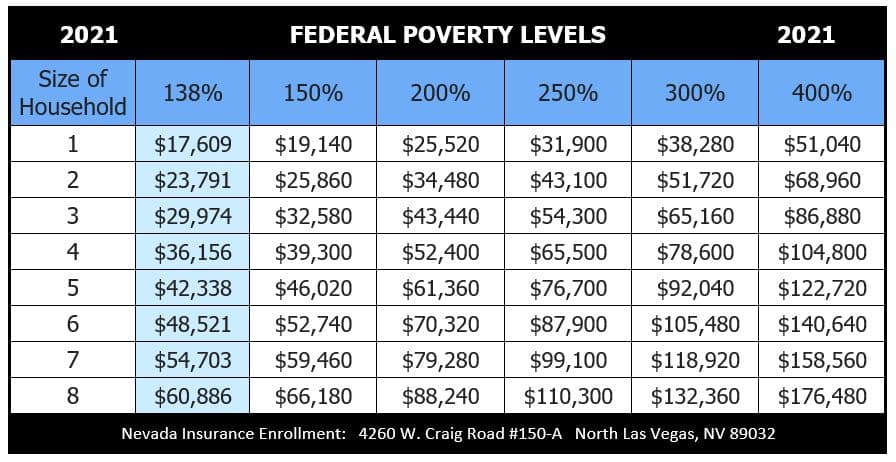

2021 Health Insurance Federal Poverty Level Chart

2021 Health Insurance Federal Poverty Level Chart

Health Insurance In Las Vegas Nv Health Insurance Agent

Health Insurance In Las Vegas Nv Health Insurance Agent

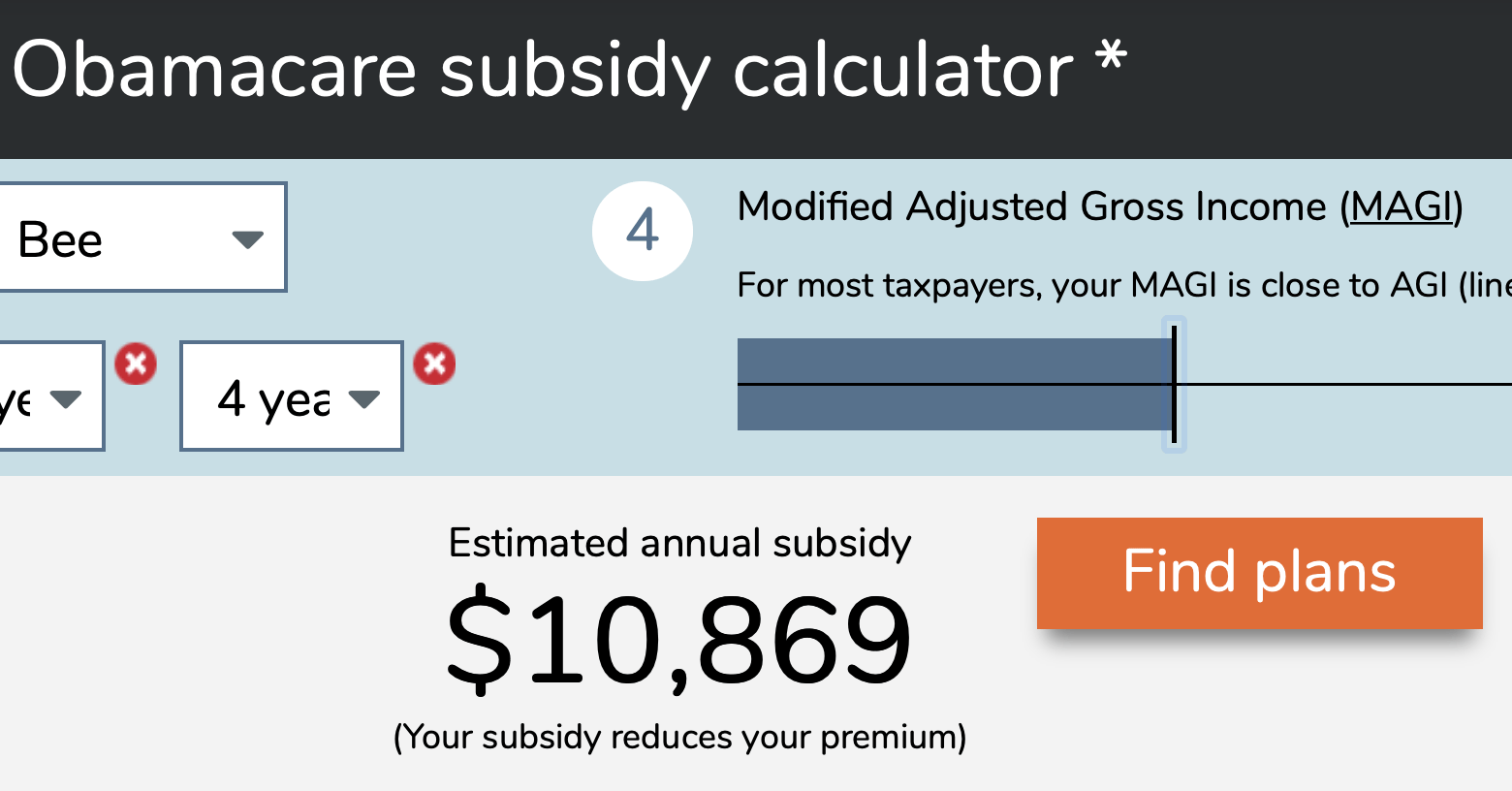

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

2015 Aca Obamacare Income Qualification Chart My Money Blog

2015 Aca Obamacare Income Qualification Chart My Money Blog

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

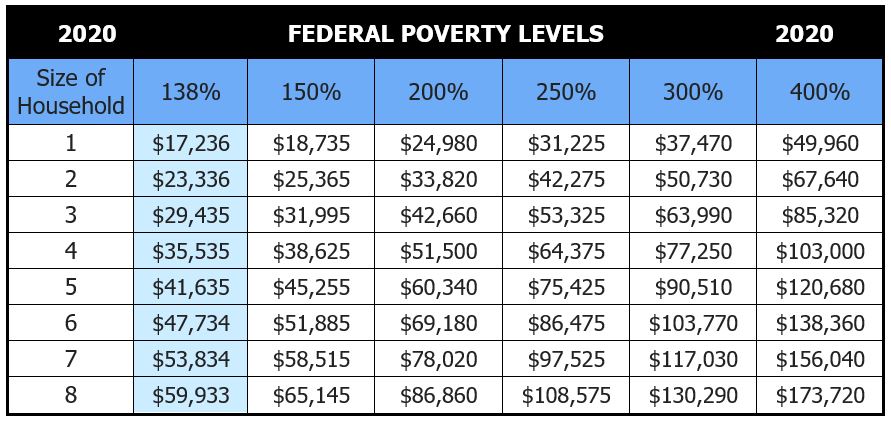

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.