35 Zeilen CMS released the 2020 low-income premium subsidy amounts or. The amount of extra help you get will determine your total monthly plan premium as a member of our Plan.

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

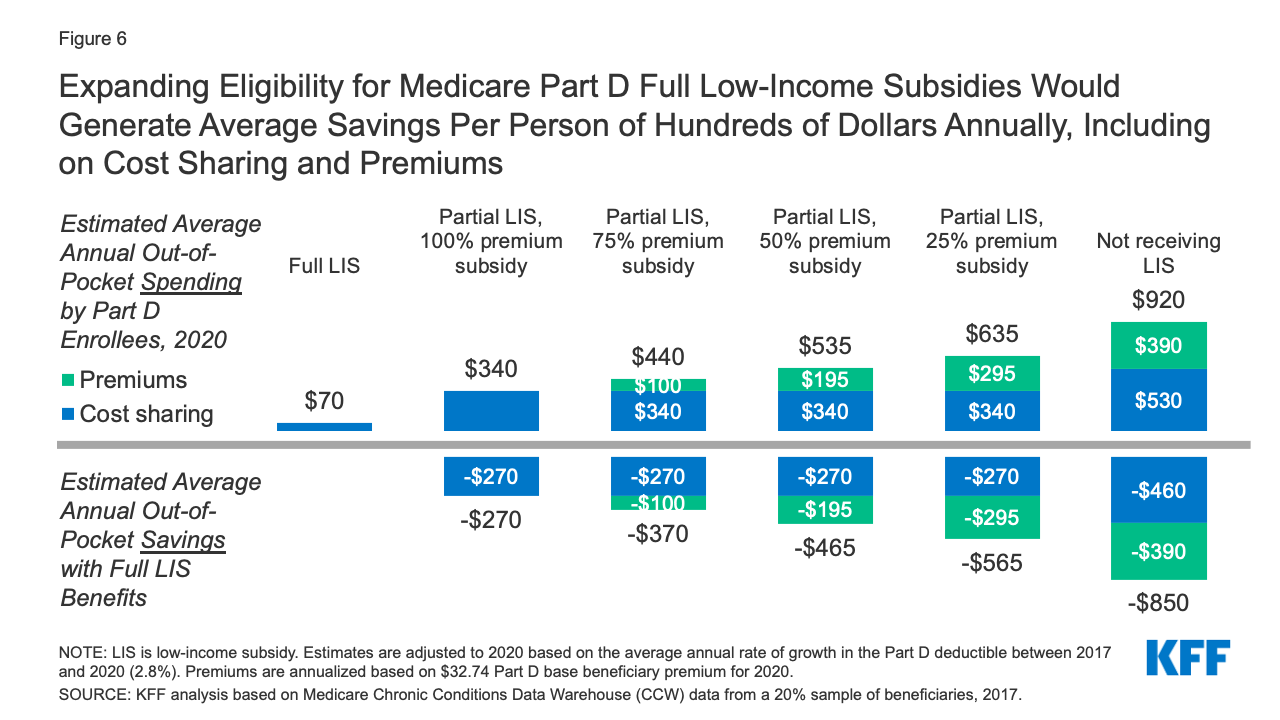

Extra Help Low Income Subsidies can help Medicare enrollees pay for various prescription costs including premiums deductibles and copays.

Low income subsidy 2020. This page contains information on eligibility for the Low-Income Subsidy also called Extra Help available under the Medicare Part D prescription drug program. How to Apply for Extra Help 2020 Medicare Low Income Subsidy LIS. Eligibility for Low-Income Subsidy.

When Can I Sign Up for the Benefit. These limits include a 20 income disregard that the Social Security Administration SSA automatically subtracts from your monthly unearned income eg retirement income. The Extra Help is estimated to be worth about 5000 per year.

In other words if your income is below LICO you are poor. The 2020 adjustment factor for the low-income subsidy resource limits is 137. It includes information on how one becomes eligible for the Low-Income Subsidy as well as useful outreach material.

Or Meets the eligibility criteria for a participating providers existing low-income or COVID-19 program. The Social Security Administration SSA and the Centers for Medicare Medicaid Services CMS work together to provide the benefit. Those whose incomes are.

The subsidy is based on the guarantee that you pay no more than a certain percent of your income for the second-lowest Silver plan. The application for Community Care Fund CCFs One-off Living Subsidy for Low-income Households Not Living in Public Housing and Not Receiving Comprehensive Social Security Assistance CSSA Programme 2020 was closed on 30 November 2020. Beneficiaries with Medicare who have limited income and assets may qualify for Extra Help with the costs of their prescription drugs.

This is how to save on PrescriptionsEligible beneficiaries who have limited income may. To apply for Low Income Subsidy LIS complete the Social Security Application for Extra Help with Medicare Prescription Drug Plan Costs SSA-1020. You may download a copy of Childcare Infant Care Subsidy infographics here.

The percentage varies based on your income. This program is also known as LIS or the Part D Low Income Subsidy. Apply for Extra Help.

The 2020 Federal Poverty Level FPL Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy LIS program also known as the Extra Help program. Child Care Infant Care Subsidy Calculator. To qualify for the Extra Help a person must be receiving Medicare have limited resources and income and reside in one of the 50 States or the District of Columbia.

Explanatory Notes on Infant Care and Child Care Subsidies. Per the statute Per the statute the resource limits are increased by. In 2020 two groups of Medicare beneficiaries.

Apply online at wwwssagovextrahelp. For example if your income is between 100 and 133 of the FPL subsidies will cover any premium costs above 206 of your annual household income. You may refer to our FAQs and additional information of subsidy via the link below.

The Medicare Part D Extra-Help or Low-Income Subsidy program helps pay both your monthly Medicare prescription drug plan. Those whose incomes are between 135 percent and 150 percent of FPLup to 19140 for an individual and 25860 for a couple. Call Social Security at 1-800-772-1213 to apply over the phone or to request an application.

The Low Income Subsidy resource limits for 2020 have been announced so this is a great time to remind your clients about this important source of financial assistance. The first table on this page shows LICO for those people who intend to immigrate to Canada in 2020. Experienced a substantial loss of income due to job loss or furlough since February 29 2020 and the household had a total income in 2020 at or below 99000 for single filers and 198000 for joint filers.

Both groups must also have assets that fall within specific lower and upper limits. You may do it one of three ways. Supporting Documents Checklist.

LICO changes every year due to inflation. The low-income cut-off LICO table represents the poverty line in urban areas of Canada with a population of 500000 or more. 2020 Medicare Low-Income Subsidy LIS Eligible patients may be able to access brand-name drugs for less than 10 per month.

Low Income Subsidy Premium Table - 2020 If you get extra help from Medicare to help pay for your Medicare prescription drug plan costs your monthly plan premium will be lower than what it would be if you did not get extra help from Medicare.

:max_bytes(150000):strip_icc()/subsidy-6-56a27d9b3df78cf77276a4e5.png)