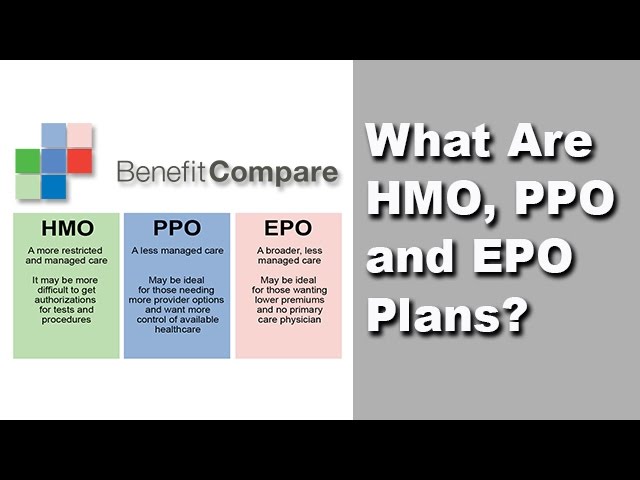

EPO health insurance got this name because you have to get your health care exclusively from healthcare providers the EPO contracts with or the EPO wont pay for the care. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO.

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO.

What does epo in health insurance mean. An EPO Exclusive Provider Organization insurance plan is a network of individual medical care providers or groups of medical care providers who have entered into written agreements with an insurer to provide health insurance to subscribers. Members however may not need a referral to see a specialist. An EPO is a managed care plan in which services are only covered if the patient sees a doctor specialist or hospital within the plans network.

The Exclusive Provider network or EPO is a managed care plan where services are covered only if you go to doctors specialists or hospitals in. Exclusive provider organizations EPOs are a lot like HMOs. If its not an emergency and you see an out-of-network provider you will have to pay the full cost out of your pocket.

This allows people who have trouble getting insurance that allows them to afford care to have a regular physician who knows their case and can advise them on what they should do regarding their ongoing health care. However an EPO generally wont make you get a referral from a primary care physician in order to visit a specialist. There are a number of different types of networks with HMO PPO EPO and POS being some of the most common.

An Exclusive Provider Organization plan EPO is similar to an HMO plan in that it has a limited doctor network and no out-of-network coverage but it is similar to a PPO plan in that you dont have to designate a primary care physician upon applying and you dont need a referral to see a specialist. The only exception is that emergency care is usually covered. An EPO Exclusive Provider Organization plan lets you use any of the providers within the EPO network.

However there are some exceptions to this rule such as if the patient experiences a medical emergency. Like a PPO you do not need a referral to get care from a specialist. Organization EPO Exclusive Provider Organization and HDHP High Deductible Health Plan.

EPO health insurance stands for Exclusive Provider Organization. Like HMOs EPOs cover only in-network care but networks are generally larger than for HMOs. However there are no out-of-network benefits - meaning you are responsible for 100 of expenses for any visits to an out-of-network doctor or hospital.

An EPO plan may be right for you if. This managed care health plan comprises a network of health care providers that the EPO contracts with at negotiated rates. Your insurance will not cover any costs you get from going to someone outside of that network.

Exclusive Provider Organization EPO EPOs got that name because they have a network of providers they use exclusively. An exclusive provider organization or EPO is a health insurance plan that only allows you to get health care services from doctors hospitals and other care providers who are within your network. Many health insurance cards show the amount you will pay.

There are no out-of-network benefits. They may or may not require referrals from a primary care physician. As a member of an EPO you can use the doctors and hospitals within the EPO network but cannot go outside the network for care.

EPO is just one of several common health insurance plans offered by employers. You must stick to providers on that list or the EPO wont pay. Under an EPO plan you can go to a doctor andor hospital that is in-network.

Like an HMO your care is covered only if you see a provider in the plans network unless its an emergency as defined by the plan. A type of managed care health insurance EPO stands for exclusive provider organization. They generally dont cover care outside the plans provider network.

EPO stands for Exclusive Provider Organization plan. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. Basically an EPO is a much smaller PPO.

An exclusive provider organization EPO health insurance plan offers the cost savings of an HMO with the flexibility of a PPO. An Exclusive Provider Organization EPO is a lesser-known plan type. Exclusive Provider Organization EPO combines elements of PPOs and HMOs.