Your FSA will include the existing Health Spending Account HSA and the additional Wellness Spending Account WSA. Flexible Spending Account FSA An FSA account can be used.

Everything You Need To Know About Health Savings Accounts And Flexible Spending Accounts Blue Cross And Blue Shield Of Illinois

Everything You Need To Know About Health Savings Accounts And Flexible Spending Accounts Blue Cross And Blue Shield Of Illinois

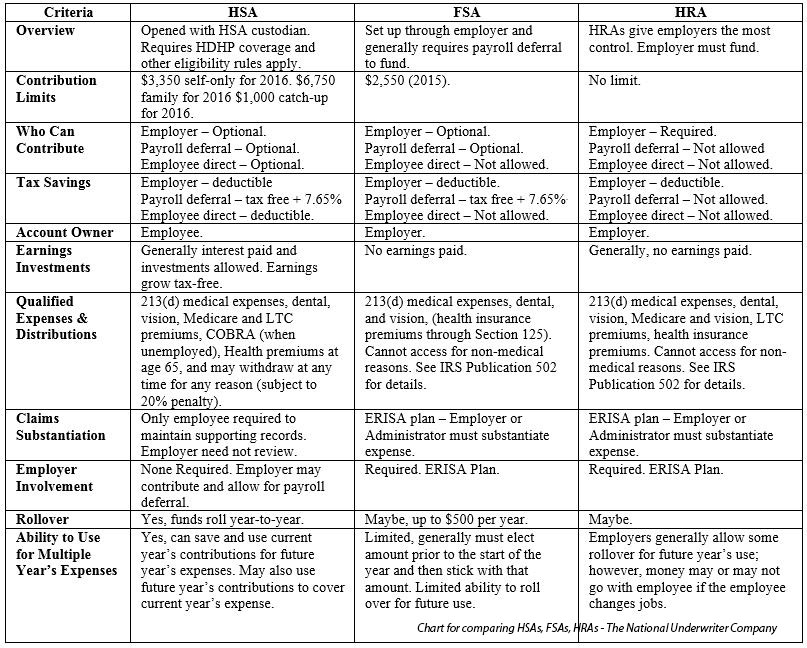

A healthcare flexible spending account FSA is a benefit that allows employees to set aside pretax funds on an annual basis to pay for qualified healthcare expenses.

Blue cross flexible spending account. Your employer owns the account but you are the one. The total amount you choose to deposit is taken out of your paycheck over time but you get the full amount for use at the beginning of the year. To make your FSA work with HSA requirements your employer should provide a special FSA plan for you instead of a general purpose FSA.

Blue Cross and Blue Shield of Vermont will always attempt to pay your expenses from the FSA first as this is a use it or lose it type of account. Flexible Spending Account FSA This is a tax-advantaged account that allows you to pay for qualified medical expenses not covered by your plan such as copays deductibles coinsurance and certain services. A health flexible spending account FSA is an employer-sponsored plan that allows you to set aside a portion of your income on a pre-tax basis and then use that money to pay for qualified out-of-pocket medical expenses.

A flexible spending account FSA is set up through your employer and can be used to pay for many of your out-of-pocket medical expenses with tax-free dollars. Your employer provides and owns the account. Blue Cross Blue Shield of Wisconsin BCBSWI underwrites or administers PPO and indemnity policies and underwrites the out of network benefits in POS policies offered by Compcare Health Services Insurance Corporation Compcare or Wisconsin Collaborative Insurance Corporation WCIC.

A dependent care FSA or Dependent Care Assistance Program operates in the same manner as a healthcare FSA. These funds can be used to pay for medical dental and vision expenses that are not covered by insurance. Flexible Spending Account FSA - Albany BlueCross BlueShield of WNY Flexible Spending Account FSA Take control of your health care A flexible spending account or FSA will allow you to set aside pre-tax dollars in an account you can use for qualified medical.

An FSA can be used along with any traditional health insurance plan and has tax advantages. WCIC underwrites or administers Well Priority HMO or POS policies. However medical expenses cant be paid from the FSA during the HDHP deductible so the FSA will be bypassed in this circumstance.

A flexible spending account or FSA is a way for you to set aside money for qualified medical dental or vision expenses or dependent care. A Flexible Spending Account or FSA is an employer-sponsored arrangement that provides employees with an opportunity to set aside a portion of the employees earnings on a pre-tax basis for the sole purpose of paying qualified medical expenses. You can use it to pay for eligible non-covered medical or dental expenses child care and even dependent adult care costs.

Anyone under age 65 whos employed. Independent licensees of the Blue Cross and Blue. A flexible spending account or arrangement is an account you use to save on taxes and pay for qualified expenses.

They give employees more control over planning and paying for qualified medical expenses to help them maximize their health care dollars. A Flexible Spending Account FSA offers a smart simple way to set aside money tax free to cover the everyday expenses you know youll have in the coming year. An FSA can be used along with any traditional health insurance plan and has tax advantages.

Flexible spending account Offer our new health care FSA dependent care FSA or even a limited-purpose FSA that works with a health savings account plan or offer all three. A Flexible Spending Account or FSA is an employer-sponsored arrangement that provides employees with an opportunity to set aside a portion of the employees earnings on a pre-tax basis for the sole purpose of paying qualified medical expenses. Other key things to know about FSAs are.

For regular predictable healthcare expenses such as vision care that are not covered by your medical or dental plan. These expenses include copays deductibles qualified prescription drugs insulin and medical devices. Plus they help you and your employees save.

The Flexible Spending Account FSA Plan consists of an annual credit allotment of 900 provided by the Employer to each eligible Employee. An FSA is typically funded by you as an employee but your employer can fund as well and does not need to be paired with a health plan. This includes copayments deductibles chiropractic care and over-the-counter medications.

To provide a significant tax advantage. Dependent care FSA. To pay for most healthcare expenses not covered by your insurance plan.

FSAs also can be set up for childcare parking and commuting costs. A limited purpose FSA is a special FSA. You fund an FSA through pre-tax deductions from your paycheck.

Spending accounts are a smart addition to your Independence Blue Cross health plans. Compcare underwrites or administers HMO or POS policies.