Refer to the following list for details concerning insurance carriers and whether or not they cover birth control pills. Learn when to schedule screening tests such as mammograms and pap tests to help prevent or detect possible health concerns.

Https Www Bcbsri Com Sites Default Files Polices Contraceptive Drugs And Devices Pdf

Is it True That Health Plans are Now Required to Cover Birth Control for Free.

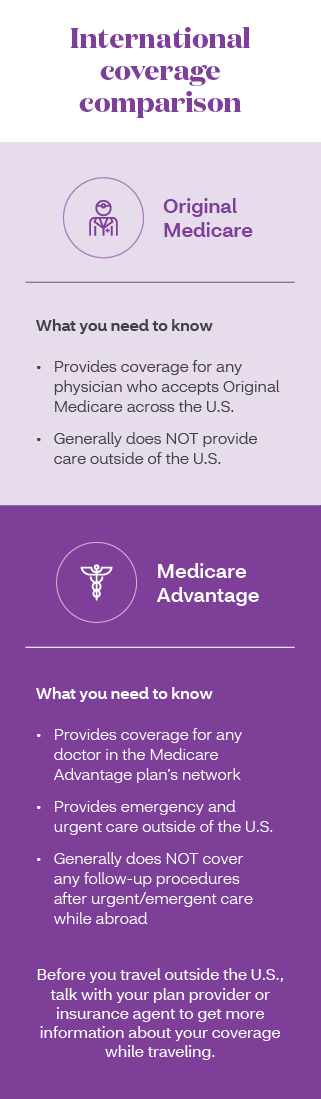

Birth control insurance coverage blue cross. You can also review the summary of womens care services covered by Blue Cross and Blue Shield of Minnesota and Blue Plus plans. Coverage will be available for applicants who are awaiting provincial coverage to begin. The Affordable Care Act ACA or health care reform law requires Anthem Blue Cross and Blue Shield Anthem to cover certain preventive care services with no member cost-sharing copayments deductibles or coinsurance1 Cost-sharing requirements may still apply to preventive care services received from out-of-network providers.

1 2021 Your health plan may provide certain contraceptive coverage as a benefit of membership at no cost to you when you use a pharmacy or doctor in your health plans network. Cialis Insurance Coverage Blue Cross - A months worth of pills is available from wholesalers for less than 20. Preventive Care Coverage at No Cost to You Effective Jan.

Cialis insurance coverage blue cross Best Quality and EXTRA LOW PRICES cross insurance blue coverage cialis. This member document describes the limited prescription coverage program provided by BCN in compliance with the Patient Protection and Affordable Care Act by which generic contraceptives may be fully covered with no copayment requirement. Enhanced plans only eg.

Your health insurance typically covers preventive care services and birth control methods. Drugs used for birth control are eligible under this option only. Coverage for contraceptives can vary.

For people under age 19 who want to apply for coverage under one of our plans an adult must be designated as the policyholder. A patient s pharmacy benefit may be managed by a company other than BCBS. May vary based on your health so ask your doctor.

You should also ask your health plan representative about coverage and out-of-pocket costs for removal keeping in mind your insurance may change. We now cover 100 of the cost of these procedures as long as theyre done by a network doctor1 Whats covered by your pharmacy benefit Other types of birth control need a doctors prescription. Commercial Plans Aetna PPOPOS Beech Street Blue Cross Blue Shield PPO Most plans Cigna PPOPOS Consociate Dansig Coventry PPO Health Alliance PPOPOS Region restrictions may apply Health Link Health Spring Humana PPO MultiPlan Network plans includes PCHS and numerous smaller carriers.

Coverage for contraceptives can vary depending on. BCN provides these services to members who are not enrolled in a BCN program that includes prescription drug coverage or in any other prescription. The Affordable Care Act requires just one form or brand of each of the 15 or so birth control methodspills rings IUDs implants patch injections and so onto be covered.

Listed below are drugs covered by Blue Cross and Blue Shield of Michigan and Blue Care Network of Michigan that comply with health care reforms preventive benefits requirements. If not ask about your out-of-pocket costs. Enhanced Prescription Drug Option.

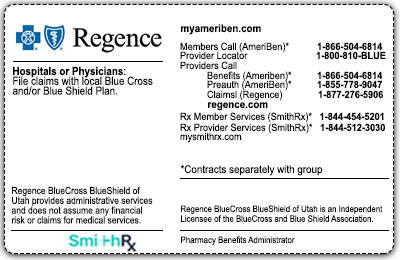

Benefit coverage contact the number on the patient s S member card. One Phase - Monophasic ethinyl estradiol-norethindrone-iron mili. Preventive Care Coverage at No Cost to You Effective Jan.

Comprehensive lactation breastfeeding support and counseling by a trained provider during pregnancy andor in the postpartum period and costs for breastfeeding equipment see Exclusions Frequency. We now cover 100 of the cost of some prescription birth controls from. Some types of birth control help prevent pregnancy with a procedure done in a doctors office visit hospital or outpatient surgery center.

This is an increasing benefit coverage option up to a predetermined. What birth control drugs are covered for free with BCBSIL plans. Ask the representative whether NEXPLANON and the insertion procedure are 100 covered.

For information specific to your preventive benefits please check your Blue Cross benefits-at-a-glance or BCN drug rider. Policyholders must be at least 19 years of age. Birth control pills oral contraceptives and injectable contraceptives are examples of womens preventive wellness health services under the list of Essential Health Benefits and many are covered 100 percent by Independence Blue Cross health plans.

1 2021 Your health plan may provide certain contraceptive coverage as a benefit of membership at no cost to you when you use a pharmacy or doctor in your health plans network. Here well guide you to the very best prices available today. Planned Parenthood of Illinois accepts the following insurance plans.

There is no copay deductible or coinsurance even if your deductible or out-of-pocket maximum has not been met. This is an increasing benefit coverage up to a predetermined maximum. Interventions during pregnancy and after birth to promote and support breastfeeding.

No coverage for birth control pills. There is no co-pay deductible or coinsurance even if your deductible or out-of-pocket maximum has not been met. All health plans with prescription drug coverage.

If NEXPLANON is covered. Have a pharmacy benefit with Blue Shield of California to be covered for contraceptives obtained from a pharmacy. Please call the customer service phone number listed on your Blue Shield ID card for any questions about contraceptive coverage.

The Enhanced drug option covers 80 of the cost of PharmaCare-eligible prescription drugs plus prescriptions that are not eligible under the government PharmaCare plan. Coverage includes generic anastrozole 1 mg raloxifene hcl 60 mg and tamoxifen citrate 10 and 20 mg tablets when used for prevention in members ages 35 and over with a prescription.