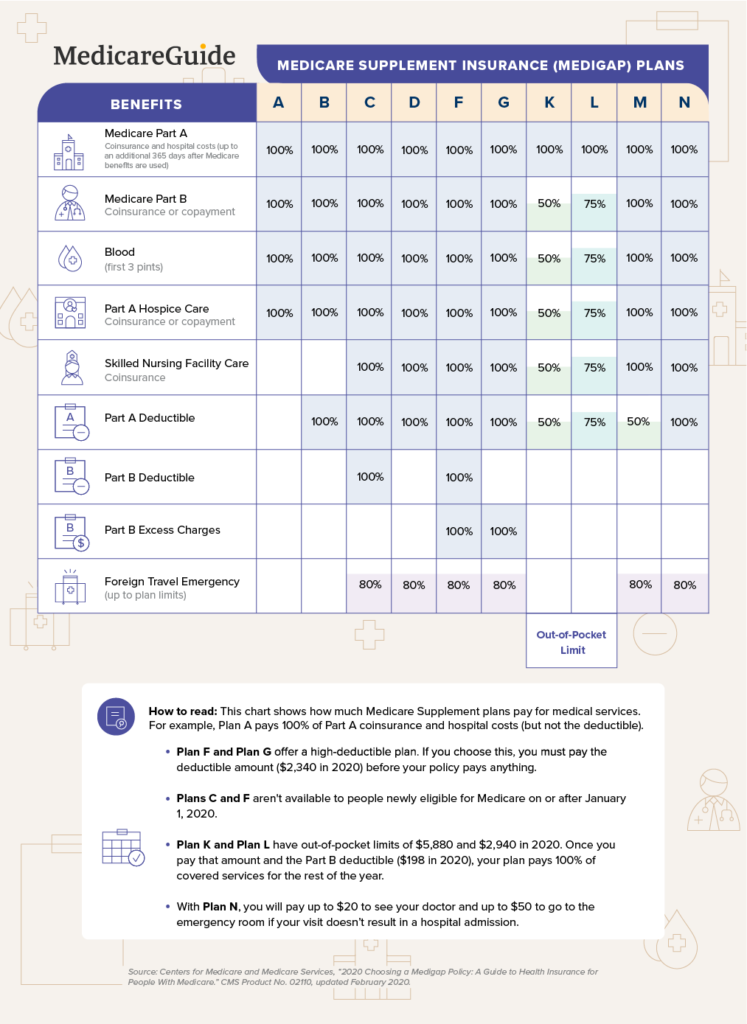

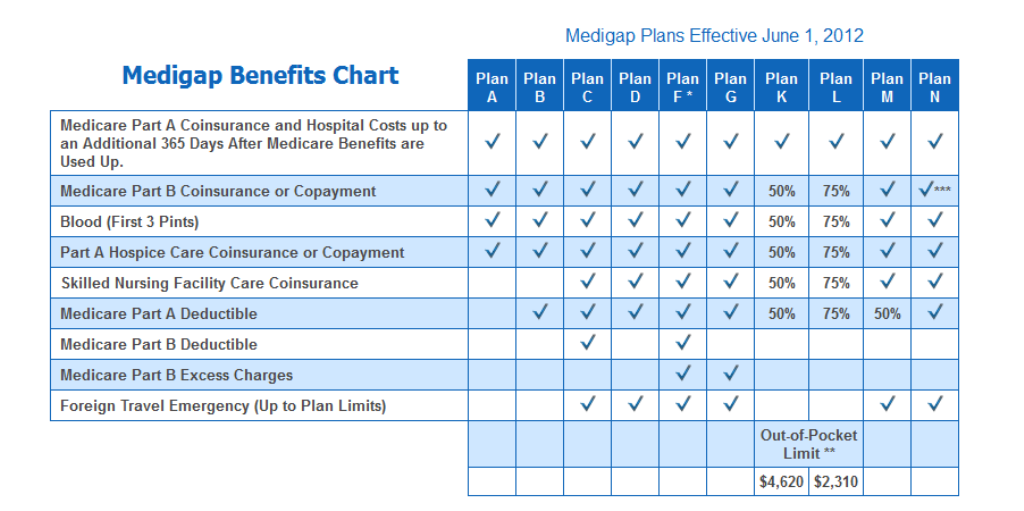

Then your Plan F supplement pays your deductible and the other 20. Part B excess charges.

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Plan to keep Original Medicare as your primary coverage.

Anthem supplement plan f. Plan F also pays the 20 for a long list of other Part B services. The most noteworthy addition to Innovative F is a 750 hearing aid coverage. The gaps cover up everything that youd want to imagine.

And coming soon are Innovative Plans G and N. Part B precautionary care coinsurance. When you enroll in an Anthem Medicare supplement plan.

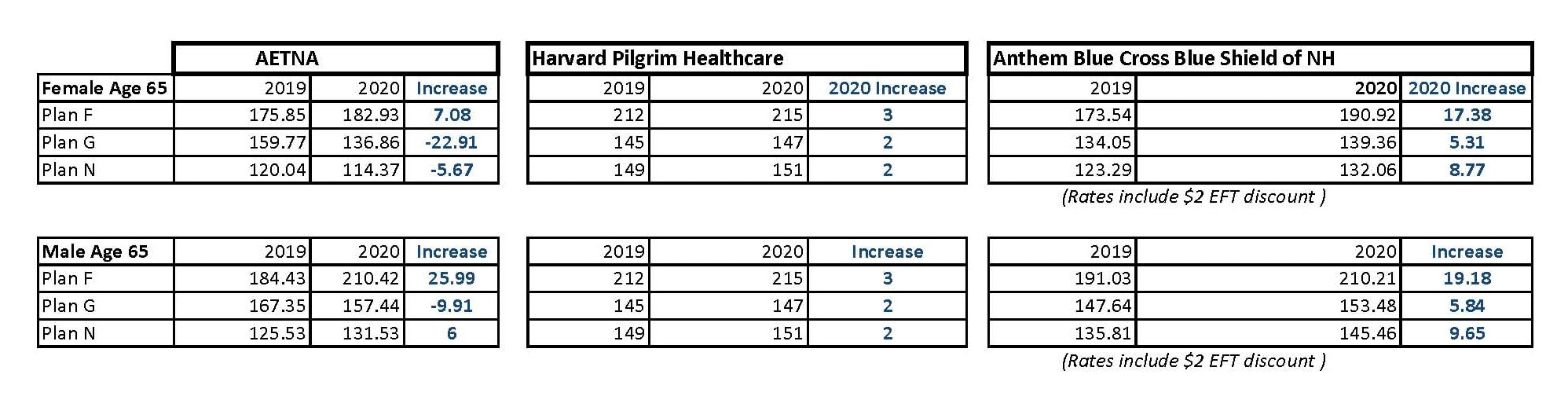

Some doctors charge a 15 excess charge beyond what Medicare pays. Plan F is a plan thats included in Medicare supplement insurance Medigap. Anthem Medicare Supplement Plan G.

Innovative F Medigap is a Medicare Supplement plan offered by Anthem Blue Cross in California and Nevada. Anthem Medicare Supplement Plan F Newcomers to Medicare who join starting on January 1 2020 or after are no longer allowed the option to join on Plan F. And Anthem Health Plans of Virginia Inc.

Anthem Medigap Plan F covers your Medicare Parts A and B deductibles and your copays for hospitalization. Anthem Medicare Supplement Plan F. ANTHEM is a registered trademark of Anthem.

This is the exact same coverage only you will have a. In Virginia our service area is all of Virginia except for the City of Fairfax the Town of Vienna and the area east of State Route 123. Plan F from Anthem covers all the gaps in Medicare.

Plan F covers all of the costs for an additional 365 additional hospital days. Plan F covers all of the costs of 3 pints of blood per calendar year. The New Anthem Innovative Plan F provides the same coverage as the traditional Plan F but now also offers hearing and vision benefits at no additional cost.

Part B excess charges. Anthem Plan F leaves you nothing out of pocket. This is why Anthem Medicare Plan F is popular with our customers.

That does not mean that if you are already on Plan F you must get off. There is no overall cap on what. The industry calls this a first-dollar coverage which means you wont have to get your wallets out for Medicare Part A and Medicare Part B services.

Anthem Innovative Plan F Medicare Supplement. Skilled Nursing Facility SNF care coinsurance. Anthem Insurance Companies Inc.

Medicare Plan F is the most comprehensive of the 10 standardized supplements sold by Anthem Blue Cross. Plan F covers all gaps in deductibles for Medicare coinsurance and copays you normally would pay out of pocket. Medicare Supplement plans are a great option for you if you.

This includes durable medical equipment lab work tests mental health care home health chiropractic adjustments and much more. Anthem Medigap Plan F is great as it gives you the most comprehensive coverage of all the Medicare supplement plans in the US. Anthem Medicare Supplement Plan F In addition to all the benefits included in Medicare Supplement Plan A the Anthem Medicare Supplement Plan F offers.

Out of all of the Medicare supplement. Items that are covered by the Medigap Plan F offered through Anthem include. Medicare Part A coinsurance and hospital expenses up to an additional 365 days after your Medicare benefits have been used up.

With the Anthem Part F options available to supplement your existing Medicare plan. Plan A Plan F Plan G and Plan N. Plan F Anthem Medicare Supplement.

Plan F will cover. Anthem Insurance Companies Inc. The coverages of Anthem Plan F.

3 Pints of Blood The first 3 pints of blood or equal amounts of packed red blood cells per calendar year unless this blood is replaced. It covers all deductibles coinsurance and copays that you normally would pay. Although Anthem Blue Cross does not offer Plan F to all seniors or in all states see above where offered the plan covers the following.

Independent licensees of the Blue Cross and Blue Shield Association. The benefits are the same as any other carrier. This plan covers all the benefits offered by traditional Medigap Plan F with the exact same network of doctors but now includes new vision and hearing benefits.

Therefore Plan F is now a closed plan and Anthem Plan F Coverage is no longer available to individuals joining Medicare. Anthem offers four different Medicare supplement plans. Anthems Medicare Supplement Plan F is the most comprehensive in terms of its coverage as compared to other available Medigap plans.

Medicare Supplement plans are offered by Anthem Health Plans of New Hampshire Inc. A high deductible version of Plan F is also offered. Anthem Medicare Supplement Plan F.

It can help pay for expenses that arent covered under original Medicare. Lets review the ins and outs of Innovative Plan F. The Health Exchange Agency offers a variety of plans through Anthem with one of the most popular one being the Anthem Plan F.

Anthem Plan F Benefits. As a Medicare Supplement plan member including vision and hearing discounts fitness club memberships home safety and more. Plan F covers that for you.

Recent Medigap Plan F changes wont impact all Medicare beneficiaries. The Innovative Plan F is Plan F with extra benefits. Anthem does offer Plan F.

Enjoy the flexibility of seeing any Medicare approved health care professional. But qualifying members may enjoy the newer all-inclusive updated plan. Coverage of your Original Medicare Part A and Part B deductibles 100 of coinsurance for skilled nursing care.

In the industry we call this first dollar coverage. Anthem Medicare Plan F offers a number of benefits. The Anthem Part F coverage extends to the majority of expenses youd regularly take on without the coverage.

Anthem Blue Cross Plan F also covers skilled nursing facility care excess medical charges and even emergencies wherever and whenever you travel worldwide which is excellent. It means you wont pull your wallet out for any Part A or B services. There is also a high deductible version of Plan F.

Foreign travel emergency care.