Family income must be at or below 225 FPL for a family to receive another 12-month eligibility period at redetermination. Income is below the tax filing threshold.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

100 of Poverty Level 1 1 064.

Medical income requirements 2020. Income numbers are based on your annual or yearly earnings. For 2020 salary reduction contributions to a health FSA cant be more than 2750 a year. Level of Care Required.

Your earned income was more than 12400. Retirement or pension Income. Income over 62 month must be paid towards ones.

156 Zeilen No set income limit. Covered California listed the single adult Medi-Cal annual income level 138 of FPL at 17237 and for a two-adult household at 23226. Social Security Disability Income SSDI Yes.

Short coverage gap of 3 consecutive months or less. To see if you qualify based on income look at the chart below. Larger amounts are prorated over a longer timeframe Medicaid eligibility is based on monthly income.

2020 income guidelines for financial assistance and MNsure overview Keywords. 2 1437 SSI Limits 1 - 2000. The DHCS 2020 FPL income chart lists a higher amount of 17609 for a single adult and 23792 for two adults.

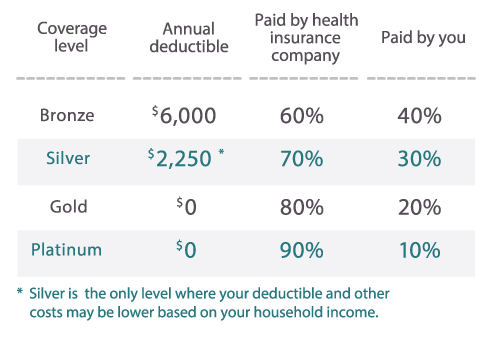

Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL AIAN Zero Cost Share 100300 FPL AIAN Limited Cost Share all income levels. The plans must also comply with rules applicable to other accident and health plans. Age 65 or older Spouses income and resources if live together at home.

10 Zeilen Income Level Guidelines for Financial Help The income limits for Medical Assistance are. 2 - 3000 YES. 2020 MassHealth Income Standards and Federal Poverty Guidelines Author.

15900 for applicant 130380 for non-applicant. Select your income range. May be eligible regardless of income.

Gross income before taxes effective June 5 2020 Family Size Annual Income Monthly Twice-Monthly Bi-Weekly Weekly 1 23606 1968 984 908 454 2 31894 2658 1329 1227 614 3 40182 3349 1675 1546 773 4 48470 4040 2020 1865 933 5 56758 4730 2365 2183 1092 6 65046 5421 2711 2502 1251. You can probably start with your households adjusted gross income and update it for expected changes. Qualified lottery winnings and lump-sum income including inheritances tax refunds etc is only counted in the month its received if its less than 80000.

884 month for applicant. Include most IRA and 401k withdrawals. The unshaded columns are associated with Covered California eligibility ranges.

Institutional Nursing Home Medicaid. Include both taxable and non-taxable Social Security income. 15-B Employers Tax Guide to Fringe Benefits explain these requirements.

Level of Care Required. Eligibility for its programs as required by regulation. Income guidelinesrnfinancial helprnMNsure overview Created Date.

Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate. But do not include Supplemental Security Income SSI. Income for a new application must be at 200 or below of the Federal Poverty Level FPL for the family to be income eligible for CCAP.

Premium subsidy eligibility on the other hand is based on annual income. See details on retirement income in the instructions for IRS publication 1040. You must file a tax return for 2020 under any of the following circumstances if youre single someone else can claim you as a dependent and youre not age 65 or older or blind.

Chapters 1 and 2 of Pub. Health coverage is considered unaffordable exceeded 824 of household income for the 2020 taxable year Families self-only coverage combined cost is unaffordable. Household Size Annual Monthly Twice-Monthly Bi-Weekly Weekly.

2020 Income Guidelines and MNsure Overview Author. Your unearned income was more than 1100. Level of Care Required.

For each additional member. Certain non-citizens who are not lawfully present. Estimating your expected household income for 2021.

Enter the full amount before any deductions. If income exceeds income limit and the indicator is yes the individual or family may be able to be.