Coinsurance is another important factor that youll want to pay attention to when youre shopping for a healthcare plan. Your doctor decides you need an MRI.

Coinsurance And Medical Claims

Coinsurance And Medical Claims

A copay is a type of insurance cost that is a set amount designated to be paid by the insured party whereas coinsurance is a percentage of health care costs covered by the insurer after the deductible is met.

What is better copay or coinsurance. You schedule an MRI which costs 2000. Your primary care copay is 30 so you pay that before seeing the doctor. Typically a health insurance plan with a high deductible has a much lower monthly premium while plans with lower deductibles will feature higher monthly premiums.

Co insurances a set percentage can be cha. Copays are typically cheaper than co insurances but co pays are typically for things like doctor office visits or medications sometimes for lab work. Difference between Copay and Co-insurance Copay is the fixed amount that you have to pay for your treatment.

When comparing coinsurance and copay a copay seems to be the better option. The remaining balance is covered by the persons insurance company. You go to the doctor for an aching back.

This video explains deductibles coinsurance and copay. The out of pocket cost differences between Co-Insurance and Co-Payment will depend on the medications that you are using and how they are organized in a specific Medicare Part D plan. A copay short for copayment is a fixed amount a healthcare beneficiary pays for covered medical services.

Is Co-Payment less expensive or better than Co-Insurance. However copays do count toward the annual out-of-pocket maximum which is the total amount you are liable to pay for all your healthcare costs in any given year including copay and coinsurance. No copays do not count toward the deductible.

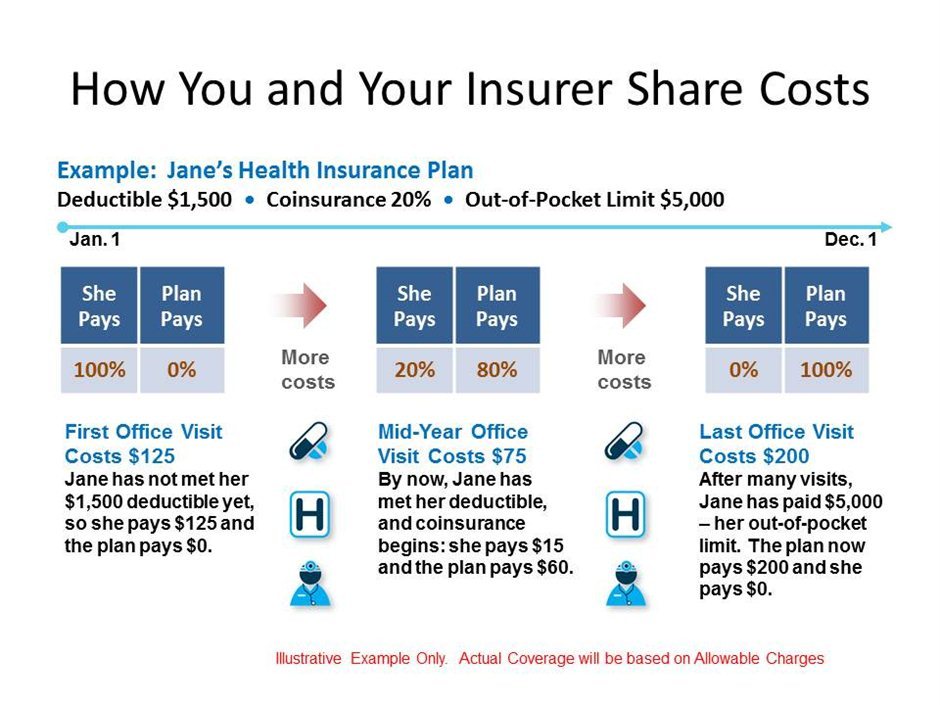

Generally heres how cost sharing works if you stay in network. Coinsurance is a portion of the medical cost you pay after your deductible has been met. Copays are flat fees members pay for things like visiting a doctors office or a prescription drug.

Thus coinsurance for an emergency room visit might be 38 and 25 for the given policies respectively. Coinsurance and copays are both forms of cost sharing between health insurance companies and consumers. All health insurance plans have a premium deductible and out-of-pocket maximum and yours might have a copay and coinsurance too.

As soon as you sign off on your health insurance plan youll begin paying monthly premiums. For example a prescription medicine. The amount A deductible is the fixed amount that you have to pay as a share of your medical bill upon which your policy comes into effect.

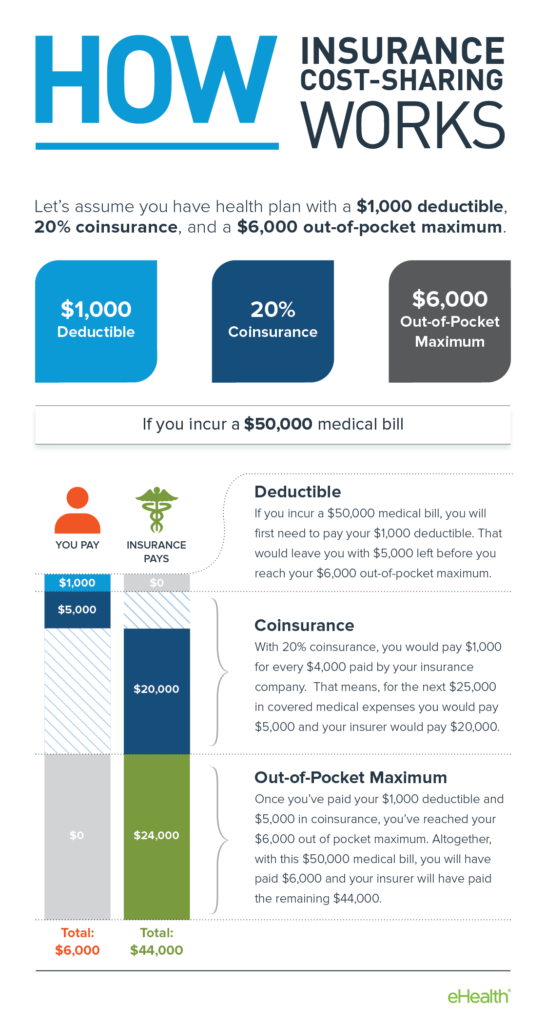

This is because usually copays do not add to medical coverage deductibles or out-of-pocket maximums. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent. For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills.

Lets take a look at what coinsurance is and why it can have a big effect. Your deductible is 1000 and your coinsurance responsibility is 20. Normally a plan will have both.

Whereas coinsurance is the percentage you pay for medical costs after your deductible your copay is a set amount you have to pay for other covered expenses. But there are key differences between them that consumers should understand. Coinsurance is a percentage of the cost for a.

It can be a fixed amount per the nature of the treatment of a fixed percentage.

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

25 Unique Deductible Copay And Coinsurance Example

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

Copays Vs Coinsurance For Health Insurance

What Is The Difference Between Copay Coinsurance

What Is The Difference Between Copay Coinsurance

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

/whats-the-difference-between-copay-and-coinsurance-1738506_final-4c635a490ace4b8d9ab16ac6fa61d192.jpg) Differences Between Copay And Health Coinsurance

Differences Between Copay And Health Coinsurance

Difference Between Coinsurance And Copay Difference Between

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.