Youve paid 1500 in health care expenses and met your deductible. Having health insurance can lower your costs even when you have to pay out of pocket to meet your deductible.

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

With a 2000 deductible for example you pay the first 2000 of covered services yourself.

How do you meet your deductible. After you pay your deductible you usually pay only a copayment or coinsurance for covered. Depending on your plan you may also need to meet this in-network deductible before you pay for covered prescription drugs. It could take as little as one visit or over the course of many months to meet your deductible.

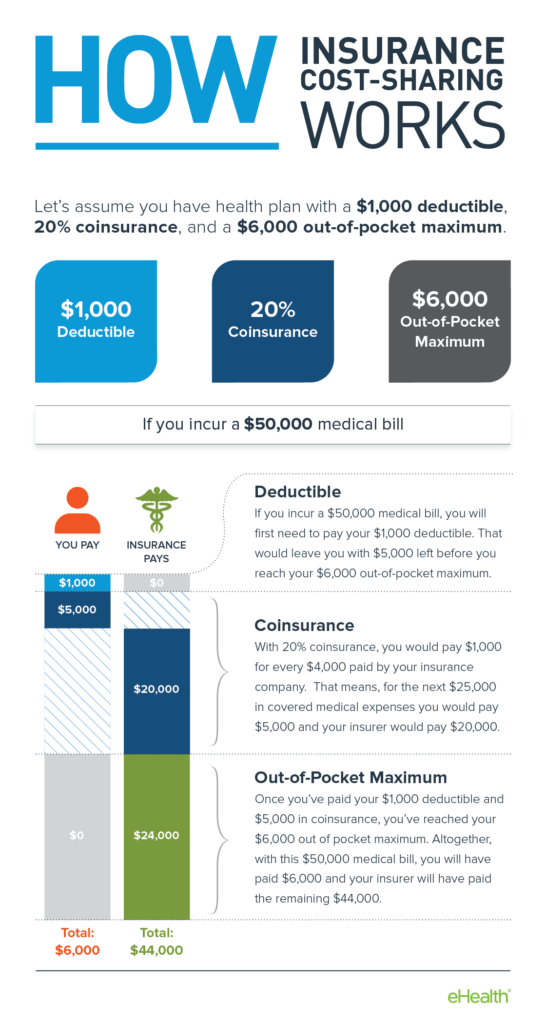

Once youve met your deductible you might pay 20 of the cost of the health service or procedure for instance. Another example would be if you receive health care services that total 1200 and you have a 20 coinsurance. A low deductible health plan may be referred to as an LDHP.

Not every health plan has a deductible and this amount may vary by plan. Youll pay your deductible payment directly to the medical professional clinic or hospital. Every year it starts over and youll need to reach the deductible again for that year before your plan benefits start.

Many patients cram in bunion or hammertoe surgeries meniscus repairs and frozen shoulder surgeries at the end of the year when theyve met their deductible and they know their surgery will be fully paid for. Insurance companies negotiate their rates with providers and youll pay that discounted rate. If you were considering an elective orthopedic surgery get it done like the rest of these folks.

Until you meet your health insurance deductible your insurer will require you to pay for some if not all of your medical bill. Your plan pays 80 or. If you choose elective surgery the amount that you pay will probably not count towards your deductible.

For example your plan pays 70 percent. Depending on the type of plan you have there could be separate deductibles for prescriptions andor separate deductibles per family member. Understanding how deductibles work for health insurance is vital.

The amount you pay for covered health care services before your insurance plan starts to pay. As many healthcare providers and hospitals will tell you there is a difference in someone meeting their deductible and actually paying their deductible expenses. Ortho surgeons are very busy this time of year.

What Doesnt Count Toward the Deductible. But some plans do not have a deductible. You have already met your deductible you pay 240.

If your plan has a deductible you must first pay a predetermined amount out of pocket before your health insurance plan will begin to pay for covered services and products. This means you will pay the prescriptions full cost upfront until the deductible is met. You meet a deductible by using healthcare services and paying for them out of your pocket until the deductible amount is met.

By paying out of your pocket I mean you pay the amount that the insurance company says you owe your provider after they process the bill. A deductible is a set amount you may be required to pay out of pocket before your plan begins to pay for covered costs. A health insurance deductible is different from other types of deductibles.

Review your plan documents for specific details on your plans out-of-pocket expenses and deductibles. You start paying coinsurance after youve paid your plans deductible. Once you meet your out-of-pocket maximum for the year including your deductible coinsurance and copayments your insurer pays 100 of your remaining medically-necessary in-network expenses assuming you continue to follow the health plans rules regarding prior authorizations and referrals.

High Deductible Health Plans. In order to meet your deductible simply check your policy to find out how much your deductible is and what medical services will count towards it. The total amount of your deductible and whether it is combined for medical and prescription will vary by plan.

Some plans have deductibles only for surgical procedures or hospital visits. Meeting Your Deductible After you meet your deductible you may still pay either a co-pay andor co-insurance amounts when you receive medical services or prescription drugs. Your insurance company would pay the balance.

People without insurance pay on average twice as much for care. A prescription deductible is a form of cost-sharing. Call your health insurance company or read your plan booklet to see what type of deductible you have to meet.

If you incur a 700 charge at the emergency room and a 300 charge at the dermatologist youll pay. A deductible is defined as the amount of financial responsibility you the policy holder need to pay out of pocket before the insurance company will help you pay any expenses. When you go to the doctor instead of paying all costs you and your plan share the cost.

Then you will pay your copay or coinsurance amount until you meet your yearly out-of-pocket maximum. You have met your deductible by incurring expenses in excess of your plans deductible. The 30 percent you pay is your coinsurance.