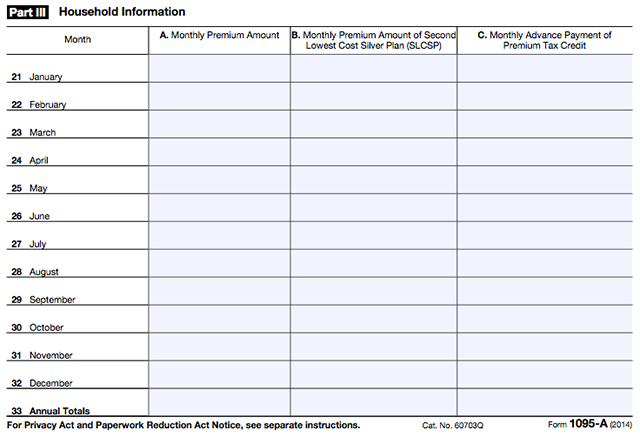

The 1095-A Form is a Covered California statement that is needed to file your Federal Income Tax Return. Access to your online account 1095-A tax form and the Shop and Compare Tool will be unavailable from 1201 am.

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

It shows how many months you had health insurance and how much Advanced Premium Tax Credit APTC you received.

Covered california login 1095 a. The IRS has created the 1095-A form to help reconcile the tax credits received and it is there to make sure you are not owed any money or make sure you dont owe any money based on the income projection you provided to Covered California. Its the only place where you can get financial help when you buy health insurance from well-known companies. You may find the form in your Secure Mailbox iffy or more reliably on your Documents and Correspondence page.

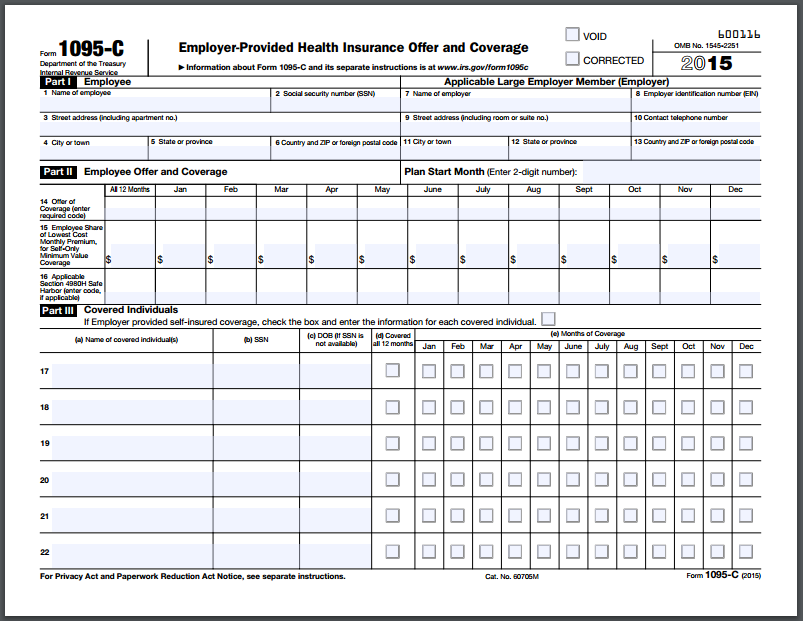

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. Beneficiaries should keep Form 1095-B for their records as proof they received health. The federal IRS Form 1095-A Health Insurance Marketplace Statement.

Look for the list of links in the bottom-center of the page. During tax season Covered California sends two forms to members. To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download CalNOD62A_IRSForm1095A_2016.

You will find the 1095-A form in your Documents and Correspondence folder. IRS Form 1095-A Covered California will send IRS Form 1095-A Health Insurance Marketplace Statement to all enrolled members. If you have a Covered California online account sign in here.

Login to your Covered California online account. CCSBSHOP plan members of the Small Employer less than 50 full-time employees group plans will receive a 1095-B from the Healthcare Plan Provider. To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download CalNOD62A_IRSForm1095A_2016.

If you dont have a login and password call 800-300-1506. To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download CalNOD62A_IRSForm1095A_2016. This is a step-by-step guide to quickly and easily download your 1095-A.

After logging in youll be on the Consumer Home Screen. You will find the 1095-A form in your Documents and Correspondence folder. On May 8 to 6 am.

Login to your Covered California online account. You will find the 1095-A form in your Documents and Correspondence folder. It is used to fill out IRS Form 8962 Premium Tax Credit as part of your federal tax return.

Click to see full answer. If the individual is a recipient of Medi-Cal and other Government Sponsored Health Coverage in 2015. The California Form FTB 3895 California Health Insurance Marketplace Statement.

The Form 1095-B will report the months of MEC a Medi-Cal beneficiary received during the calendar year. Click on Eligibility Results Click on Summary. DHCS will send your MEC information to the IRS and beneficiaries are not required to provide Form 1095-B to the IRS if they chose to file their taxes.

Until Covered CA makes it easier to find Ive implored them to put this link right on your home page duh this same map will get you there every year. The Government Agency will issue a 1095-B to the plan member. This will allow you to view your application online and update your account information.

Use the California Franchise Tax Board forms finder to view this form. The web address for the Covered California Account Login is. It is your proof that you had health insurance in place so that you wont be subject to a tax penalty.

Login to your Covered California online account. Close Skip Navigation menu. If you dont already have one we recommend that you create a Covered California online account.

You will have to login to your Covered California online account. May 15 2019 admen Advices. You will find the 1095-A form in your Documents and Correspondence folder.

May 15 2019 admen Interesting. To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download the 1095-A document as PDF. We have simplified the process to get your 1095-A form today or within 24 hours worst case scenario.

To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download CalNOD62A_IRSForm1095A_2016. Login to your Covered California online account.