Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance. Individuals who fail to maintain qualifying health insurance will owe a penalty unless they qualify for an exemption.

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

You were not eligible for an exemption from coverage for any month of the year.

Does california have a penalty for not having health insurance. Get information about exemptions and the California Individual Shared Responsibility Penalty for failure to have qualifying health insurance coverage or an exemption. Portra Images Digital Vision Getty Images. Californians be warned.

A new state law could make you liable for a hefty tax penalty if you do not have health insurance next year and beyond. As a result California has managed to keep their healthcare premiums much lower than the national average and encourages their residents to maintain their healthcare coverage. California residents who do not have health insurance in 2020 will have to pay a tax penalty in 2021.

Covered California and the Franchise Tax Board each administer exemptions for qualifying. Other exemptions do not require an application instead you. This penalty revenue will be used to fund health insurance subsidies to encourage more people to purchase health insurance and to provide health care to illegal immigrants.

If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021. Uninsured Californians still have time to avoid a penalty for not having healthcare if they sign up through Covered California by March 31. But the law contains several exemptions that will.

To find out more about health insurance options and financial help visit Covered California. Get an exemption from the requirement to have coverage. The penalty applies to those months in which you or your family did not have health insurance coverage.

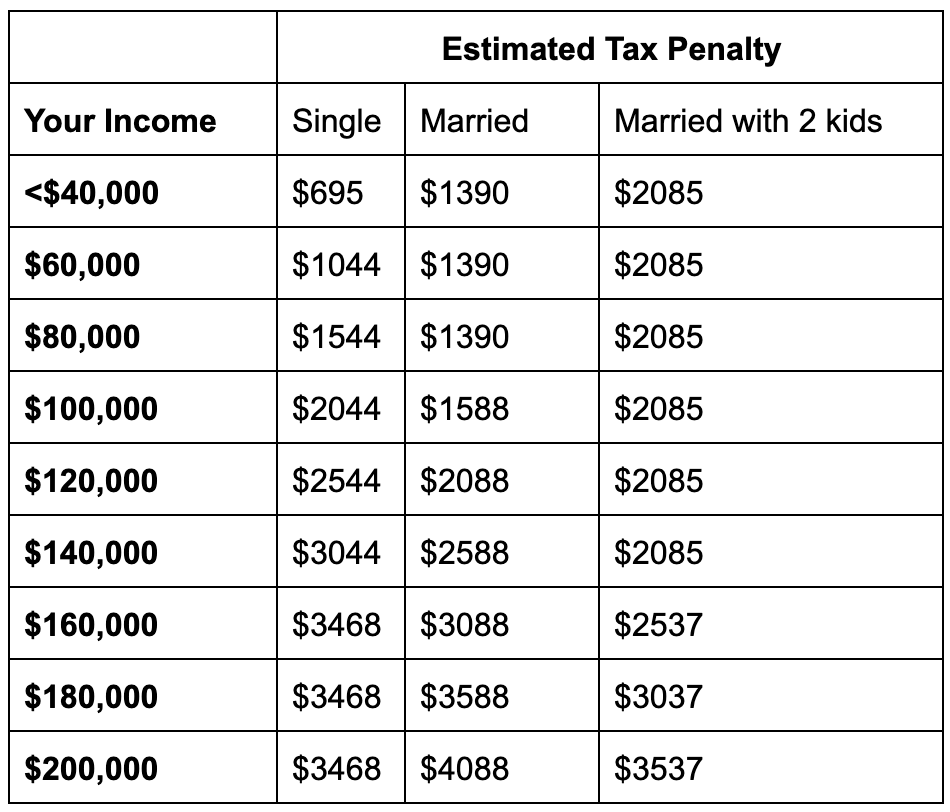

The penalty is based on the previous federal individual mandate penalty which is 965 per uninsured adult or 25 percent of the individuals household income. The annual penalty for Californians who go without health insurance is 25 of household income or 696 per adult and 37550 per child whichever is greater. But there are some areas of the country where penalties still apply if a person is uninsured and not eligible for an exemption.

Despite that 93 percent of Californians have health insurance the California Legislature voted Monday to tax California citizens who do not buy health insurance. But some of you need not worry. As of 2021 there are penalties for being uninsured in Massachusetts New Jersey California Rhode Island and the District of Columbia.

The dollar figures will rise yearly with inflation. Some exemptions require an exemption application through Covered California. You can get an exemption so that you wont have to pay a penalty for not having qualifying health insurance.

Californians be warned. A new state law could make you liable for a hefty tax penalty if you do not have health insurance next year and beyond. The tax penalty was eliminated in 2017 by the Trump administration but the state of California has reinstated it for 2020.

You did not have health coverage. Starting in 2020 California residents must either. Read our blog to learn more.

According to the California Franchise Tax Board FTB the penalty for not having health insurance is the greater of either 25 of the household annual income or a flat dollar amount of 750 per adult and 375 per child these number will rise every year with inflation in. You will have to pay a penalty the Individual Shared Responsibility Penalty when you file your state tax return if. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021.

There are several conditions that will exempt you from having to pay the penalty on your California income tax return. Certain conditions will be process by the Franchise Tax Board FTB such as. The law contains several exemptions that will allow certain people to avoid the penalty among them prisoners low-income residents and those living abroad.