Ad Varied Adaptable Cover To Suit You Your Familys Requirements. Counts as Income.

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

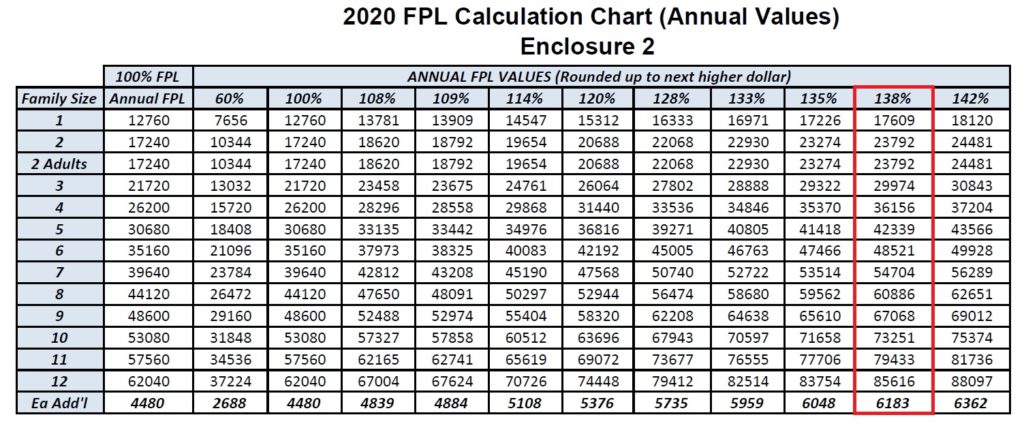

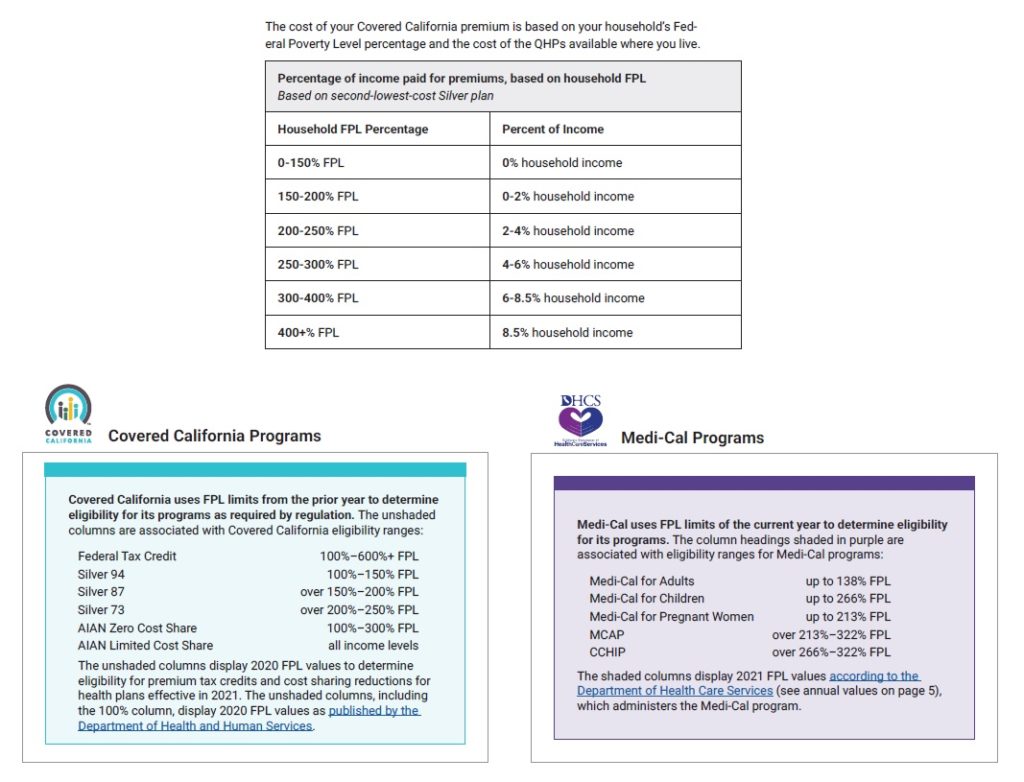

Most consumers up to 138 FPL will be eligible for Medi-Cal.

Covered california minimum income. For Bronze and Silver there are no other benefit changes for next year. The Covered California exchange will permit individuals to enroll in health plan coverage or Medi-Cal during the initial enrollment period from October 1 2013 to March 31 2014 and thereafter during an open enrollment period that will begin on October 15 and last through December 7 annually. This site is not maintained by or affiliated with covered california and covered california bears no.

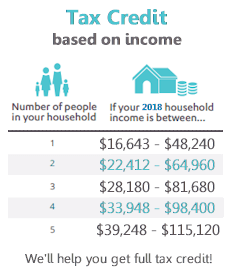

The Franchise Tax Board and Covered California are working together to administer the new Minimum Essential Coverage Individual Mandate Senate Bill 78 Ch. Whether you qualify for financial assistance depends on your household income and. The subsidies are for individual Californians who earn between 50000 and 75000 and families of four earning 103000 to 155000.

This web site is owned and operated by health for california which is solely responsible for its content. How do I calculate my annual income when applying for health coverage through Covered California. Covered California rates are going up 06 on average and the plan benefits are not changing very much.

2019 otherwise known as the health care mandate which takes effect January 1 2020. You can start by using your adjusted. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income.

We Do All The Hard Work For You Finding You the Best Cover At The Right Price. Covered California will accept a clear legible copy from the allowable document proof list from the following categories which you can click on for more details. Federal tax credit Silver 94 87 73 plans and AIAN plans.

In order to be eligible for assistance through Covered California you must meet an income requirement. Ad Varied Adaptable Cover To Suit You Your Familys Requirements. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL.

Also new in the coming year low-income undocumented young. If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies that lower your premium costs so that you pay less for top-quality brand-name insurance. Pandemic Unemploment Compensation 300week Social Security.

How to Estimate Your Income. Proof of Income Proof of Citizenship or Lawful Presence Proof of California Residency and Proof of Minimum Essential Coverage. Social Security Disability Income SSDI Retirement or pension.

Covered california california health benefit exchange and the covered california logo are registered trademarks or service marks of covered california in the united states. If however students accept and enroll in the schools health insurance plan they will not be eligible for tax credits through Covered California while they are covered by their schools plan. Covered California will let you know which categories they need documentation.

And Californias 600 Golden State Stimulus payment when you calculate your household income. Covered California Outreach and Sales Division Updated. We Do All The Hard Work For You Finding You the Best Cover At The Right Price.

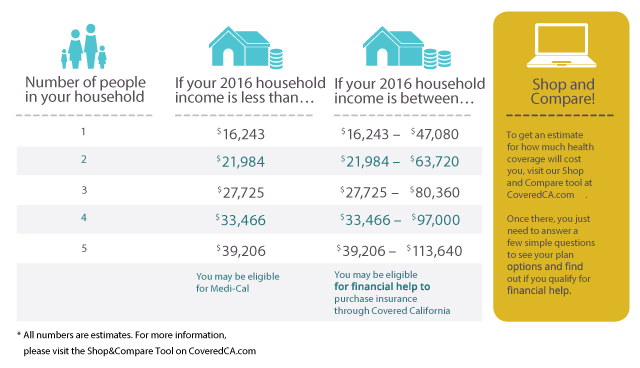

April 15 2016 OutreachandSalescoveredcagov or Low to help determine if you qualify Income Guidelines use through October 2016 You may be eligible for Medi-Cal -Income Health Plan. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. In short you dont need to include any stimulus payments the federal 1200 600 and 1400 payments.

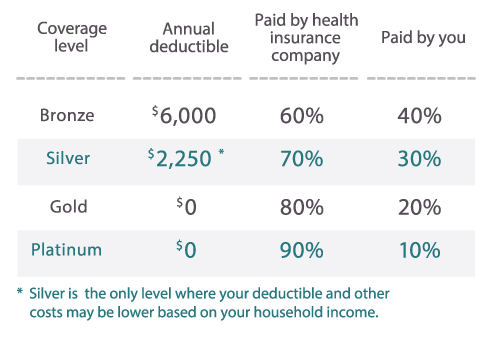

If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including. Depending on income students may receive tax credits to help pay for a private health plan through Covered California or receive low- or no-cost coverage through Medi-Cal. Bronze Silver and Gold The out-of-pocket maximum is going up from 7800 to 8200 on the Bronze Silver and Gold Plans.

The price is based on your estimated income for the coverage year your ZIP code your household size and your age. Starting in 2014 the state of California is planning to expand the Medicaid program called Medi-Cal in California to cover people under age 65. Medi-Cal and Covered California have various programs with overlapping income limits.

The income thresholds to qualify for the additional help from the state are 74940 for an individual 101460 for a couple and 154500 for.

Covered Ca Plan Benefit Changes For 2021 Health For California Insurance Center

Covered Ca Plan Benefit Changes For 2021 Health For California Insurance Center

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Covered California Income Limits Explained

Covered California Income Limits Explained

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Covered California Income Tables Imk

Covered California Income Tables Imk

Covered California Health Insurance Income Guidelines

Revised 2020 Covered California Income Eligibility Chart

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.