But due to the Rescue Plan Act I am not required to repay the excess advance premium tax credit that I received. Itll help you file your 2020 federal income taxes.

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

If you have health insurance through the federal or a state-sponsored marketplace it means a couple of important yet simple changes on your next income tax return.

Marketplace insurance and taxes. Your reported income also determines your eligibility for the tax credits associated with Marketplace health coverage. Insurance is required to reinforce trust and win over risk-averse users. Take the premium tax credit reconcile the credit on their returns with advance payments of the premium tax credit advance credit payments and.

However turbo tax is taking the full amount of the health insurance premium as a deduction for self employed health insurance. Find your situation below for more information. File an accurate tax return.

You will receive a denial notice from HIP and you will keep the health insurance coverage you purchased on the Health Insurance Marketplace. Insurance is a critical topic online peer-to-peer marketplaces will need to consider to benefit from these growth projections. You no longer need to report health insurance coverage for the tax year unless you or a family member were enrolled in health insurance through the Marketplace and advance payments of the Premium Tax Credit were made to your insurance company to reduce your.

Marketplace insurance allocation. Learn how to maximize health care tax credit get highest return. Here is what you need to know.

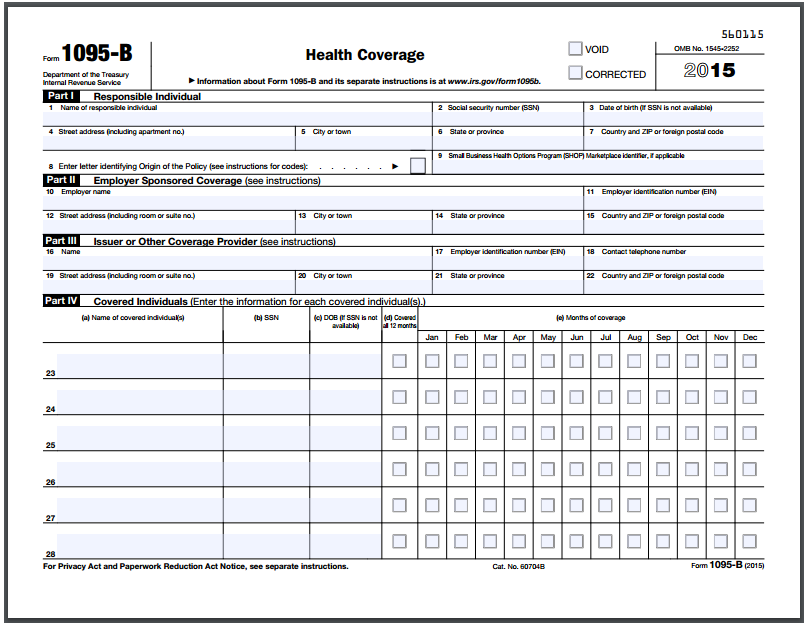

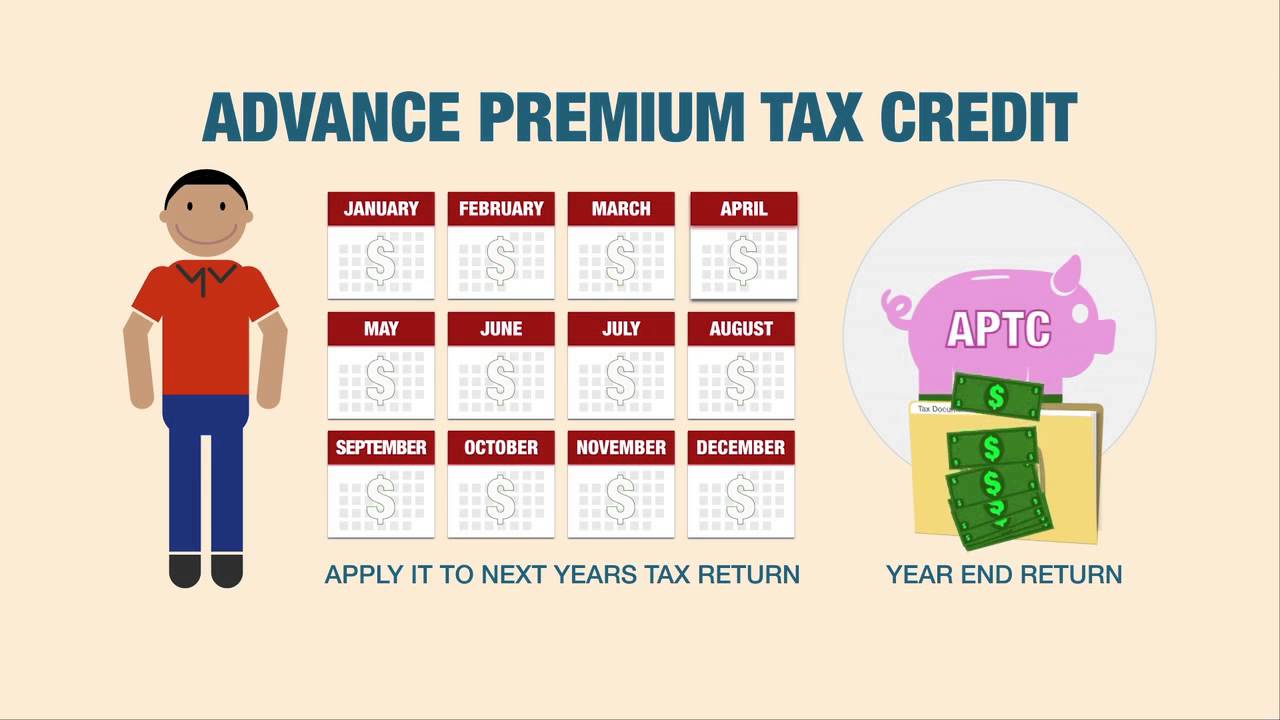

I purchased health insurance through the exchange for 2020 and received an advance premium tax credit. IRS to report certain information about individuals who enroll in a qualified health plan through the Health Insurance Marketplace. The amounts are different on them in line 2 the marketplace-assigned policy number are different on each 1095-a and under the Covered Individuals on line 16 it has only one name on it mine on one and my exs name on the other.

Your 2020 Taxes If you had a Marketplace plan in 2020 you must file a 2020 federal income tax return. Our professionals also assist small business owners with administrative tasks related to the insurance plan that may ease some of the burden of recordkeeping. If no plan offered by the employer covers the spouse or children the spouse or children may purchase insurance in the Marketplace and qualify for a premium tax credit assuming all other eligibility rules are met.

Under the new law many people who buy their own health insurance directly through the Marketplace will become eligible to receive increased tax credits to reduce their premiums. The steps you take will depend on your eligibility for the premium tax credit. Health care insurance purchased through the Marketplace If you purchased health care insurance through the Marketplace you should receive a Form 1095-A Health Insurance Marketplace Statement at the beginning of the tax filing season.

Our first article should give you an overview of the insurance. Similar to a W-2 you will receive the form completed by the Marketplace. Starting April 1 2021 consumers enrolling in Marketplace coverage through HealthCaregov will be able to take advantage of these increased savings and lower costs.

Anyone who was enrolled in a Marketplace health insurance plan in 2020 will need to use Form 1095-A when filing their taxes. Contact us to learn more about your health insurance. Why would people buy non-Marketplace.

Health insurance and income taxes once an unlikely pair are now close companions as a result of the Affordable Care Acts insurance mandate that took effect Jan. 1 Find your Form 1095-A Health Insurance Marketplace Statement Find it in your HealthCaregov account select your 2020 application not your 2021 application and select Tax Forms from the menu on the left. It turned out my income for 2020 was higher than expected and I would not have qualified for the premium tax credit.

You must file tax return for 2020 if enrolled in Health Insurance Marketplace plan. We will be publishing a series of articles on the subject to help you understand why insurance is so challenging and what options are open to you. Your cost for Marketplace health insurance is based on the income you file on your tax return.

I had a Marketplace plan in 2020 Watch your mail for Form 1095-A. This means that people who dont receive Obamacare tax credits will generally pay less by picking lower-cost off-Marketplace health insurance on a private website. If you did not receive the form it may be because you asked for only electronic communications in your Marketplace.

Household income includes incomes of the. The Health Insurance Marketplace Calculator allows you to enter household income in terms of 2018 dollars or as a percent of the Federal poverty level. The American Rescue Plan Act includes a one-time provision that will rescue marketplace plan buyers from repayment of thousands of dollars in excess insurance premium subsidies for the 2020 tax year.

You must file a federal tax return for 2020 even if you usually dont file or your income is below the level requiring you to. Its a new plan year and Joses. Individuals to allow them to.

How to get a 1095-A form. So what is Marketplace insurance. Marketplace plans and non-Marketplace plans are generally mirror images of each other though off-Marketplace plans dont provide premium subsidies and enrollees have to pay rate increases themselves.

Do not make any changes to your Marketplace plan until you know if you are eligible for HIP or. You will not face a tax penalty provided that you cancel your Marketplace coverage prior to beginning HIP. If you are not eligible for HIP.

The information shown on Form 1095-A helps you complete your federal individual income tax return. Whether you are an individual or a small business owner purchasing health insurance eHealths licensed insurance agents can help determine if you are eligible for any tax-advantaged marketplace plans or government-sponsored health programs. You should have received Form 1095-A also called a Health Insurance Marketplace Statement by mail from the Marketplace.

Tax Filing With The Affordable Care Act Katz Insurance Group

Filing Taxes And Marketplace Health Insurance Form 8962 Healthcare Counts

Filing Taxes And Marketplace Health Insurance Form 8962 Healthcare Counts

Tax Changes You Need To Know For 2014

Tax Changes You Need To Know For 2014

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

/obamacare-taxes-penalties-and-credits-3306061_FINAL2-acbc62123f0a4d59860dd165ecc6aa8d.png) Will You Have To Pay Obamacare Taxes This Year

Will You Have To Pay Obamacare Taxes This Year

How Does Health Insurance Affect Your Taxes

How Does Health Insurance Affect Your Taxes

Marketplace Health Insurance 2016 Taxes 3 Tips Healthcare Gov

Marketplace Health Insurance 2016 Taxes 3 Tips Healthcare Gov

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

How To Report Your 2018 Health Coverage Status When You File Taxes Healthcare Gov

How To Report Your 2018 Health Coverage Status When You File Taxes Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Get Lower Costs On Monthly Premiums In The Health Insurance Marketplace Youtube

Get Lower Costs On Monthly Premiums In The Health Insurance Marketplace Youtube

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.