This is done in the Healthcare section of your account. You can enter 1095-A and produce Form 8962 by following these instructions.

2020 Form Irs 8962 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 8962 Fill Online Printable Fillable Blank Pdffiller

On the site with all the document click on Begin immediately along with complete for the editor.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

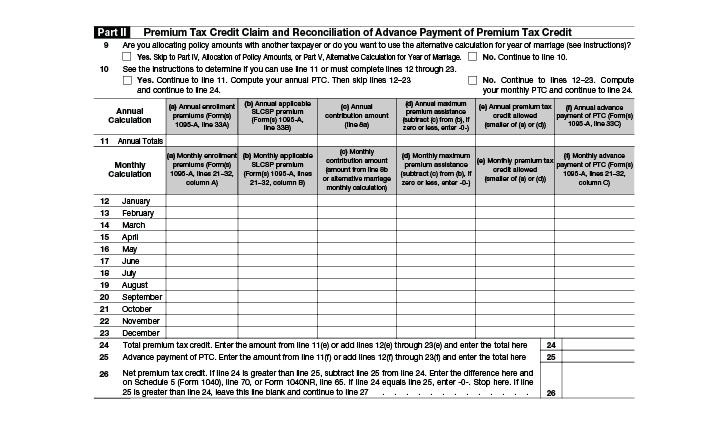

How to file form 8962. The IRS uses Form 8962 to reconcile the tax credit the well being plan obtained based mostly on the individuals estimated revenue with the amount of his or her actual earnings as reported on their federal tax return. TurboTax Live 2021 Commercial Treehouse Official TV Ad. How to Fill Out Form 8962.

You fail to provide information of your form 1095A from the market place health insurance. Part I is where you enter your annual and monthly contribution amounts. You can get the IRS Form 8962 from the website of Department of the Treasury Internal Revenue Service or you can simply download IRS Form 8962 here.

Form 8962 is divided into five parts. If you need to fill out Form 8962 Premium Tax Credit after you have filed your return you will need to enter Form 1095-A. Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file.

Under the menu for Medical click StartRevisit next to Affordable Care Act Form 1095-A Answer Yes indicating that you have the form to enter. If you are required to use lines 12 through 23 of Form 8962 enter the amounts from lines 1 through 12 of this worksheet in the lines for the corresponding months and columns on Form 8962. Here are some of the sources you can obtain it from.

You first need to get hold of the IRS form 8962. It requires you to note. The 8962 Form is one of the simplest.

We will then proceed with the Part 1 of the. Youll enter the number of exemptions and the modified adjusted gross income MAGI from your 1040 or 1040NR. Youll also enter your household income as.

Complete the information on the next screen to match your form and click continue. Before you dive in to Part I write your name and Social Security number at the top of the form. How to fill out Form 8962 Step by Step - Premium Tax Credit PTC Sample Example Completed - YouTube.

Second Lowest Cost Silver Plan. IRS Form 8962 Premium Tax Credit is automatically generated by the TurboTax software after you have entered the Form 1095-A you received for Marketplace Insurance in the Health Insurance section of the program. You need to use 8962 Form to reconcile your estimated and precise income for the yr.

At the top of. As noted above you may also need to file additional 1040 forms like a Schedule 2 used for repaying excess tax credits due to the way the 1040 was changed for the 2018 tax year forward. Can turbo tax complete a form 8962 for me.

This includes your formal legal name and your Social Security number. It only has two pages as you can see from the Form 8962 printable template. Even its official instruction has 20 pages and besides that the most important reminders are printed on the form itself.

Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. Lets find out how to fill out form 8962. How to fill Out Form 8962.

In this video I show how to fill out the 8962. How do I file Form 8962 on Turbotax. Use your indications to submit established track record areas.

Sign In to Turbo Tax Click Tax Home in the upper. If you need IRS 8962 form instructions here is the information you need to know. You then mail your forms to the IRS regional office that covers your state of.

If youre filling out a paper tax return and mailing your forms to the IRS you include Form 8962 with your Form 1040. If you completed Part IV check the No box on line 10 skip line 11 and enter the amounts from lines 1 through 12 of this worksheet in the lines for the corresponding months and columns of lines 12 through 23 of Form 8962. Click on Deductions Credits under Federal.

You will now receive a PDF file of the form. How to complete any Form Instructions 8962 online. Add your own info and speak to data.

The 8962 form will be e-filed along with your completed tax return to the IRS. We will be using this to start the filing process. Instructions for How to Complete IRS Form 8962 The following step by step instruction given below will guide on how to complete the IRS Form 8962.

Next you need to enter your basic information. After you complete your return we will generate Form 8962 for you based on the information you have entered from your Form 1095-A. Complete Form 8962 and attach it to your 1040.

You will need to to. The first page of the blank Form 8962 seems quite obvious to file though there are some tricks. You need to get IRS Form 8962 from the Department of the Treasury IRS or through various online portals where you can download it as a PDF.

Irs Form 8962 Premium Tax Credit Community Tax

Irs Form 8962 Premium Tax Credit Community Tax

Https Www Irs Gov Pub Irs Prior F8962 2014 Pdf

How To Fill Out Irs Form 8962 Correctly

How To Fill Out Irs Form 8962 Correctly

Irs Form 8962 Calculate Your Premium Tax Credit Ptc Smartasset

Irs Form 8962 Calculate Your Premium Tax Credit Ptc Smartasset

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

Printable Tax Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Printable Tax Form 8962 Fill Out And Sign Printable Pdf Template Signnow

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

What Individuals Need To Know About The Affordable Care Act For 2016

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

8962 Form 2021 Irs Forms Zrivo

8962 Form 2021 Irs Forms Zrivo

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.