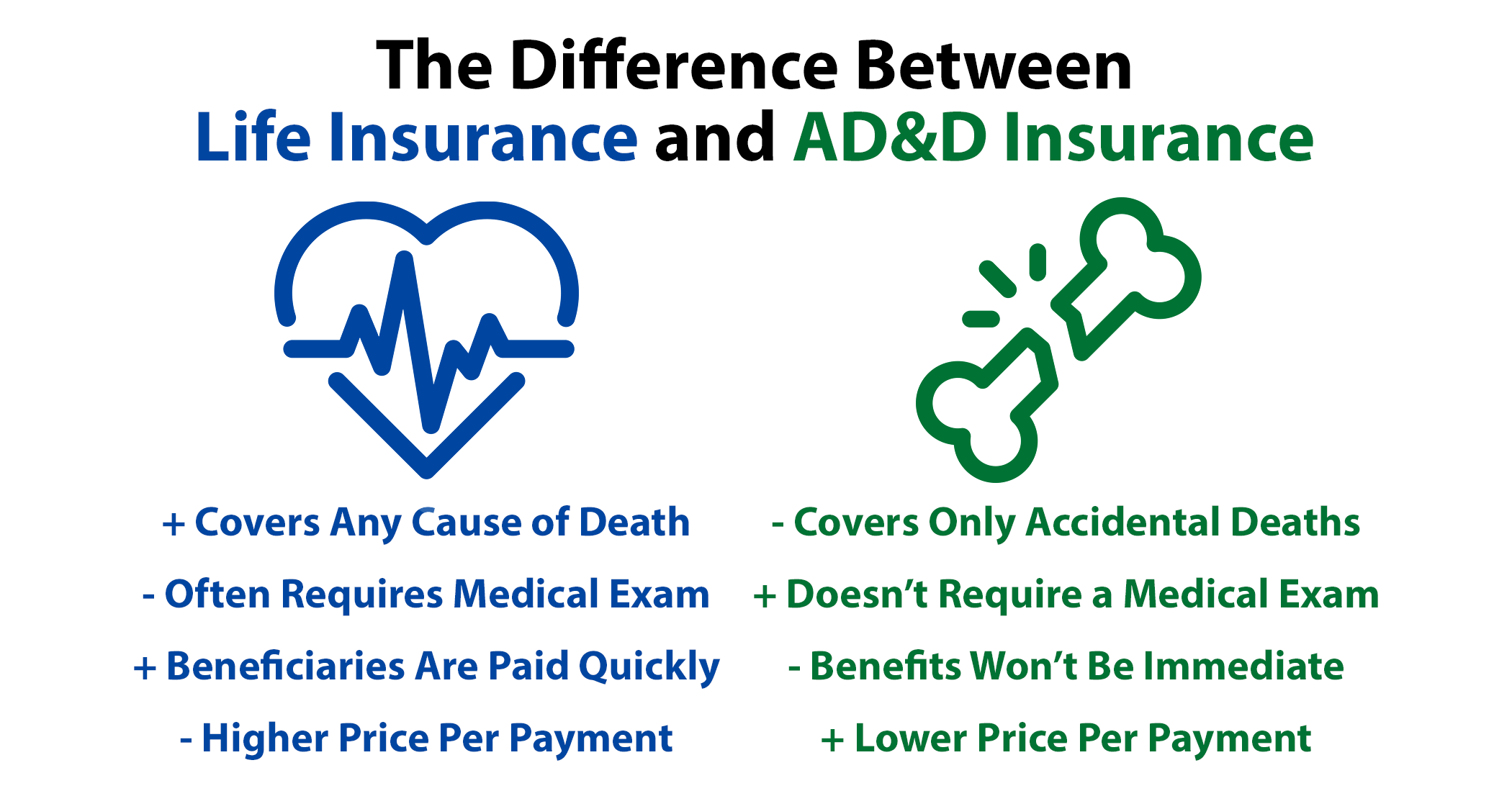

Your employer provides you with Basic Term Life and ADD insurance coverage. Basic Life refers to life insurance that would pay the death benefit to the beneficiary if death occurred by any reason except suicide in the first two years.

Policy 1 Basic Life And Ad D Insurance Spokane Fire Fighters Benefit Trust

Policy 1 Basic Life And Ad D Insurance Spokane Fire Fighters Benefit Trust

Accidental Death Dismemberment Coverage Options.

Basic life and ad&d. If you are dismembered because of an accident the policy generally pays out a predetermined amount as specified in your policy. ADD stands for Accidental Death and Dismemberment insurance. Employee Basic Life Insurance is paid to your beneficiary in the event of your death.

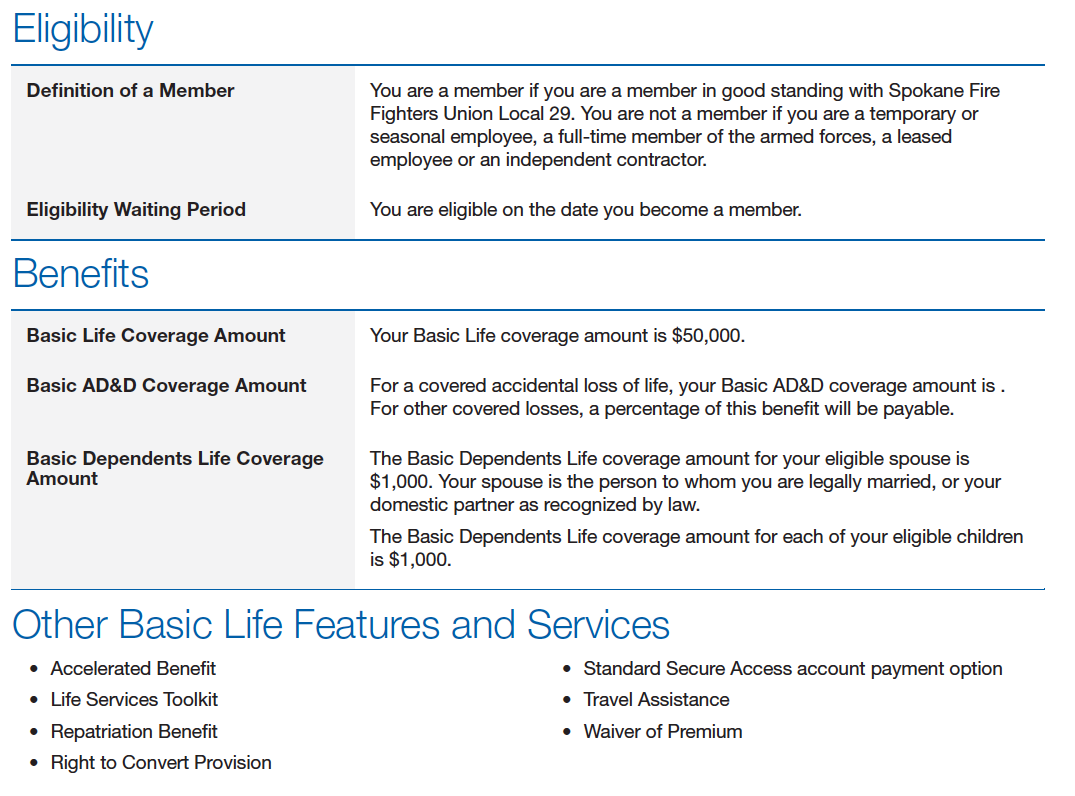

Life and ADD coverages under your employers plan terminates when your employment ceases when your Life and ADD contributions cease or upon termination of the group insurance policy. Basic Life ADD Plan Description Eligibility. It pays the beneficiary if death occurs by accident or it pays the insured person if they lose a limb.

Some life insurance companies may include or offer ADD in their group insurance plans. ADD includes life insurance but only for accidental death. Basic Term Life and Accidental Death and Dismemberment ADD Insurance.

Basic Life and ADD Insurance are the names often used when offering supplemental insurance to employees. It may also pay benefits for a severe physical loss such as a hand a foot or your eyesight. The benefit is equal to your annual base salary up to a maximum of 50000.

ADD Helps After a Severe Accident. Benefit Plan Summary Basic Life and ADD FEATURE FLAT BENEFIT SALARY PLAN 2-9 Lives Flat Benefit in increments of 10000 and 25000 up to 50000 1 times Basic Annual Earnings to 100000 10-24 Lives Flat Benefit in increments of 10000 and 25000 up to 100000 1-3 times Basic Annual Earnings to 350000. Services which give you and your family.

You must provide your beneficiary information on the enrollment form. Through the Life claim process. What does ADD insurance cost.

Its also different from life insurance because it covers severe non-fatal injuries such as loss of a limb or paralysis. 100 of eligible employees. ADD coverage pays benefits to you or your beneficiaryies if you die or are injured as a result of an accident.

An employee is best protected when they have access to both Life and ADD. FY 2019-2020 The renewalBasic LifeADD monthly premium rate will remain the same at 766 per employee per month effective712019. FY 2019-2020 Basic Life and ADD Insurance.

An accidental death and dismemberment insurance policy ADD is not the same as a standard life insurance policy. With Life and Accidental Death and Dismemberment ADD Insurance you can help them prepare for the unexpected and give them the confidence to live life to its fullest knowing their loved ones will be protected. LifeKeys services which provide access to counseling financial and legal support services.

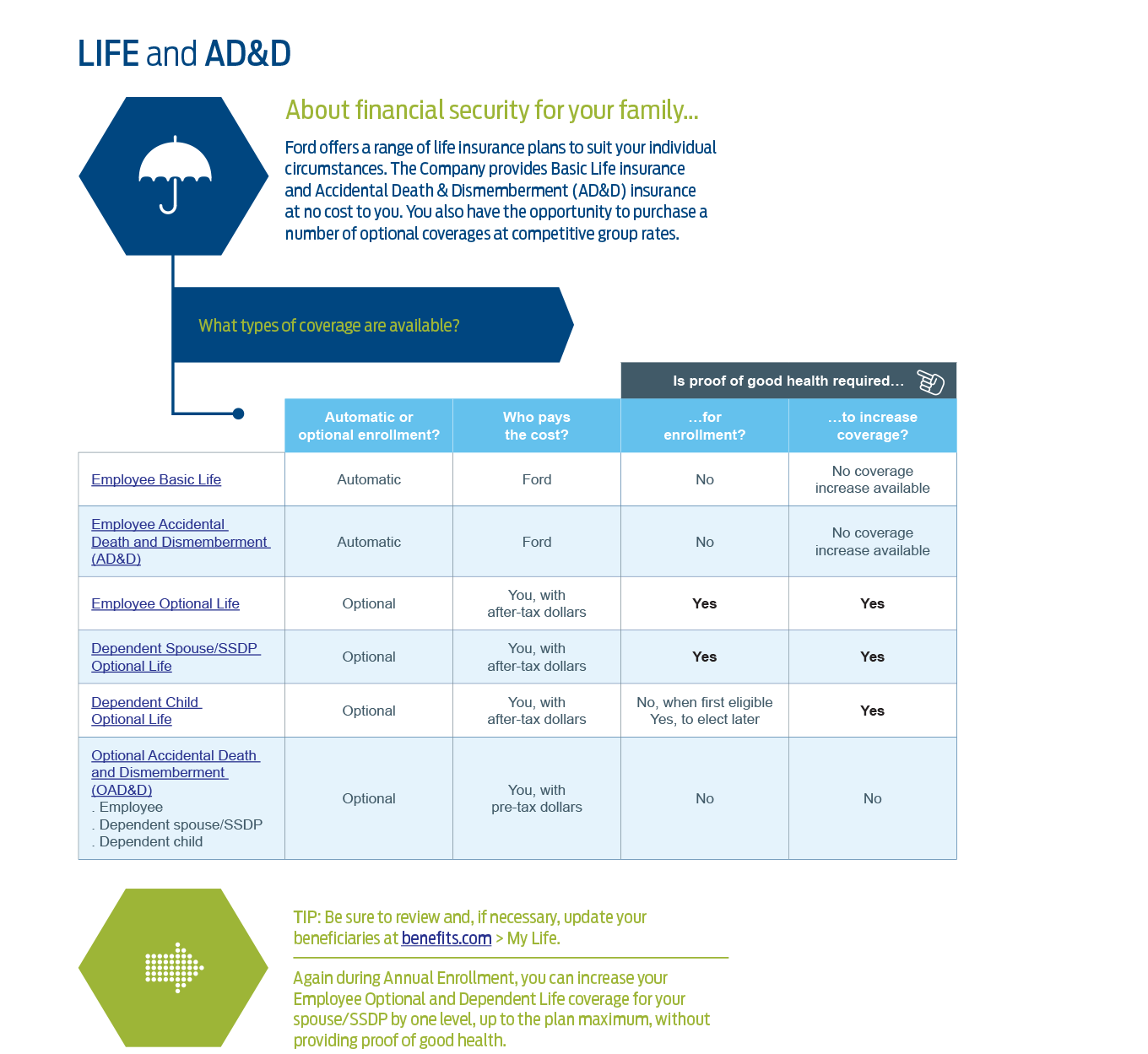

ADD coverage is paid to you or your beneficiary if you suffer a serious injury or die because of an accident. Basic life insurance pays a beneficiary if death of the insured person occurs by any reason except suicide in the first two years. Basic Life and ADD All eligible employees receive company-paid basic life and accidental death and dismemberment ADD insurance.

An employees loved ones depend on them. Accidental Death and Dismemberment insurance known as ADD pays an amount specified in the policy if a covered accident results in your death. The age used for an employees premium calculation from 112019 to 12312019 will be the employees age as of 12312018.

Depending on the amount of coverage purchased and the benefits it provides ADD insurance premiums can cost as little as 60 per year. Accidental death and dismemberment ADD insurance is insuranceusually added as a rider to a health insurance or life insurance policythat covers the unintentional death or dismemberment of. ADDD stands for Accidental Death and Dismemberment.

Zo kun jij bij ons een compleet nieuwe outfit shoppen die helemaal bij jou past. Your are automatically enrolled in Basic Employee Term Life upon hire. Bij ons kan je terecht voor jurken t-shirts truien broeken jassen blazers jeans laarzen sneakers boots maar ook accessoires zoals sjaals kettingen oorbellen ringen armbanden tassen.

Accidental Death Dismemberment ADD coverage complements your Basic Life insurance coverage and helps protect you 24 hours a day 365 days a year. Yes it pays a death benefit but as the name suggests only provides coverage in the event you die due to an accident. Your basic life insurance coverage is a term life policy.

Each active full-time employee working the minimum hours required per your city or town and no less than 20 hours is eligible to participate in the MMIA Life Insurance program. Life and ADD coverages are provided under a group insurance policy Policy Form GPNP99 or G2130-S issued to your employer by MetLife. Full-time employees are enrolled in this benefit.

If you are a full-time employee you automatically receive Basic Life Insurance and ADD coverage of 2x Benefit Compensation up to 2 million.

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

What Is Accidental Death And Dismemberment Coverage Quotacy

What Is Accidental Death And Dismemberment Coverage Quotacy

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

Life Insurance Human Resources Academic Personnel Services

Life Insurance Human Resources Academic Personnel Services

Group Basic Life And Ad D Benefits New Mexico State University

Group Basic Life And Ad D Benefits New Mexico State University

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Basic Life And Ad D Desoto School District

Is Group Accidental Death Dismemberment Ad D Worth It Glg America

Life Insurance Human Resource Management And Development The George Washington University

Life Insurance Human Resource Management And Development The George Washington University

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.