Contact your state Medicaid office or use the marketplace for details. Americans in this income range are caught in the trap where they make too much for Medicaid but not enough to afford private health plans.

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

In 32 states plus Washington DC that expanded Medicaid the minimum income is 138 FPL.

Obamacare minimum income 2020. In 2015 the minimum income for ObamaCare cost assistance was 11770. The types of assistance offered under the Affordable Care Act are. Meanwhile on 2018 plans bought during 2018 open enrollment Nov 1 - Dec 15 2017 the minimum income for the marketplace is 12060.

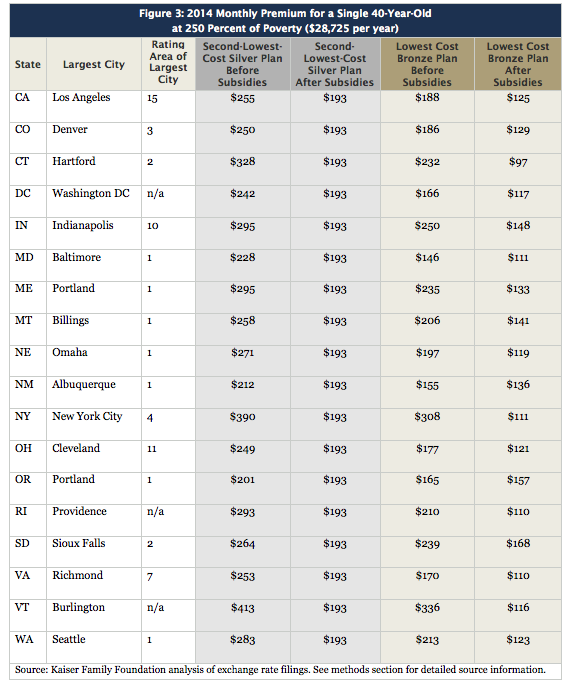

Specifics may differ by state. What Is the Income Limit for ACA Subsidies in 2021. Obamacare promises you wont pay more than 978 of your income a year or 464746 for the second-lowest Silver plan.

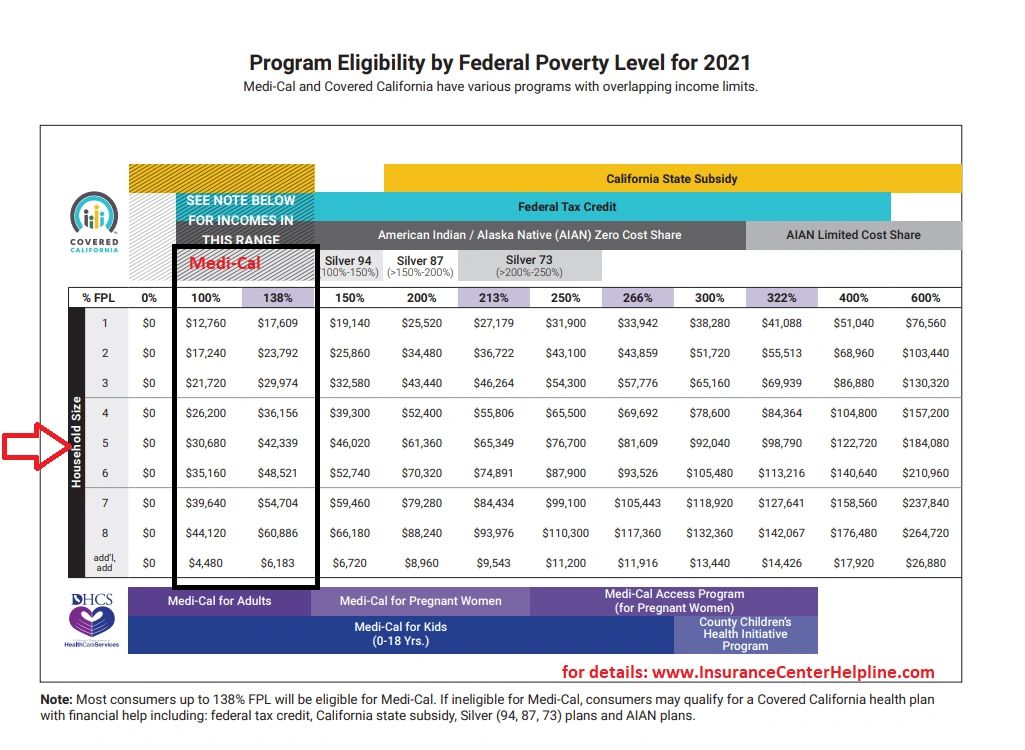

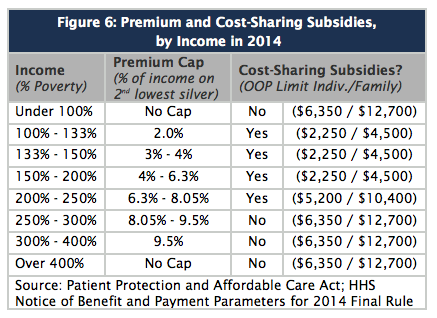

Your income is no more than 400 of the federal poverty level According to the Federal Register the 2020 poverty level for an individual is 12760. ObamaCare Cost Assistance To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. Phaseout levels After earning an income of 100400 or higher for a family of four 83120 for a family of three 65840 for a married couple with no kids and 48560 for single individuals you will no longer receive government health care subsidies.

If you are a single person making more than 400 of that amount 51040 you will likely not qualify for subsidies. In 2020 for example thats a family of four with an income between 26200 and 104800 a year. And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff.

Select your income range. From what I can tell the minimum income for a 1 person household in 2020 is 12490. Your subsidy is the cost of the plan minus 464746.

Specifics may differ by state. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. HealthCareGov is the official website to use if you want to lower costs on private health insurance and qualify for Medicaid under the Affordable Care Act.

Among many other benefits the law increases health insurance premium subsidies provides free health insurance if youre unemployed in 2021 and waives excess subsidy payments for the 2020 tax year. The basic math is 4X the Federal Poverty Level FPL as determined by the government. Nor can I see 16164 being too high.

Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income. You wont face a federal tax penalty for going without health insurance in 2021but there are many other downsides to being uninsured. Say you are a single person and you earn 47520 nearly 400 of the poverty level.

In states that didnt expand Medicaid the minimum income is 100 FPL and there are other qualifications in Florida that might knock you out. How do you know if you qualify for a premium subsidy on your ACA policy. The minimum income for ObamaCare is 100 of the federal poverty level.

The dollar amount of this changes every year but for 2020 it is 12490 for an individual and 25750 for a family of four. You can check the federal poverty level guidelines each year to figure out what the minimum income level is. You can probably start with your households adjusted gross income and update it for expected changes.

It raises by about 100 a year. In general you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between 12490 to 49960 or if your household income is between 21330 to. 23 Families of four with a household income between 26500 and 106000 can also qualify for premium subsidies.

You may qualify for free or low-cost care for Medicaid based on income and family size if you make 138 of the poverty level or for example 17609 individual or 36156 for a family of four in 2020. Heres how the subsidy works. Estimating your expected household income for 2021.

3 The income limit for ACA subsidies in 2021 for individuals is between 12880 and 51520. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate. You may qualify for free or low-cost care for Medicaid based on income and family size if you make 138 of the poverty level or for example 1723620 individual or 35535 for a family of four in for Jan 2019 Jan 2020.

For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. As noted above ObamaCares 2021 Open Enrollment period for 2021 health plans starts November 1 2020 and ends December 15 2020. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify.

So what is happening and how do I.

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Obamacare Health Insurance Subsidies Faq Ehealth

Obamacare Health Insurance Subsidies Faq Ehealth

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Obamacare Health Insurance Income Requirements Il Health Insurance

Obamacare Health Insurance Income Requirements Il Health Insurance

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.