Lee said the threat of a penalty drove a 41 increase in people newly signing up for health insurance through Covered California bringing that total to 418052 residents. Obtain an exemption from the requirement to have coverage.

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

You may qualify for an exemption to the penalty.

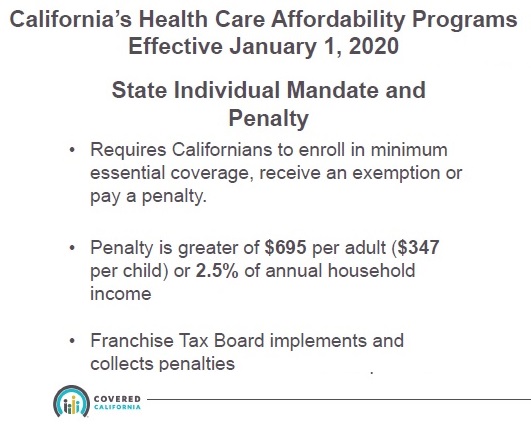

2020 ca health insurance penalty. Californias individual mandate penalty will require residents to prove they either had minimum essential coverage during the year have a valid exemption or pay a penalty. According to the California Franchise Tax Board FTB the penalty for not having health insurance is the greater of either 25 of the household annual income or a flat dollar amount of 750 per adult and 375 per child these number will rise every year with inflation in the household. Obtain an exemption from the requirement to have coverage.

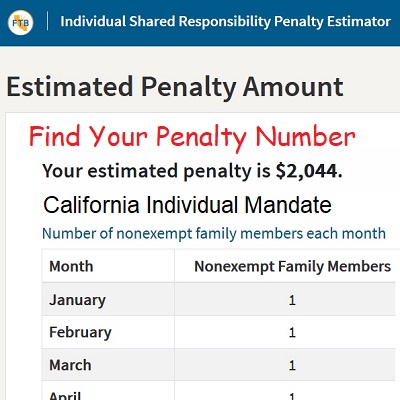

Obtain an exemption from the requirement to have coverage. Sample penalty amounts. The penalty will be the greater of 695 per adult 347 per child OR 25 of the household income.

Beginning January 1 2020 California residents must either. Beginning January 1 2020 California residents must either. Starting in 2020 California residents must either.

An adult who is uninsured in 2020 face could be hit. Vermont has an individual mandate as of 2020 but the state has not yet created any sort of penalty for non-compliance. An individual who makes 14600 and goes uninsured for.

Most exemptions may be claimed on your state income tax return while filing. Have qualifying health insurance coverage. Pay a penalty when they file their state tax return.

The penalty is in effect for the first time in 2020 after Gov. Pay a penalty when they file their state tax return. Have qualifying health insurance coverage.

However the health. Beginning January 1 2020 all California residents must either. For 2019 the threshold is 18241 for a single childless individual under 65 and 58535 for a married couple under 65 with two.

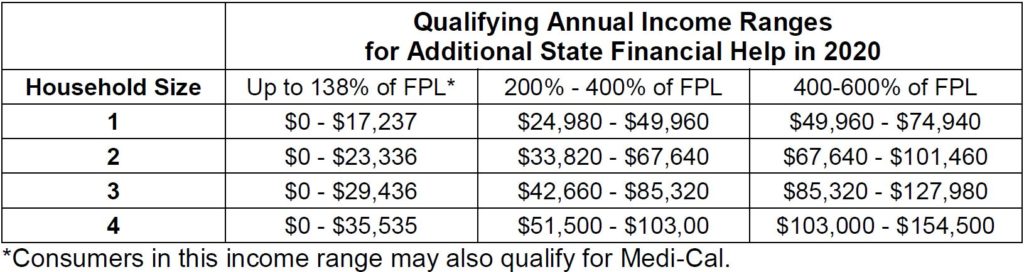

Household size If you make less than You may pay. Beginning in 2020 California residents must either. Pay a penalty when they file their state tax return.

The penalty varies based on a taxpayers income level and how long they go without coverage in 2020. The 2020 California filing thresholds are not available yet. Have qualifying health insurance coverage orPay a penalty when filing a state tax return orGet an exemption from the requirement to have coverageAbout the Penalty Generally speaking the penalty will be 695 or more when you file your 2020 state income tax return in 2021.

Have qualifying health insurance coverage. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. California created an individual mandate and associated penalty as of 2020.

The money raised from the penalties which is expected to be about 1 billion over the next three years. If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021. Family of 4 2 adults 2 children 142000.

A new California law that went into effect on Wednesday resuscitates the requirement that people obtain health coverage or face tax penalties. Get an exemption from the requirement to have coverage. Gavin Newom signed Senate Bill 78 last summer which requires Californians to have health insurance and provides for some state.

The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in. Maryland has created a program under which the state tax return asks about health insurance coverage but instead of penalizing uninsured residents. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021.

Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you.

Penalty For No Health Insurance 2020 In California Cost U Less Insurance

Penalty For No Health Insurance 2020 In California Cost U Less Insurance

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Californians Without Health Insurance Will Pay A Penalty Or Not California Healthline

Californians Without Health Insurance Will Pay A Penalty Or Not California Healthline

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

The 2017 Covered California Tax Penalty For Not Having Insurance

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

Health Insurance Penalty In The Year 2020 Do I Pay It

Health Insurance Penalty In The Year 2020 Do I Pay It

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.