This deductible is currently 2021 203year. 94 rânduri Psychiatric Medications Plan Plan G To request Plan G coverage an individual and.

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

These plans administered by private medical insurance companies help.

Plan g coverage. Plan G coverage though is the only Medigap plan besides Plan F which pays both the 20 coinsurance and the 15 excess charge in this example. The Part A deductible. At the end of the year the practitioner may re-apply for continued coverage.

People who frequently travel to foreign countries. Foreign travel emergency costs. Hospice copayments and coinsurance.

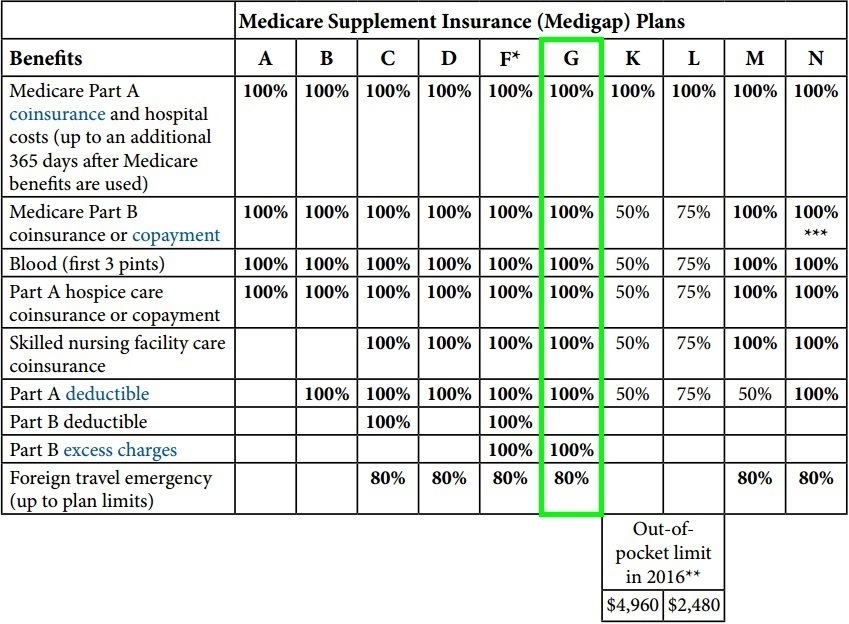

After your out-of-pocket expenses reach the Part B deductible amount you must pay 20 of the cost of Medicare-approved Part B services. For a full summary of what Plan G covers in contrast to other plans see the chart below. Medicare Plan G covers more than most Medicare supplement insurance Medigap plans.

Providing the patients contact information will allow them to be notified when their coverage needs to be renewed. Medicare Supplement Medigap insurance Plan G benefits are the same as Medigap Plan F except that the Medicare Part B deductible must be paid out-of-pocket. Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to with one exception.

10 rânduri Medicare Supplement Plan G is a type of Medigap plan to cover your out-of-pocket healthcare. Medicare Supplement Plan G covers more of your costs than most other Medicare Supplement plan types so it might have a higher premium than those that offer less coverage. Plan G in particular covers all the gaps in Medicare with the one exception of the Medicare Part B deductible.

High-Deductible Plan G is available in 13 states including Alabama Arizona Delaware Georgia Illinois Iowa Kansas Louisiana Maryland North Carolina Ohio Pennsylvania and South Carolina. However Plan G does not cover the Medicare Part B deductible. Medicare Supplement Plan G covers your share of any medical benefit that Original Medicare covers except for the outpatient deductible.

Plan G coverage is for a set period of no more than one year. In their initial research phase many people compare Plan G to Plan F which covers the Part B deductible. When it comes to covered benefits Medicare Supplement insurance Plan G is nearly identical to Medicare Supplement insurance Plan F.

As we already stated Plan G does not cover the Part B deductible. In some states both plans offer a high deductible version. These two plans offer the most comprehensive coverage of the 10 Medigap plan types available in most states.

Plan G Coverage What Medical Services Does Plan G Cover. When you enroll in Medigap Plan G coverage you pay an annual deductible and your plan provides coverage for any gaps in Medicare coverage for expenses that would normally require additional payment on your part including deductible and. Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs such as deductibles copayments and coinsurance.

Medigap plans F and G offer similar coverage. The Part B deductible for 2021 is 203. Plan G covers 80 of emergency health care costs while in another country after you pay a 250 deductible.

Aetnas Medicare Supplement Plan G has a premium discount of 7 if someone in your home is also on one of its plans. Part B excess charges. Plan G is one of only two supplement plans that cover Part B excess charges extra charges from doctors who dont participate in Medicare.

In addition no Medigap plan including Plan G covers routine dental care. Plan G covers. Plan G may be a good fit for you if you want a lower premium and are able to pay the Part B.

The main difference between the two plans is that Plan G doesnt cover the Medicare Part B deductible. A person with such a plan. So it helps to pay for inpatient hospital costs such as blood transfusions skilled nursing and hospice care.

With Plan G you will need to pay your Medicare Part B deductible. Medicare Supplement Plan G. What Plan G doesnt cover.

Health insurers that offer Medicare Supplement plans can set their own premium rates but the plans are standardized and must offer the same coverage for example Plan G in Nebraska must offer the same coverage as Plan G.