Read more below on how to apply for your FEIN. The NPI is a 10-digit intelligence-free numeric identifier.

What S New In Acuitylogic 7 10 For On Premises Users

What S New In Acuitylogic 7 10 For On Premises Users

Other commonly used terms for EIN are Taxpayer Id IRS Number Tax Id.

Doctor tax id. What You Need to Know The NPI Registry Public Search is a free directory of all active National Provider Identifier NPI records. You may apply for an EIN in various ways and now you may apply online. The NPI Final Rule issued in Jan 2004 has adopted the NPI number as that standard for healthcare provider identificationThe NPI has replaced the UPIN Unique Provider Identification Number as the required identifier for all Medicare services including health insurance claims.

Businesses are often confronted with customers who wish to make purchases tax free either because they intend to resell the item and charge the sales tax or because they are making a purchase for an organization possessing a tax exempt card issued by the State Comptrollers Office. A Taxpayer Identification Number TIN is an identification number used by the Internal Revenue Service IRS in the administration of tax laws. When a business changes its structure it will usually be issued a new ID number.

A federal tax ID lookup is a method of searching for a businesss information using their tax identification number FTIN or employer identification number EIN. Generally businesses need an EIN. Step 2 Obtain a Federal Tax ID Number from the IRS.

This Department is the initial step but only. Tax ID numbers are issued to individuals as Social Security numbers and to businesses as Employer Identification numbers. The National Provider Identifier NPI is a unique identification number for covered health care providers doctors dentists chiropractors nurses and other medical staff.

5 Click on the provider name for additional information. Individual Taxpayer Identification numbers are assigned to people who are required to have a Tax ID but either dont have a Social Security number or are not eligible for one. Federal Tax ID Number Search Experts.

Healthcare providers acquire their unique 10-digit NPIs to identify themselves in a standard way. Often the reason why people need the identification number is because they have been advised by a bank that no account will be opened without it even if it is requested by a non-profit organization. 3 Select the State in which you would like to search.

Since 1996 HIPAA requires the adoption of a standard unique number for healthcare providers. The NPI Number National Provider Identifier is the only healthcare provider identifier that can be used for identification purposes in standard transactions by covered entitiesThe Health Insurance Portability and Accountability Act HIPAA requires that covered entities use NPI numbers in standard transactionsThe NPI number must be used in lieu of legacy provider identifiers such as. View EIN for P C DOCTOR.

XX-XXXXXXXXX to business entities operating in the United States for the purposes of identification and employment tax reporting. The United States federal government uses a federal tax identification number for business identification. 2 Enter your Criteria.

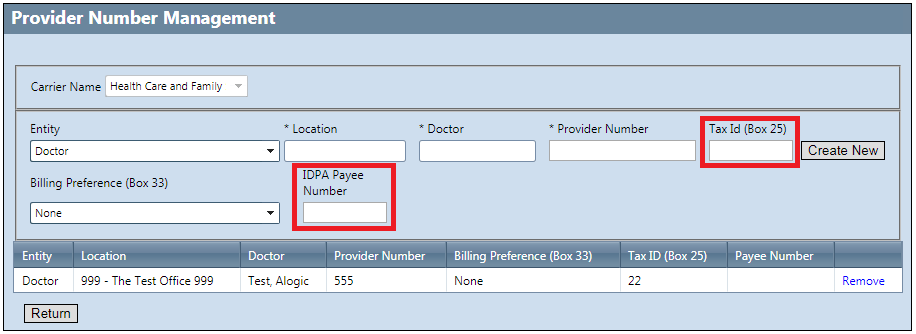

Because of variability of the nature of this it is difficult to state your cost with certainty before the doctor evaluates your eyes. The Tax ID number is actually called a Federal EIN Federal Employer Identification Number. The TIN is required for doctors to conduct normal business activities such as pay business taxes bill insurance providers and process payroll.

Employer Identification Number EIN. Taxpayer Identification Number TIN and Employer Identification Number EIN are defined as a nine-digit number that the IRS assigns to organizations. A Social Security number SSN is issued by the SSA whereas all other TINs are issued by the IRS.

The National Provider Identifier NPI is a unique identification number for covered health care providers doctors dentists chiropractors nurses and other medical staff. Search over millions of EINs online. For more information please refer to NPI.

Online Verification of Maryland Tax Account Numbers. The NPI is a 10-digit intelligence-free numeric identifier. An identity thief that steals or buys your personal or business Tax ID number can use the information to.

An Employer Identification Number EIN also known as a Federal Tax Identification Number is used to identify a business and required for a business to file taxes. 1 Choose a Search Type. It is issued either by the Social Security Administration SSA or by the IRS.

The cost of a contact lens evaluation varies based on type of lenses that the doctor prescribes and the level of continued care needed. A doctor is no different and should have a Federal Tax Identification Number TIN issued by the Internal Revenue Service. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

Issuance of an NPI does not ensure or validate that the Health Care Provider is Licensed or Credentialed. Network Status Provider NameTIN Search. The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Federal Tax Identification Number FTIN is a unique nine-digit number assigned by the Internal Revenue Service IRS format.

Verify and locate Tax IDs instantly. Tax identification numbers are issued to businesses by the IRS depending on their structure. The IRS uses the number to identify taxpayers who are required to file various business tax returns.

TINEIN are used by employers sole proprietors corporations partnerships nonprofit associations trusts estates of decedents. EINs are used by employers sole proprietors corporations partnerships non-profit.