CVS has surpassed 200 million in affordable housing investments in California as part of an ongoing commitment to address housing insecurity throughout the country. Options for the whole family.

Flu Shot Cost Comparison Walmart Vs Cvs Vs Walgreens Vs Target Cheapism Com

Flu Shot Cost Comparison Walmart Vs Cvs Vs Walgreens Vs Target Cheapism Com

Flu vaccine for age 18 months and up.

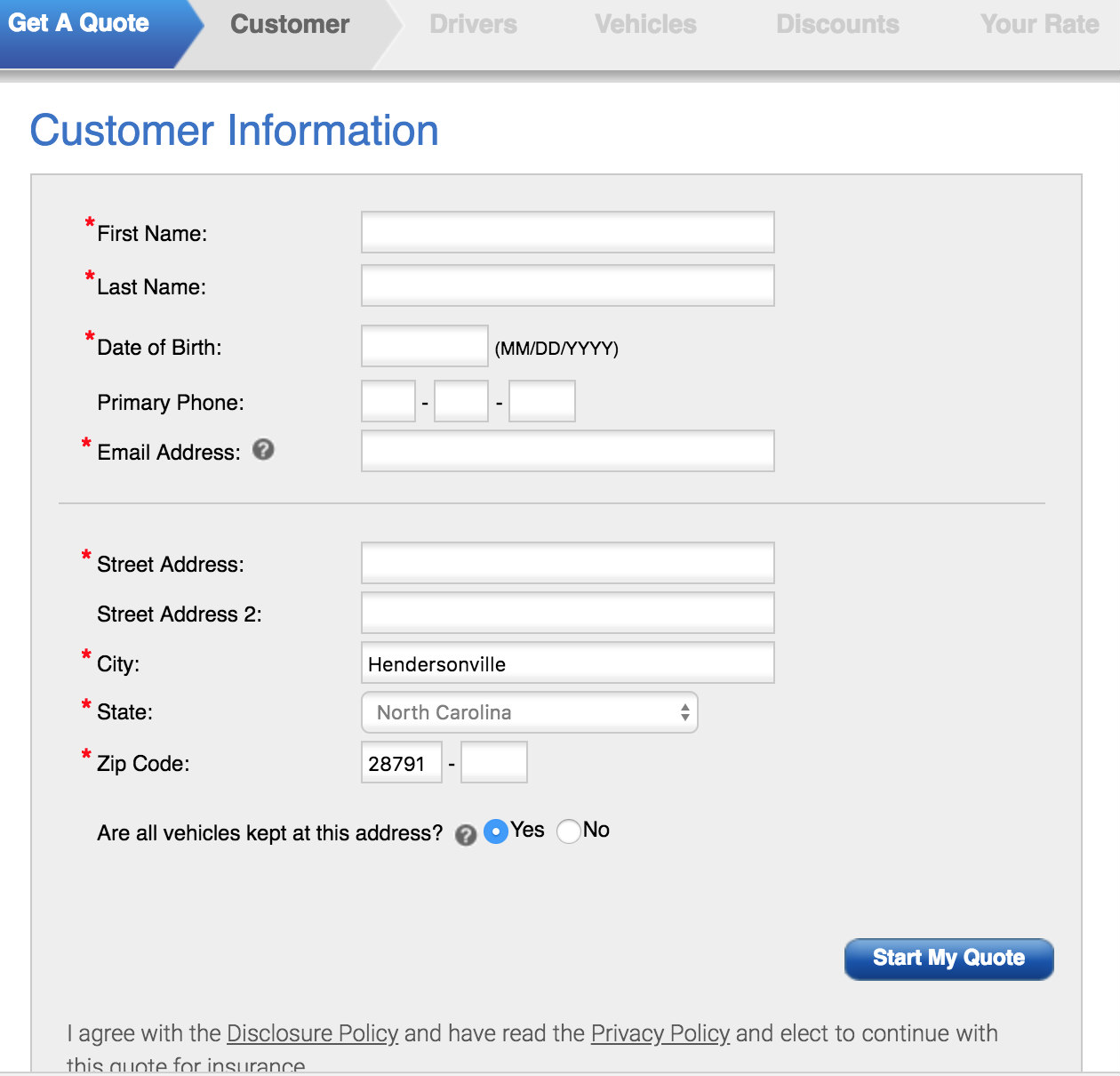

Cvs flu cost. Molinari N Ortega-Sanchez I Messonnier M Thompson W Wortley P Weintraub E. It means we accept over 5000 health plans for vaccinations. Compare prices print coupons and get savings tips for Flumist Quadrivalent and other Flu Vaccination drugs at CVS Walgreens and other pharmacies.

If you have health insurance or Medicare Part B your flu shot may be free at CVS. In addition and for a limited time while supplies last in participating states customers will receive a 5 off 20 shopping pass when they get a flu shot at CVS Pharmacy or MinuteClinic valid August 18 through October 31. A generic version of Tamiflu is available see oseltamivir prices.

Birth control injection 114 DTaP diphtheria tetanus pertussis 105. Schedule a flu shot with a certified pharmacist at a CVS Pharmacy. CVSpharmacy and MinuteClinic can directly bill many national and regional health insurance plans that cover all or part of the cost of a flu shot.

Seasonal for adults and children preservative-free. The cost for Tamiflu oral capsule 30 mg is around 155 for a supply of 10 capsules depending on the pharmacy you visit. All non-flu vaccines as well as the high-dose senior flu vaccine are excluded.

Your out-of-pocket cost if any will depend on your specific insurance plan. Who should get vaccinated. Because the risk of shingles increases for older adults a single dose of shingles vaccine is recommended for people 60 years of age and older.

While walk-ins are always welcome at CVS. However on the other side of the country Cigna paid 4753 to a provider in Long Beach California and 85 to Sutter Health in Sacramento for the shot. With record-breaking hospitalization rates for widespread influenza activity the 2017-2018 flu season marked one of the worst in years.

The San Francisco Health Department offers convenient locations for members of the public to easily access free or low-cost flu vaccines. COVID-19 is continuing to affect communities across the country and yet we have another potentially harmful virus to worry about the flu. Seasonal high dose ages 65yr 70.

SOURCE FOR 163 BILLION IN LOST EARNINGS. CVS is sweetening the deal with a. 1110 MinuteClinic locations schedule flu shots for the whole family.

Seasonal ages 18mth 50. Health care providers are busy meeting pandemic-related demands including COVID-19 testing occurring at medical offices and drive-thru locations like CVS. Prices are for cash paying customers only and are not valid with insurance plans.

CVS pharmacies including those in Target stores offer quadrivalent flu shots for about 40. CVS Health Corp. Will offer rapid strep throat and influenza tests at its roughly 1100 MinuteClinics by mid-November the company said Friday.

Flu vaccine for adults over age 18. Seasonal Flublok ages 18yr 70. Plus additional laboratory fees.

We have the right flu shot for seniors adults and children. Both CVS Pharmacy and MinuteClinic offer vaccines for the whole family. Clients are invoiced for the vouchers redeemed on a monthly basis.

Preparing for this years flu season. Immunization with a high-dose flu shot for seniors costs 70. According the Centers for Disease Control and Prevention CDC influenza began increasing in November reached an extended period of high activity during January and February and remained elevated through March.

For instance the insurer paid 32 for a shot administered at a CVS in Washington DC and 40 to a CVS that was less than 10 miles away in Maryland. The high-dose flu vaccine for seniors without insurance costs 6999. See service page for details.

Many vaccines including the regular flu shot are considered a preventive service under the Affordable Care Act and so are fully covered and available at no cost through most insurance plans including Medicare Part B. Other visit fees will apply. The Houston Health Department offers flu shots to uninsured and underinsured people on a sliding scale that ranges from free to 15.

Prices start at 2499. 5 Zeilen Cash price. A flu shot is the best way to protect yourself and your family from flu which sends more than 200000 people to the hospital each year.

Cant find a location near you on this list.

/GettyImages-603707289-57310e865f9b58c34ce03555-c99023fc8b4b4855990ca0ac0a990a82.jpg)