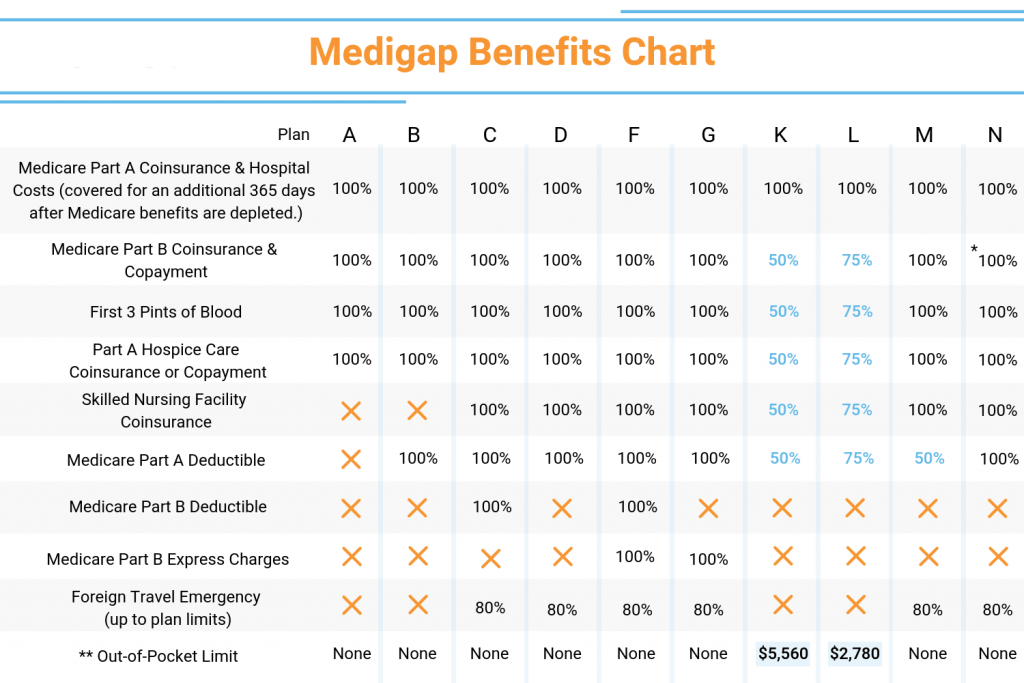

Each plan gives you comprehensive coverage and are among the most robust of all supplements sold by Avera Health Plans. The small difference is that Plan G makes the beneficiary pay the Medicare Part B deductible out-of-pocket.

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

One of these add-on programs is called Medicare SELECT.

Medicare select plan g. Medigap Plan G Premiums vs. This can be financially advantageous to many people but its not offered everywhere. The only difference is that Plan G makes you pay the Medicare Part B deductible out-of-pocket.

Plan G covers everything listed on the benefits chart with the exception of the Part B deductible. Simply put Medicare SELECT is a Medigap policy a supplemental insurance plan added on to Medicare that confines your treatment options to a local group of hospitals and doctors. Medicare SELECT plans pay for the same costs that the standard version of the same type of Medigap plan covers.

Or some other wellness coverage. Medicare SELECT plans negotiate with these doctors and. For example Medicare Supplement Plan G and its SELECT option cover the same benefits such as.

Annons Free No Obligation Comparisons of Medicare Advantage Plans. With Plan G youll only be responsible for the annual Part B. What Costs Does Medicare SELECT Plan G from Sanford Health Cover.

Plan G pay 80 of the billed charges for medically necessary emergency care outside the US. Medicare Supplement Plan G is the same with Medicare Supplement Plan. A High Deductible Medicare Supplement Plan G version also exists and has a 2370 per year deductible in 2021 Comparison of standard Medicare Plan G vs High Deductible Plan G.

Medicare Select plans are standardized in the same way as regular Medigap plans ie Plans A-N and premiums for Medicare Select plans can be lower than the premiums for a regular Medigap plan that provides the same benefits ie a Medicare Select Plan G versus a regular Medigap Plan G. Medicare Select Plans are available in specific geographic areas only and you must live within a 30 mile radius of a Medicare Select participating hospital listed below to enroll in a Medicare Select plan. Medicare Select Hospital Listing.

Medicare Supplement Plan G Coverage Like other plans Plan G fills in the gaps that Original Medicare leaves uncovered. With a standard Medicare Supplement Plan G there is a small deductible per year 203 in 2021 and 203 is the total out-of-pocket cost for the entire year. Thankfully Medicare Supplement Plans also known as Medigap help fill in the gaps.

Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs such as deductibles copayments and coinsurance. Annons Free No Obligation Comparisons of Medicare Advantage Plans. Medicare Supplement Plan G is nearly the same as a Plan F policy.

Medicare Supplement Plan G in particular offers the broadest coverage for new Medicare beneficiaries. After you meet a 250 deductible per year. Heres a quick look at what costs Plan G.

Medicare Plan G is nearly identical to a Plan F policy. Medicare Select Plans Hospital Listing by city Medicare Select Hospital List print version. A Medicare SELECT policy is a Medigap policy that limits your coverage to a network of doctors and hospitals.

What Benefits Does Medicare SELECT Plan G From Avera Health Include. Also SELECT plans dont include Part D dental or any other benefits. These providers charge less for the services they provide to members.

For example Medicare SELECT Plan G covers the same out-of-pocket costs as standard Medigap Plan G. Depending upon the condition of your health it might be a better idea to sign up for Plan N even though there is a copay and may be 15 in excess charges associated with it. Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance or copayment Blood first 3 pints Part A hospice care coinsurance or copayment Skilled nursing facility care coinsurance.

It covers a variety of expenses that arent covered by Medicare parts A and B such as coinsurance copays and some deductibles. 3 Reasons to Choose Medicare Supplement Plan G in 2021. However depending on the Medigap company you might be able to purchase an Active.

SELECT plans negotiate rates with a network of providers. The difference is that a Medicare SELECT plan limits the doctors and hospitals you can access for health care. Medigap Plan N Premiums In most states Plan G generally runs about 20-25 more per month than Plan N More about Plan G prices.

Select plans are different from Medicare Advantage plans because they dont have a copayment schedule like the Medicare Advantage plans. Medicare Supplement Plan G like other Medigap plans A. Medigap Plan G is a Medicare supplement insurance plan.

Each plan gives seniors comprehensive coverage and are among the most robust of all supplements offered by Sanford Health Plan.

/https://www.thestar.com/content/dam/thestar/life/2017/01/31/dont-worry-you-can-still-get-an-iud-in-canada-if-you-have-insurance/copper-iud-photo.jpg)