Youll be responsible for paying anything that Part A and B dont cover. By using the Medicare-select.

Compare Medigap Plans Comparison Chart For 2021 Medicarefaq

Compare Medigap Plans Comparison Chart For 2021 Medicarefaq

What is the Medicare SELECT Plan Medicare SELECT plans limit you to a network of specific doctors specialists and hospitals.

Medicare select plan. We discuss Medicare SELECT plans. Use a Medicare Select Hospital. This weeks question is less common than others but there are plenty of people asking it.

Select Plan C Select Plan C covers your Part A deductible as well as paying your annual Part B deductible in full. Annons Free No Obligation Comparisons of Medicare Advantage Plans. This plan also provides for skilled nursing facility care and medically necessary emergency care coverage outside the United States.

As with other types of Medigap plans Medicare SELECT helps you pay for costs that Medicare parts A and B doesnt cover such as. A Medicare SELECT plan is essentially a less expensive twist on a traditional Medicare Supplement or Medigap plan. It allowed companies who offered Medigap services in 15 states to market network-based medigap products meaning that the plans would be developed based on the services available in the area restricting which hospitals and doctors could be used.

Medigap plans are private insurance policies that can help close the gap between your coverage and what you pay. Theres no limit to what youll pay out of pocket in a year unless you have other insurance like Medigap Medicaid or employee or union coverage. A Medicare SELECT policy is a Medigap policy that limits your coverage to a network of doctors and hospitals.

Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance or copayment Blood first 3 pints Part A hospice care coinsurance or copayment Skilled nursing facility care coinsurance. Medicare Part A deductible for inpatient care which is 1484 per benefit period in 2021 Coinsurance payments for Medicare Parts A and B. If you go to a healthcare provider or hospital that is outside the network your coverage will not pay unless its an emergency.

You still have the same freedom to see any doctor or specialist and. If you choose to join a Medicare drug plan Part D youll pay that premium separately. This is in contrast to regular Medigap plans which will cover some or all of a patients Original Medicare out-of-pocket costs as long as the patient uses a provider who hasnt opted.

Any descriptions of Medicare supplemental coverage plans products andor services are for informational purposes only and subject to change. Select Plan E With Select Plan E your Part A deductible is covered. For example Medicare Supplement Plan G and its SELECT option cover the same benefits such as.

Our Medicare Advantage plan SelectHealth Advantage HMO HMO-SNP offers medical and pharmacy benefits together in one simple plan. The most popular Medigap plan is. These providers charge less for the services they provide to members.

You generally have to pay a portion of the cost for each service Original Medicare covers. SELECT plans negotiate rates with a network of providers. Medicare Select is a type of Medicare supplement Medigap plan that requires the policyholder to receive services from within a defined network of hospitals doctors.

Annons Free No Obligation Comparisons of Medicare Advantage Plans. Medicare Supplements pair with Original Medicare to assist with the gaps in coverage. Medicare SELECT plans require you to use a specific network of.

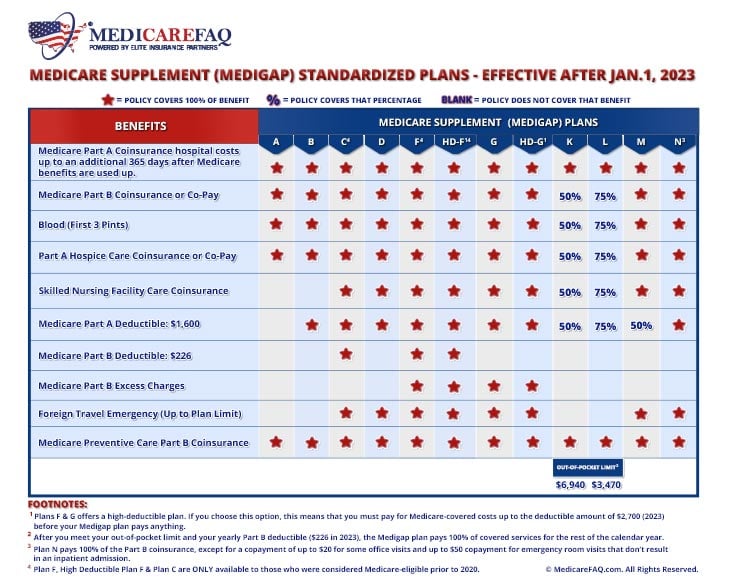

A Medicare SELECT plan is a type of Medicare Supplement Medigap plan. Medigap comes in many different formsparts A B C D F G K L M and Nthat help varying cover varying levels of copayments coinsurance extra hospital costs pints of blood deductibles foreign travel insurance and more. With a Medicare Select Plan if you need to be admitted to a hospital or if you require inpatient care you must use a network hospital.

Everything else works the same as a standard Medicare Supplement. To review most states offer 10 standardized Medicare Supplement plans Massachusetts Minnesota and Wisconsin work a little differently. Medicare SELECT was introduced to the Medicare supplemental coverage plan in the early 1990s.

What they are and whats diff. When you first become eligible for Medicare during your Initial Enrollment Period the 7-month period that begins 3 months before the month you turn 65 includes the month you turn 65 and ends 3 months after the month you turn 65 you can join a Medicare Advantage Plan with or without drug coverage or Medicare drug plan. Any advertised plans or features may not be available in all states.

:max_bytes(150000):strip_icc()/medicare-part-d-coverage-4589853-ada67299bb5a4d3eb70e32dd66bcab0f.png)