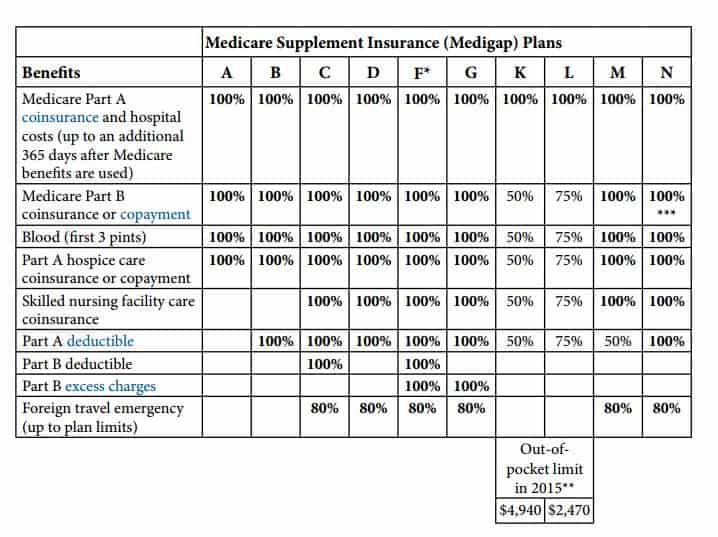

Medicare Part A coverage including coverage through a Medicare Advantage Plan is qualifying health coverage. The table below explains the types of forms where they come from and who receives them.

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Not everyone will get this form from Medicare and you dont need to have.

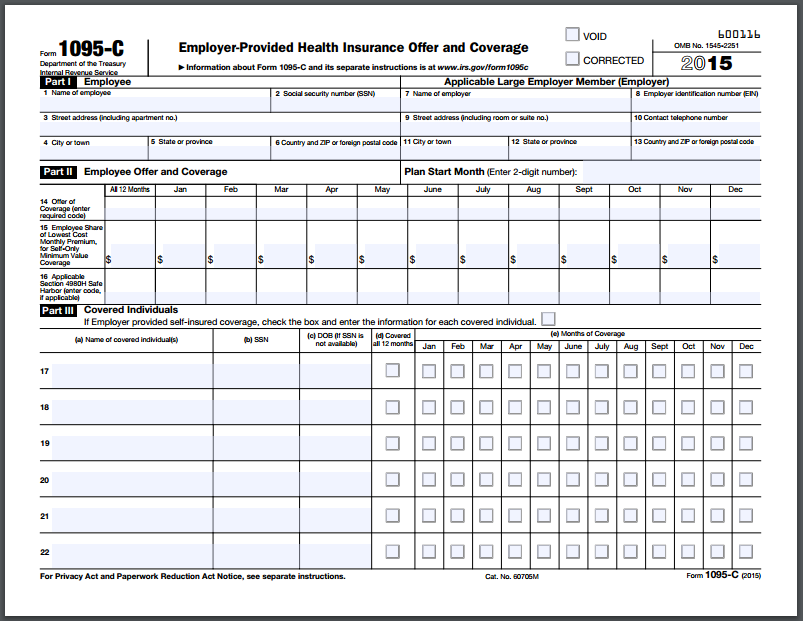

Do i get a 1095 from medicare. You may receive Form 1095-B from Medicare via mail. If you dont get Form 1095-B dont worry. Form 1095-C Individuals who enroll in health insurance through their employers will receive this form.

Do I need form 1095 to file my taxes. You shouldnt have to fill out the 1095-B form. Medicare Part A Hospital Insurance coverage is considered qualifying health coverage.

Form 1095-B Individuals who enroll in health insurance through Medi-Cal Medicare and other insurance companies or coverage providers will receive this form. If you do receive these forms in the future just be sure to keep them with your other tax records in case the IRS asks for proof of coverage though. How to find your 1095-A online Log in to your HealthCaregov account.

As a general rule no. Heres what you need to know. If you question how do I get my Form 1095-B from Medicare onlineheres the answer.

If you are on Medicare you will not receive a Form 1095-A. The 1095-B Qualifying Health Coverage Notice should be kept for your records. The Medicare premiums you pay will show on your Social Security statement Form SA-1099.

DFAS defense finance and accounting service - link. 1095-B This form provides information about your health insurance coverage who was covered and the coverage effective date. Just indicate that you had that type of insurance during the software interview questions.

Form 1095-A Individuals who enroll in health insurance through Covered California or the Federal Marketplace will get this form. Httpswwwdfasmil will provide IRS Form 1095-C to all US. If you need a replacement Form 1095-B call 1-800-MEDICARE.

How Many Forms Should You Expect. Under Your Existing Applications select your 2020 application not your 2021 application. If you have Medicare supplemental insurance and diddid not receive 1095-B and 1095-C forms for your healthcare coverage then you do not need to file them.

If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A. This form details your health coverage. Your Form 1095-B shows your Medicare Part A information and can be used to verify that you had qualifying health coverage for part of.

And theyll give you a Health Coverage Information Statement Form 1095-B or Form 1095-C as proof you had coverage. You dont need to download the form yourself. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement.

If you enrolled in coverage through the Marketplace you will receive a Health Insurance Marketplace Statement Form 1095-A. Questions and Answers about Health Care Information Forms for Individuals Forms 1095-A 1095-B and 1095-C Because of the health care law you might receive some forms early in the year providing information about the health coverage you had or were offered in the previous year. Download all 1095-As shown on the screen.

Form 1095-B is the catchall form that is issued for any type of coverage not on a Form 1095-A or C. This includes coverage from insurance companies the government Medicaid CHIP Medicare Part A TRICARE VA etc small self-insured employers and more. You may receive a tax form related to your Medicare coverage.

An IRS Form 1095 documents you and your Family members if applicable have the minimum essential. Form 1095-B and 1099-HC are tax documents that show you had health insurance coverage considered Minimum Essential Coverage during the last tax year. If you received health insurance through an employer or a government program like Medicaid or Medicare youll probably get Form 1095-B or 1095-C.

If you have Part A you may get IRS Form 1095-B from Medicare in the early part of the year. If you receive one it should come to you pre-filled by Medicare or your Medicare Advantage provider. Military members and IRS Form 1095-B to all Retirees Annuitants former Spouses and all other individuals having TRICARE coverage during all or any portion of tax year 2015.

You can learn more about this topic at the IRS website or talk with your tax advisor. Select Tax Forms from the menu on the left. If you expect a 1095-B or a 1095-C you can typically mail your taxes without the form as long as you know whether or not you were insured.

Dont worry about waiting though. If your form is accurate youll use it to reconcile your premium tax credit. If you had health insurance at any time during a calendar year you may get a version of form 1095 for tax purposes.

The 1095-B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year. You dont need this form to file your tax return. You can use this information to complete your federal income tax return.

/AHs2-51ccd77fc9744bd09dc41d38051d86e9.png)