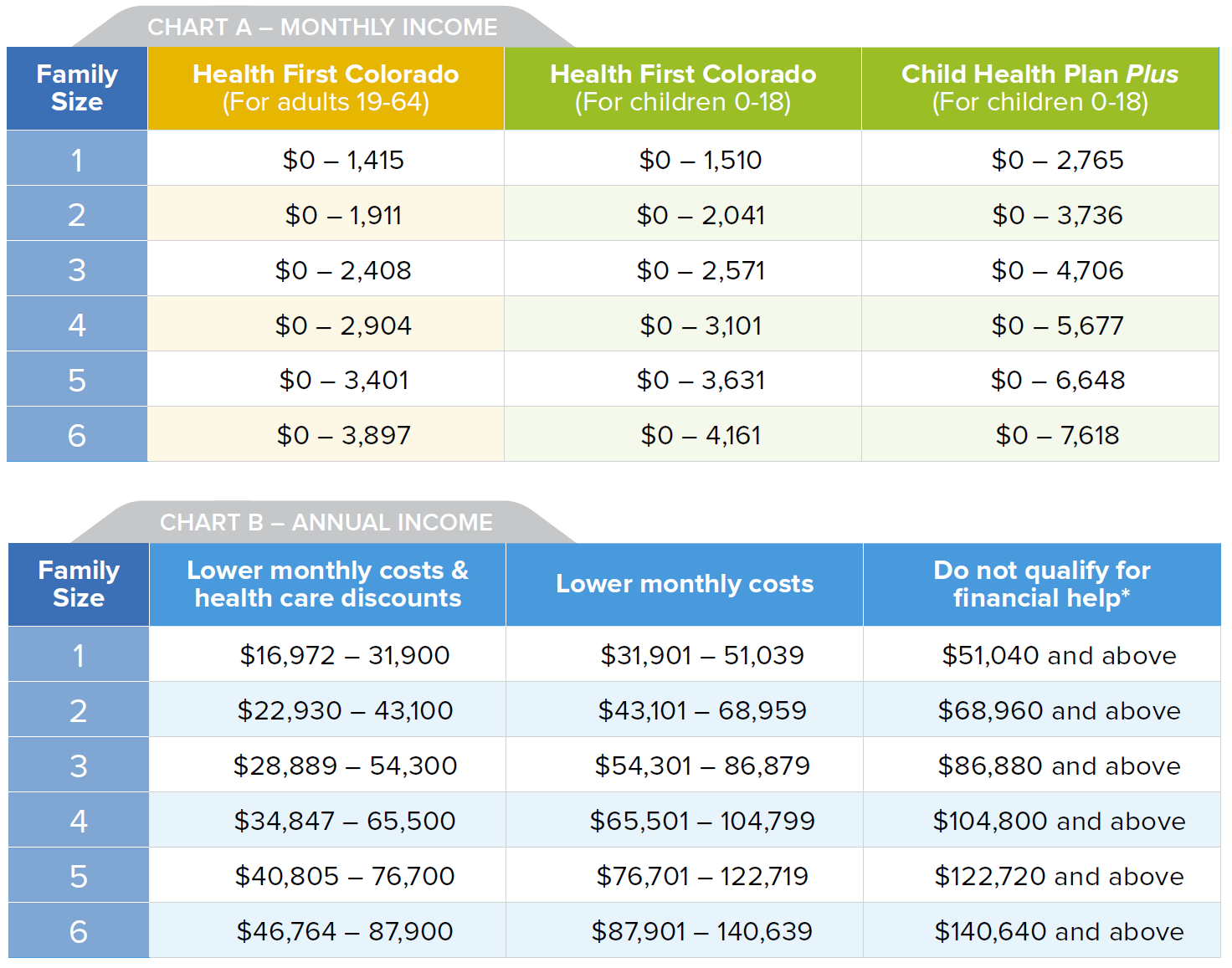

Phaseout levels After earning an income of 100400 or higher for a family of four 83120 for a family of three 65840 for a married couple with no kids and 48560 for single individuals you will no longer receive government health care subsidies. Select your income range.

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare.

Aca income limits for 2020. 9 rows Lowest eligible income 100 FPL. Under the Form W-2 safe harbor employees contribution for the lowest-priced self-only plan cannot exceed 978 for 2020 of their W-2 Box 1 wages. For a family of four that number equaled 104800 a year.

Employers with nongrandfathered plans will need to update their maximum annual OOP limit for 2020 to 8150 self and 16300 other. Heres more about that. In general you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between 12490 to 49960 or if.

Cost Share Reduction Tier 1 limit. HSA Contribution Limit for 2020 Self-only. And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff.

Retirement or pension Income. Take the 35000 income from above not including cost basis and subtract that from the ACA income limit which is 67400 for 2020. See Stay Off the ACA Premium Subsidy Cliff.

For 2021 those making between 12760-51040 as an individual or 26200-104800. The American Rescue Plan Act of 2021 lowered the applicable percentages significantly in 2021 and 2022 from previous years. If your MAGI goes above 400 FPL even by 1 you lose all the subsidy.

The remaining 32400 is available for a Roth conversion. Include most IRA and 401k withdrawals. But do not include Supplemental Security Income SSI.

Employers should also note the slight increase in ESR assessments for 2020 as IRS continues to actively enforce these penalties. What is the maximum income for ObamaCare. Before the American Rescue Plan ARP was enacted eliminating the income cap for subsidy eligibility in 2021 and 2022 subsidies were available in the continental US for a single person with an income of up to 51040.

If you make less than 100 of the FPL then there are better programs available. Estimating your expected household income for 2021. Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income.

2020 Obamacare Income Grid Family Size Maximum Income 1 49960 2 67640 3 85320 4 103000 5 120680 6 138360 Families at or below the above annual incomes receive ACA tax credits Families with annual incomes greater than the above will NOT receive any ACA tax credits. Dont include qualified distributions from a designated Roth account as income. You can probably start with your households adjusted gross income and update it for expected changes.

In this example the personal deduction does not fully wipe out the ordinary income as it did in Example 2. See details on retirement income in the instructions for IRS publication 1040. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate.

The Maximum Income You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below. For example in 2020 people with income between 250 and 300 of the Federal Poverty Level were expected to pay between 829 and 978 of their income toward a second lowest-cost Silver plan in their area. Have a household income from one to four times 100-400 of the Federal Poverty Level FPL which for the 2021 benefit year will be determined.

Lets say you offer an employee coverage for all 12 months of 2020 and their W-2 for that year reflects 30000 in Box 1. If you receive subsidies for Obamacare always report significant income changes. The basic math is 4X the Federal Poverty Level FPL as determined by the government.