Whats Medicare Supplement Insurance Medigap. Medicare Supplement Plan N is one of the more popular plans among beneficiaries in 2021.

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

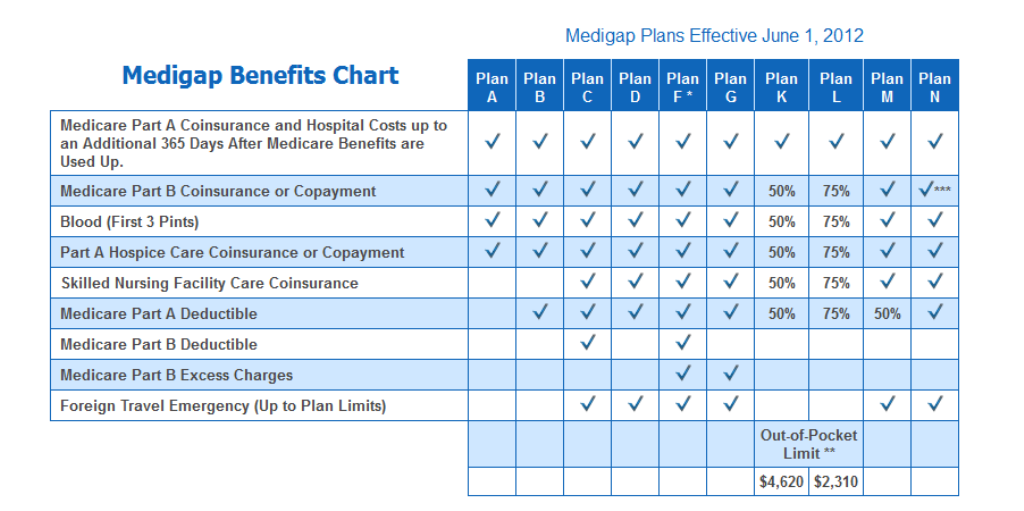

Click here to view enlarged chart.

Medicare supplement plan i. You can use the chart below to compare the out-of-pocket Medicare costs that different types of Medigap plans cover. The benefits of a Plan G will be the same regardless of the company you select. Plan I pays the Part B excess when you see a provider that does not accept Medicare Assignment.

Its the plan for those who prefer lower monthly premiums without forfeiting benefits. Youll need to enroll in Part A and B first. This plan covers 100 of the Part B Excess Charges but does not cover the Medicare Part B deductible.

The Centers for Medicare and Medicaid Services CMS constantly monitors Medicare Supplement Plans current economic situations and maintains the needs of senior citizens. Plan I pays the Part B excess when you see a provider that does not accept Medicare Assignment. The best time to enroll in a Medicare Supplement plan may be your Medicare Supplement Open Enrollment Period.

Medicare Supplement Medigap plans are designed to help pay your share of health-care costs under Medicare Part A and Part B. Medicare Supplement Plan E. New Cost of Medicare.

During that time you can buy any Medigap policy sold in your state even if you have health problems. The four Medigap plans that were emiminated are. The average premium cost for a Medicare Supplement Insurance plan in 2018 was 152 per month1 The average cost of each type of Medigap plan can vary quite a bit from one plan type to another.

However an insurance carrier doesnt have to accept your application unless you have guaranteed-issue rights. You pay the Part B annual deductible of 15500 once per year. Medicare Supplement Plan H.

You can get a Medigap policy during your Medigap Open Enrollment Period. Medicare Supplement Insurance plan premiums are sold by private insurance companies. This is also true if you want to change Medicare supplements to get a better rate or.

Read about Medigap Medicare Supplement Insurance which helps pay some of the health care costs that Original Medicare doesnt cover. Medicare Supplement Medigap plans are designed to work alongside your Original Medicare Part A and Part B benefits Medicare Supplement plans dont provide those benefits but instead they may help pay your Part A and Part B out-of-pocket costs. Your retiree coverage pays second.

There are standardized Medicare supplement insurance plans available that are designed to fill the gaps. For example they may pay your Medicare Part B coinsurance for Medicare-approved doctor visits and lab tests. For example your birthday is August 31 1953 so you turn 65 in 2018.

Plan I pays the 110000 Part A Deductible. To enroll you must first be enrolled in both Medicare Part A and Part B. Cost of Medicare 2021.

After this enrollment period you may not be able to buy a Medigap policy. This means that plan availability and plan premiums may vary. Medicare Supplement Plan I covers most of the main expenses that are approved by the Original Medicare Insurance as health care expenses it also covers all of the major gaps in coverage left by Medicare Insurance.

What is a Medicare Supplement or Medigap Plan. All Medicare Supplement plans including Plan G are standardized in the following ways. Medicare supplement plans are one health insurance option for people with Original Medicare.

If youre retired have Medicare and have group health plan coverage from a former employer generally Medicare pays first. A Medicare Supplement plan may pay your coinsurance or copayments from Medicare Part A and Part B. Yet when you enroll in this plan.

Medicare Supplement Plan I. This period automatically starts the month youre 65 and enrolled in Medicare Part B Medical Insurance and it cant be changed or repeated. Benefits You dont have to worry about which company offers the best or most benefits.

This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. Medicare Supplement plans are completely standardized so the benefits will be the same from company to company. You can sign up for a Medicare Supplement plan during your open enrollment period which starts after you turn 65 during the first month youre covered under Medicare Part B and lasts for six.

Medicare Supplement Plan I is one of the four Medicare Supplement Plans that was eliminated on June 1st 2010 due to the Medicare Modernization Act. Some Medigap plans also cover Part A andor Part B deductibles and other costs. One of the best features of Medicare supplement insurance is that you can apply for a plan anytime.

Updated on April 14 2021. Medicare Supplement also known as Medigap are supplement insurance plans that fill the gaps in Original Medicare and are sold and offered by private health insurance plans. Insurance companies cant charge you more if.

Medicare Supplement plans in Arkansas are different from Original Medicare.