Print Form 8962 PDF 110 KB and instructions PDF 348 KB. How to Fill Out Form 8962.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

This might result in you owing money at tax time.

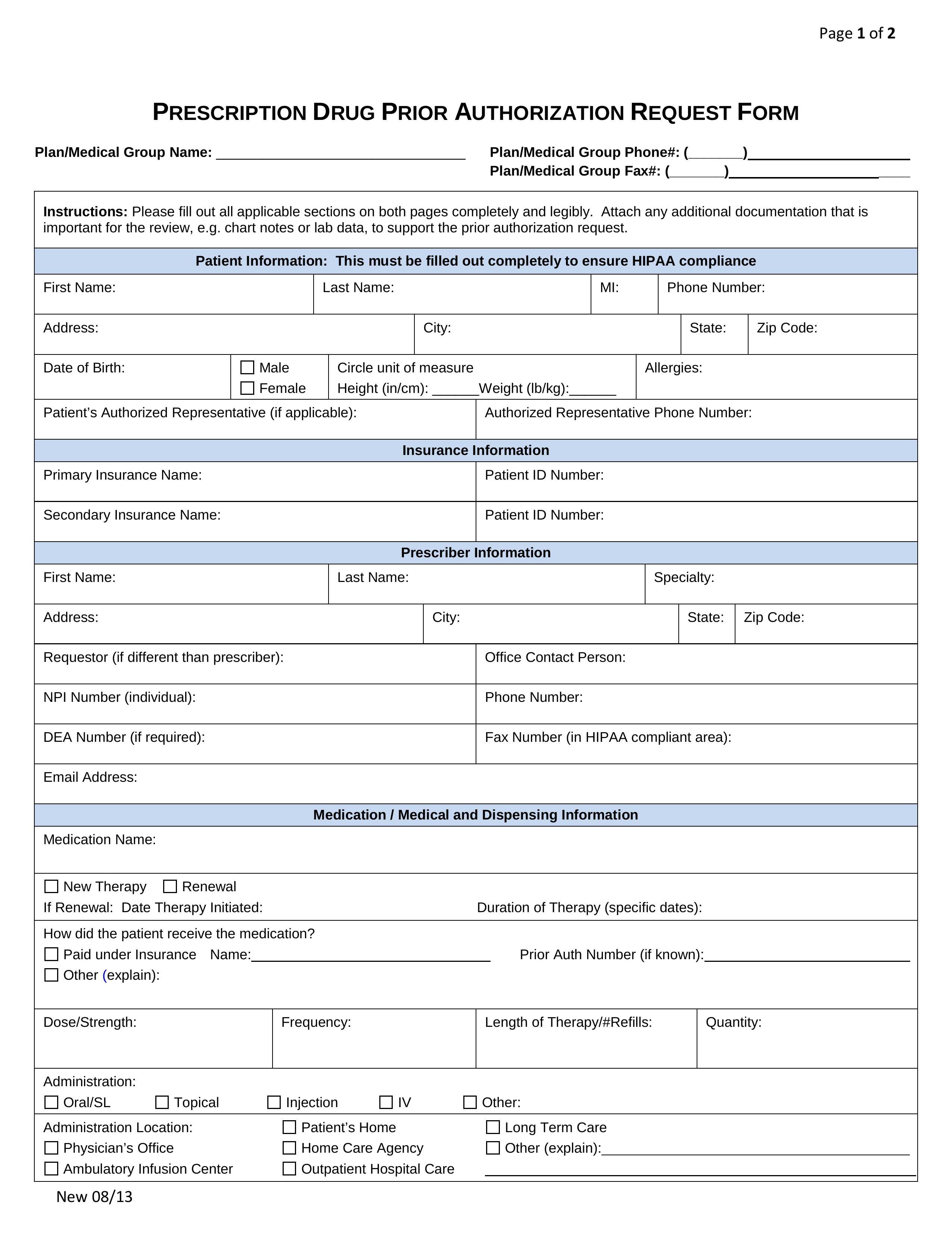

How to get 8962 form. While it uses the amend process to prepare the 8962 you do not send the Form 1040X amended reutrn to the IRS. You fail to provide information of your form 1095A from the market place health insurance. If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return.

After you complete your return we will generate Form 8962 for you based on the information you have entered from your Form 1095-A. Use Get Form or simply click on the template preview to open it in the editor. This is done in the Healthcare section of your account.

Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. The IRS fax number for 8962 form is 1-855-204-5020. Premium Tax Credit PTC 2020 Inst 8962.

To complete Form 8962. When you come to line 36 add the alternative entries for your spouses SSN on fields a b c and d. Part I is where you enter your annual and monthly contribution amounts.

Filling out Form 8962 and finding an example of Form 8962 filled out can feel stressful. Fill the electronic form version with PDFelement is a wise way to save your time and papers. Form 8962 Premium Tax Credit.

Only mailFAX what the IRS asked for and what is mentioned in that FAQ above. Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file. Product Number Title Revision Date.

Form 8962 is divided into five parts. If its for 2018 heres what to do about completing the Form 8962 in an already-filed return. Instructions for Form 8962 Premium Tax Credit PTC.

On Line 26 youll find out if you used more or less premium tax credit than you qualify for based on your final 2020 income. Under certain circumstances the marketplace will provide Form 1095-A to one taxpayer but another taxpayer will also need. You have now successfully completed the filing of the Form 8962.

Before you dive in to Part I write your name and Social Security number at the top of the form. To complete Form 8962 PDFelement can be your smart form filler. Use the information from your 1095-A form to complete Part II of Form 8962 using the table below as a guide.

You can zoom in the form for clear view and double-check. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Organizing your documents and carefully going through the forms ensures you receive the returns you need and deserve.

Youll use this form to reconcile to find out if you. Start completing the fillable fields and carefully type in required information. When you come to line 35 you need to add the alternative entries for your Social Security Number in field a b c and d.

Youll enter the number of exemptions and the modified adjusted gross income MAGI from your 1040 or 1040NR. In this video I show how to fill out the 8962. Youll need Form 1095-A Health Insurance Marketplace Statement to complete Form 8962.

Complete all sections of Form 8962. You will need to to. Quick steps to complete and e-sign Form 8962 online.