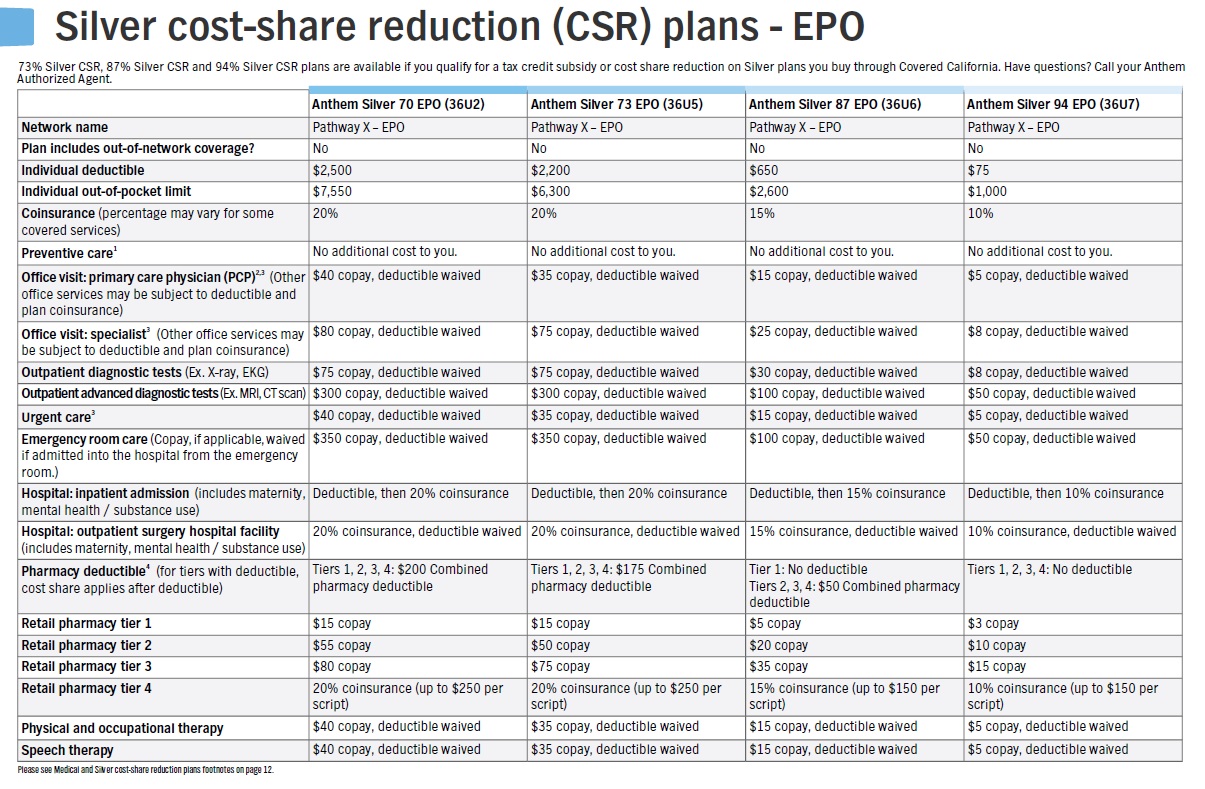

You have direct access to any specialist. If youre looking for lower monthly premiums and are willing to pay a higher deductible when you need health care you may want to consider an EPO plan.

An Exclusive Provider Organization or EPO is a type of health insurance plan in which members must utilize doctors and providers within the EPO network except in case of a medical emergency.

Epo medical plan. PO Box 997377 MS 0500 Sacramento CA 95899-7377. Learn about the differences between the standard types of health insurance plans. Restrictions and between spending a lot vs.

Access to medical records is available to patients over the age of 18 or a legal guardian and is protected by federal HIPAA regulations. An EPO is usually more pocket-friendly than a PPO plan. Learn more about our EPO.

Preventative care Preventative Care - Medical A routine health care check-up that will include tests or exams flu and routine shots and patient counseling to prevent or discover illness disease or other health problems. AdventHealth patients can create an online account for a safe and simple way to access information from their electronic health record EHR. Gold 80 PureCare One EPO Plan Overview English PDF Silver 70 PureCare One EPO Plan Overview English PDF.

License 00235-0008 Humana Wisconsin Health Organization Insurance Corporation or Humana Health Plan. Understanding the difference between PPO EPO HMO and POS is the first step towards deciding how to pick the health insurance plan that will work best for you and your family. Such fields include but are not limited to medical devices the automotive sector aerospace industrial control additive manufacturing communicationmedia technology including voice recognition and video compression and also.

By selecting the CareFirst EPO you drive your own health care decisions by enjoying many hassle-free benefits with this plan. All recommended preventive services would be covered as required by the. With Aetnas Exclusive Provider Organization EPO plans you can give your employees an easy way to get care while saving on benefits costs with an exclusive network.

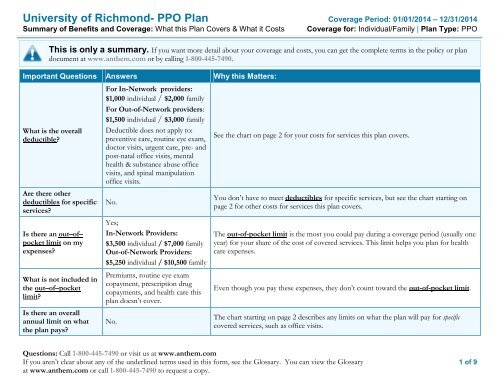

A managed health care plan will help beneficiariesmembers of the planby getting them more favorable rates or discounted medical insurance services from their plans health provider network. Managed health care plans allow plan sponsors to negotiate reduced rates for their policyholders with hospitals medical service providers and physicians by. Medical plan costs are based on your pay rates.

Regardless of which plan you choose you will have the following coverage. Then see how people like you choose a plan. Empires network provider must obtain authorization for clinicalmedical necessity for in-network services.

The Horizon Advantage EPO plans provide integrated medical and pharmacy benefits including wellness and emergency care. One of the most significant advantages to an EPO is participants dont need a referral from a primary care physician to see a specialist. USC Trojan Care EPO COVID-19 update for USC Trojan Care EPO members.

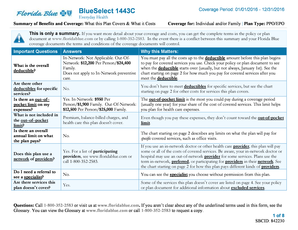

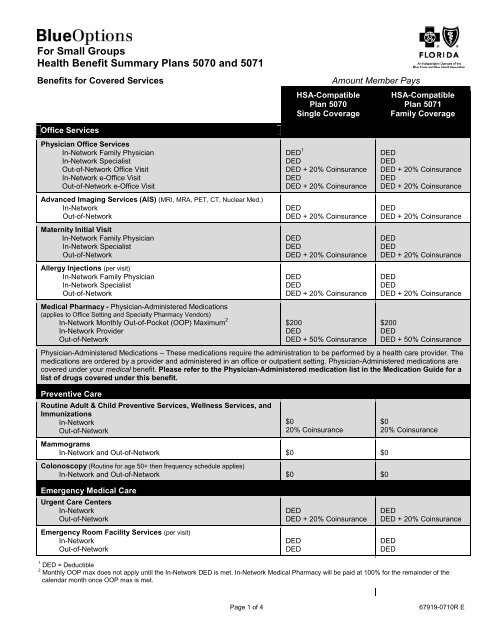

A chart has been prepared for each salary band or pay level. Insurance companies and group health plans are required to make available a uniform glossary of health coverage and medical terms commonly used in plan. Visit the Web or call for a list of participating providers.

LiveHealth Online Primary care physician and mental health visits can be conducted online where physicians can answer questions make a diagnosis and even. Although members are not required to select a Primary Care Physician. HMO EPO POS PPO and HDHP with HSA.

You will have to pay for some of the cost on your own through copays and. With our Horizon Advantage EPO plans members have access to all doctors hospitals and other health care professionals that participate in the Horizon Managed Care Network. 2021 plan comparison charts non-union Medical plan rates effective January 1-December 31 2021.

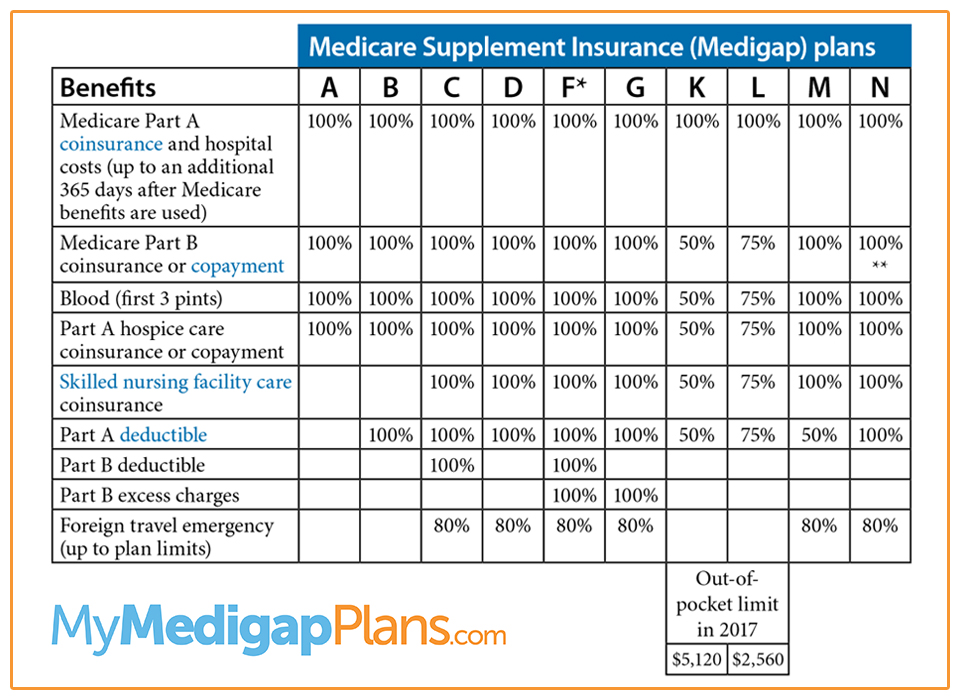

There are a number of different types of networks with HMO PPO EPO and POS being some of the most common. Screening and testing The health plan will pay 100 for only medically necessary screening and testing of COVID-19 coronavirus. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans.

How an EPO plan works. For General Public Information. The EPC thus enables the EPO to grant patents for inventions in many fields of technology in which AI finds a technical application.

COVID 19 Information Line. Medical Plan Benefits. HealthComp member portal this site offers a robust plan comparison tool and a helpful provider search tool as well.

However if you choose to get care outside of your plans network it usually will not be covered except in an emergency. COVID-19 Updates Get the most recent information about COVID-19 from Tufts Health Plan or for more information visit the CDC website. At Tufts Health Plan were with Brokers providing you the support and tools you need to succeed.

Empires EPO an Exclusive Provider Organization. Each one is just a different balance point between benefits vs. Members selecting the EPO plan must select their providers from a National network and must stay in-network to receive coverage benefits.

An EPO is a type of managed care plan which means that your health insurance plan will cover some of your medical expenses as long as you visit a health care provider doctor hospital or other place offering health care services within a particular network. Theres no perfect health plan type. Does this plan use a network of providers.

Humana group medical plans are offered by Humana Medical Plan Inc Humana Employers Health Plan of Georgia Inc Humana Health Plan Inc Humana Health Benefit Plan of Louisiana Inc Humana Health Plan of Ohio Inc Humana Health Plans of Puerto Rico Inc.