Transform Inner Health To Outer Beauty With Super Elixir Greens From Welleco. Ad We Can Help You Find The Right Expat Medical Insurance Plan For You Learn More.

Compare Top 10 Best Medicare Supplemental Insurance Companies In 2021

Compare Top 10 Best Medicare Supplemental Insurance Companies In 2021

Now Get Up To 50 Off Today.

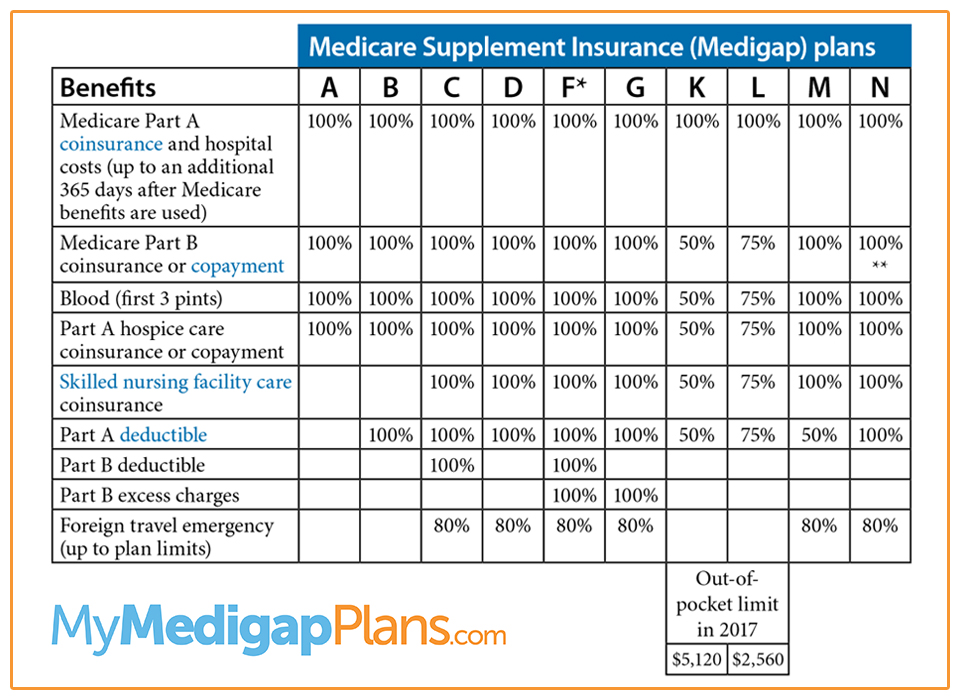

Whats the best medicare supplement plan. Cover Medical Expenses For Illness Injuries When You Buy Health Insurance With Us. 53 percent of all Medigap beneficiaries are enrolled in Plan F. Ad Dietary Supplements Made In Australia Using Carefully Sourced Plant-Based Ingredients.

Humana s Walmart Value Rx Plan is the cheapest Medicare Part D Plan premium in 47 states plus DC. If so Plan G may be the best Medicare Supplement Plan for you. Ad Unrivalled Product Range - Award Winning Nutrition - Perfect For All Your Goals.

Get advice from our licensed insurance agents at no cost or obligation to enroll. Humana is one of the largest providers of healthcare and healthcare insurance in the country. Find The Right Health Plans For Medicare Now.

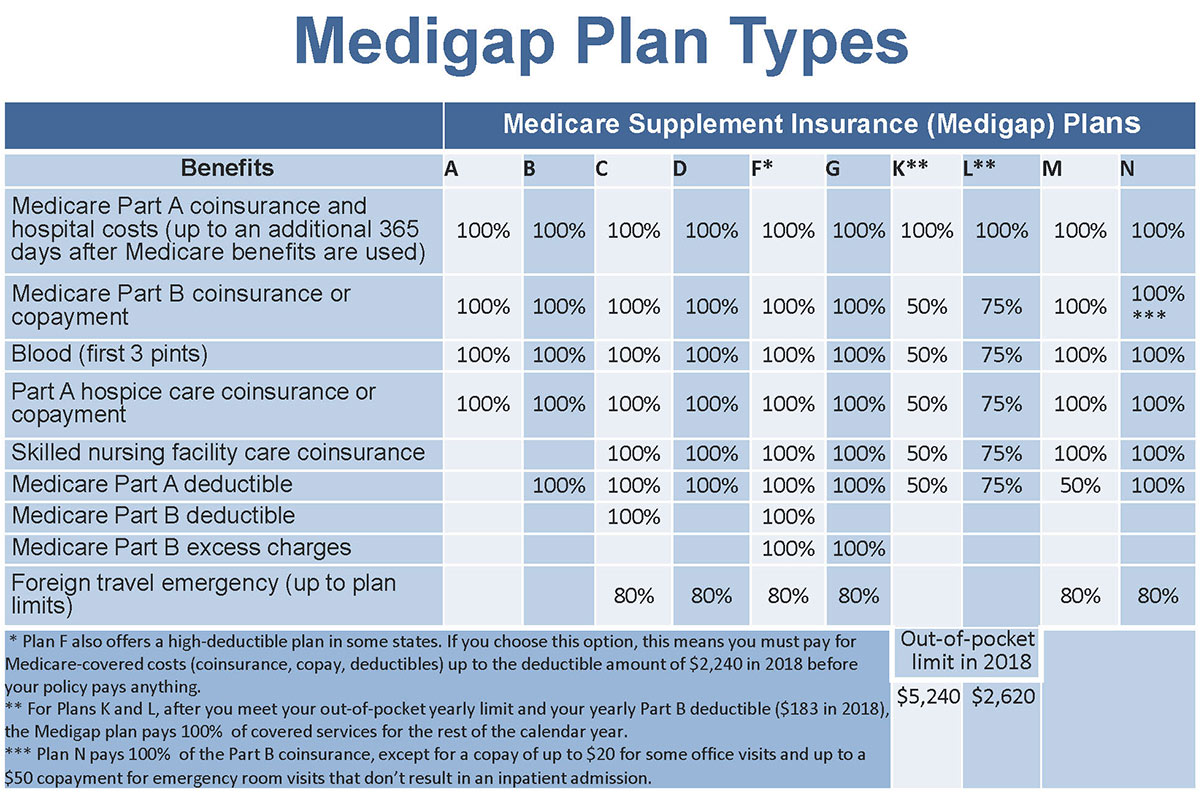

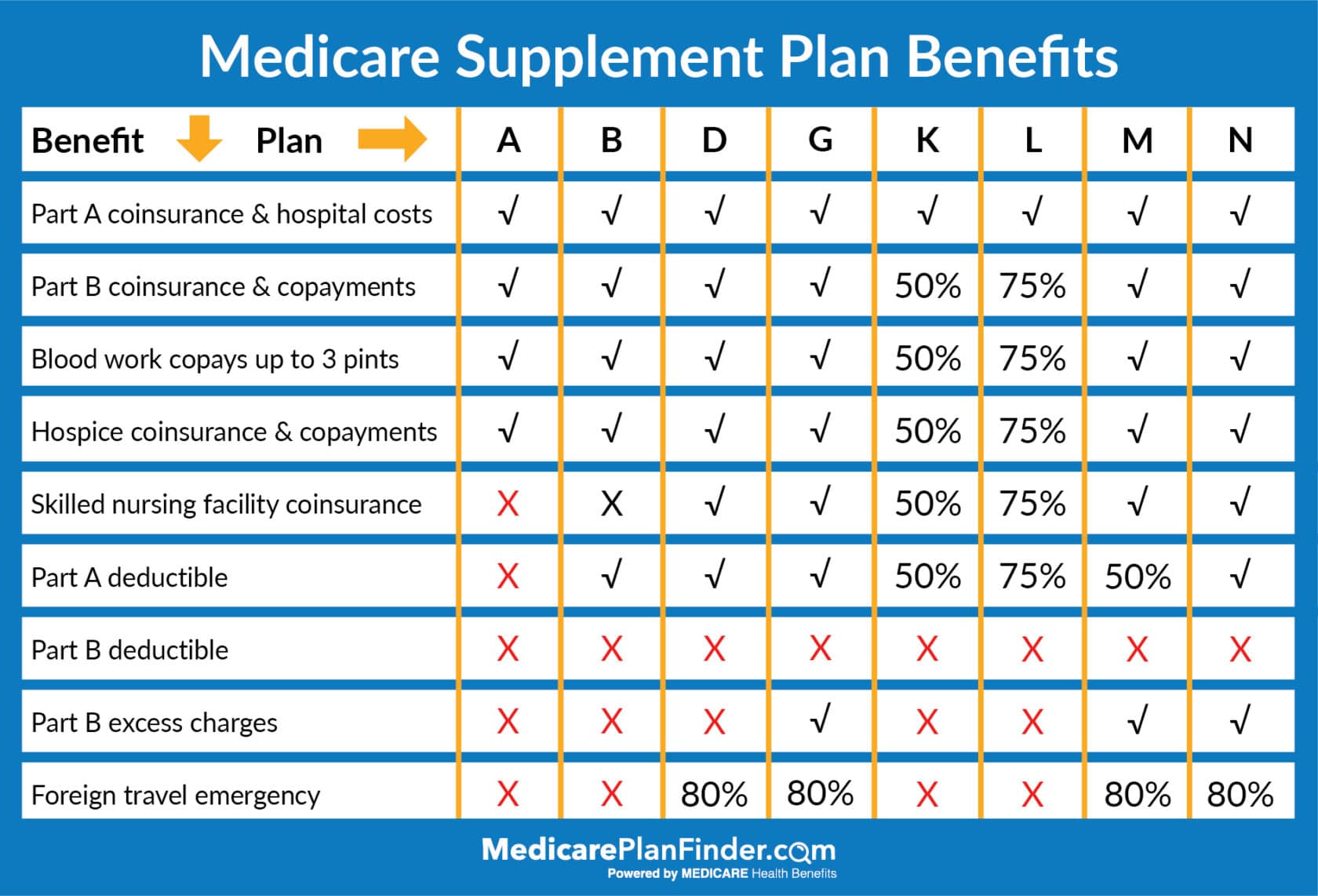

10 rows Three Popular Medicare Supplement Plans To help you find the best Medicare Supplement. Simple Honest Fair. This isnt officially known as this but I like to think of Plan F as FULL COVERAGE.

All You Need To Achieve Your Goals Is Right Here At Myprotein - Order Online. Ad Health Plans Start From Just 9 a Month. Ad Compare Award-Winning Health Insurance Providers And Ensure Your Health Is In Safe Hands.

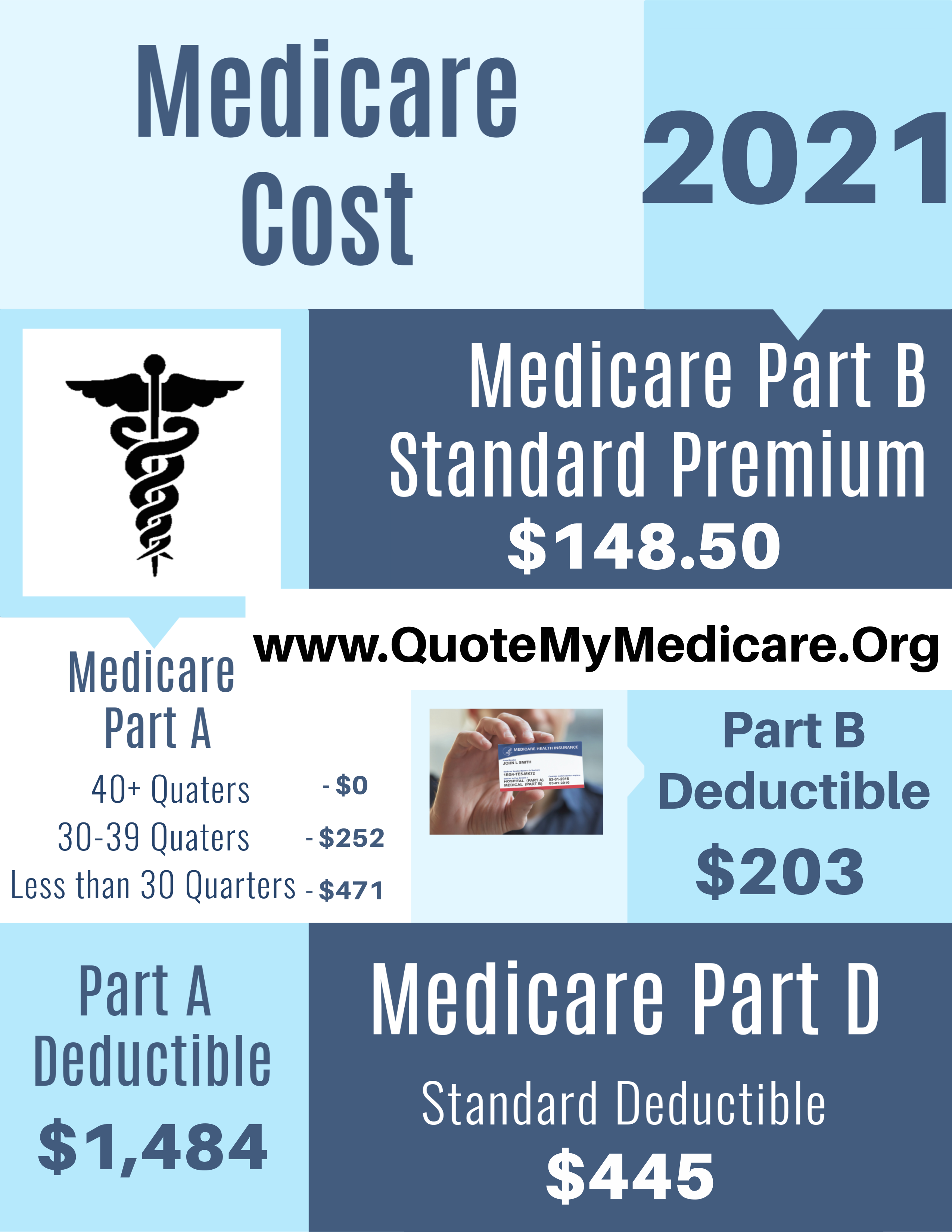

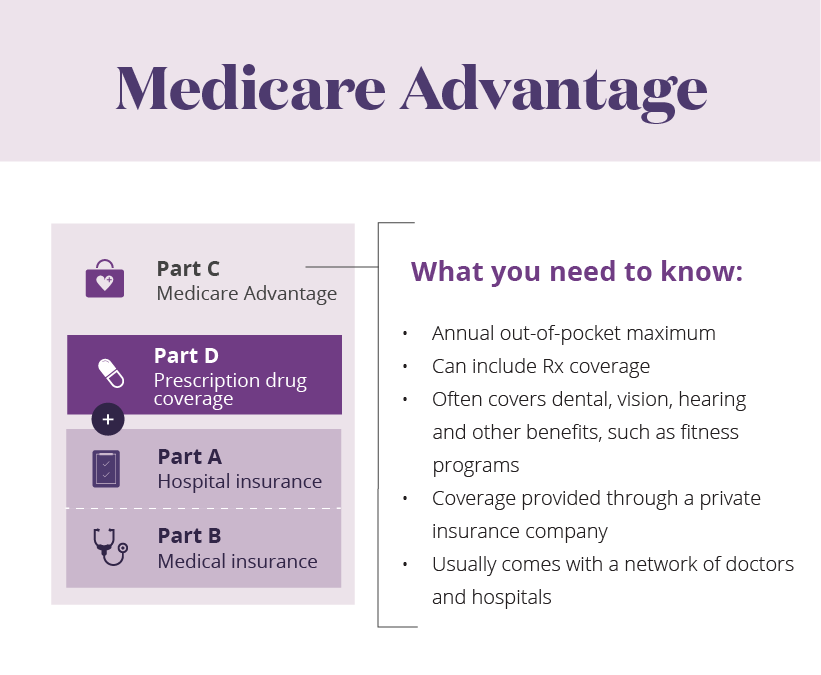

Cigna Global Telehealth Consultations With Doctors Nurses Healthcare Specialists. Medicare Part B deductible 203 in 2021. Of all the Medicare Supplement plans it gives the most comprehensive coverage to new Medicare beneficiaries.

Ranking the best medicare supplement plans of 2021 1. A specific Medigap plan might work for you if it offers coverage that works for your needs and comes with premiums that fit your budget. There isnt one best Medigap plan.

10 rows We reviewed all major Medicare insurance companies and chose the 8 best Medicare Supplement. Medicare Part A deductible 1484 in 2021. Mutual of Omaha Medicare Supplement.

Mutual of Omaha offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available and High-Deductible Plan G in all of those states except New York. People with Plan G are 100 covered for all Medicare Supplement benefits except foreign emergency care. Free delivery on eligible orders.

Plan F is the most comprehensive Medicare supplement you can buy. Compare and Buy Yours Now. Shop 2021 Medicare plans.

The Humana Walmart plan is excellent for someone with no medications or a couple of generics. Ad We Can Help You Find The Right Expat Medical Insurance Plan For You Learn More. Mutual of Omaha offers eight Medicare supplement plans that cover most out of.

If you dont spring for a Humana plan our best overall pick this is your next best option for a High-Deductible Plan G. Medigap Plan F is the most popular Medicare Supplement Insurance plan. Founded in 1909 it was one of the first.

Ad Protect the best years ahead. Ad Supplements that will help you reach your goal. Cigna Global Telehealth Consultations With Doctors Nurses Healthcare Specialists.