Heres an overview of getting care with HMO Plus and DHMO Plus. Kaiser International Health Group Inc.

There are two options to choose from with your plan.

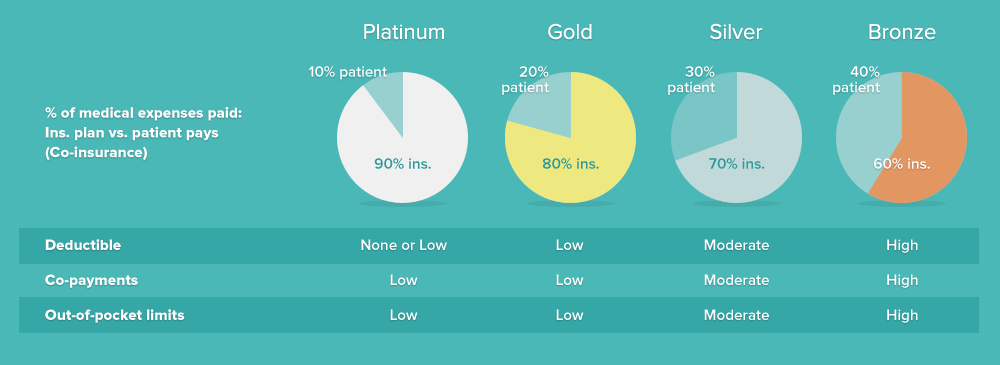

Kaiser hmo insurance. 2021 KP CA Silver 70 HMO 2500-45. Kaiser Permanente health plans around the country. 2021 KP CA Gold 80 HMO Coinsurance.

Kaiser International Healthgroup Inc. Consider the number of doctor visits and procedures you will need so you will get a plan that will cover more of your costs and meet your healthcare. Some wouldnt even consider anything but Kaiser Californias premier Health Maintenance Organization HMO.

All of our available doctors welcome our Medicare health plan members and you can switch to a different Kaiser Permanente doctor at any time for any reason. Kaiser Permanente health plans around the country. 2021 KP CA Bronze 60 HMO 8200-0.

Your Kaiser Permanente Deductible HMO Plan is not just health coverage its a partnership in health. HMO Plus and DHMO Plus plans provide limited nationwide coverage with any licensed provider balanced by the high-quality care innate to Kaiser Permanentes integrated delivery system. It brings together the best features of an HMO Health Savings Plan and a financial investment.

Kaisers Health Maintenance Organization HMO plans require you to have an in-network primary care physician. 2021 KP CA Bronze 60 HMO. PPO plans - what are the differences.

What does managed really mean. Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and. Kaiser Permanente Signature or in-network and any other licensed provider or out-of-network.

2021 PLANS OFFERED BY KAISER PERMANENTE. 2021 KP CA Bronze 60 HDHP HMO. When choosing a plan for your medical care you must take your current health into consideration.

2021 KP CA Silver 70 HMO Off Exchange. Kaiser Permanente health plans around the country. They love walking across the hall from their primary care physician to go see a specialist and then grabbing their prescription drugs on their way out the door.

This means that you must stay within the Kaiser network and that care is managed. Traditionally Kaiser is an HMO. 2021 KP CA Gold 80 HMO.

Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E. Is an actuarially-sound product-based business. Most features are available only to members receiving care at Kaiser Permanente medical facilities.

While traditional HMOs provide the financing for companies and employers medical and health concerns while a person is employed this support disappears once one. Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E. Youll see this provider for preventive care and when you are ill.

Kaiser offers a variety of HMO plans that are available through the healthcare exchanges in several states including California Colorado Georgia Hawaii Oregon Washington Maryland Virginia and Washington DC. Your care team works with you to give you the care you need when you need it and you get convenient resources to stay in control of your plan and your health. What is the HSA-Qualified HDHP.

They love Kaisers electronic medical record system and how it keeps all their various. Co-exists with the traditional health maintenance programs. Kaiser Permanente HSA-Qualified High Deductible Health Plan HDHP HMO Plan Embedded Questions and answers Set up a health savings account HSA to help pay for care.

2021 KP CA Silver 70 HDHP HMO 3250-20. Plus youll feel confident knowing that all of our. Jefferson St Rockville MD 20852 Kaiser Foundation.

Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine. We make it simple for you to know what to expect and to get the right care for your needs. Jefferson St Rockville MD 20852 Kaiser.

Like all of our Kaiser Permanente plans this plan gives you access to high-quality care and resources. With your Kaiser Permanente HMO plan you get a wide range of care and support to help you stay healthy and get the most out of life. Our Kaiser Permanente Medicare health plans provide quality care from a connected team that includes your doctor specialists and pharmacists working together for you.

You receive preventive care services at little or no cost to you and online features let you manage most of your care around the clock. Guarantees long-term care even after the age of sixty when the client has only himself to rely on. Kaiser Permanente health plans around the country.

An innovative program the first of its kind in the country. 15 Zeilen Generally no insurance coverage some provide insurance but very low coverage.

/https://www.thestar.com/content/dam/thestar/life/2017/01/31/dont-worry-you-can-still-get-an-iud-in-canada-if-you-have-insurance/copper-iud-photo.jpg)

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)