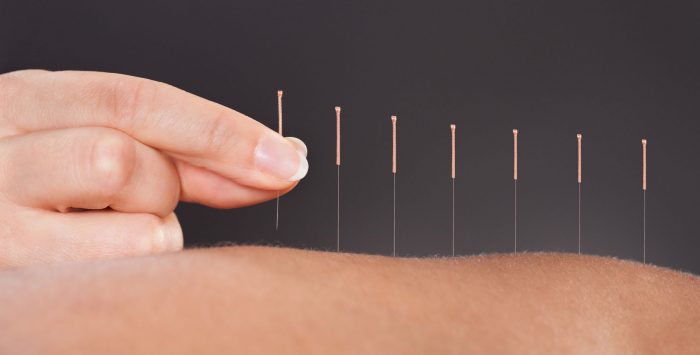

Acupuncture has been approved for Medicare coverage as of January 21 2020. On January 21 2020 the Centers for Medicare Medicaid Services CMS announced.

Medicare And Acupuncture Coverage Exclusions And Requirements

Medicare And Acupuncture Coverage Exclusions And Requirements

Now Medicare has finally decided to cover Acupuncture.

Medicare acupuncture coverage 2020. Manual manipulation of the spine if deemed medically. Acupuncture a key component of traditional Chinese medicine and most commonly used to treat pain is now being officially recognized by Medicare and several other large payers as a covered alternative treatment option for. By Dena Bunis AARP January 22 2020 Comments.

Acupuncture expenses fall 100 on the shoulders of the patient receiving that procedure. Medicare patients will be limited to no more than 20 acupuncture sessions a year. Medicare Covers Acupuncture.

If your doctor decides your chronic low back pain isnt improving or is getting worse then Medicare wont cover your treatments. Medicare Part A covers hospital costs including inpatient care lab tests surgery and other services. You will get a denial if your treatment exceeds the frquency limitations.

On January 21 2020 the Centers for Medicare Medicaid Services CMS announced that they would cover acupuncture services to help treat chronic lower back pain. Medicare covers acupuncture CPT codes 97810-97814 for people with chronic low back pain M545 Low back pain effective January 21 2020. Your patients can have up.

The coverage rule provides up to 12 visits in 90 days under the following circumstances. En español Medicare enrollees with chronic low back pain will be able to get up to 20 acupuncture treatments each year under a new policy that the Centers for Medicare Medicaid Services CMS announced Tuesday. CMS finalizes decision to cover Acupuncture for Chronic Low Back Pain for Medicare beneficiaries.

Today the Centers for Medicare Medicaid Services CMS finalized a decision to cover acupuncture for Medicare patients with chronic low back pain. Medicare will cover up to 12 acupuncture sessions over the course of 90 days as well as an additional eight sessions for patients who show improvement. Does Medicare cover acupuncture.

According to the latest information regarding Medicare coverage in 2020 from AARP original Medicare pays for only one chiropractic service. This article informs you that the Centers for Medicare Medicaid Services CMS will cover acupuncture for chronic Low Back Pain cLBP effective for claims with dates of service DOS on and after January 21 2020. Until 2020 Medicare did not offer any coverage for Acupuncture an alternative Chinese technique based on inserting needles into the body to stimulate specific points.

Medicare Part B Medical Insurance covers up to 12 acupuncture visits in 90 days for chronic low back pain. Note that CMS still determines that acupuncture. Medicare Part B is one of the core parts of Original Medicare.

On January 21 2020 a CMS Newsroom press-release read This new announcement is both exciting and refreshing. Medicare does not cover other forms of alternative medicine such as naturopathy homeopathy or except for medically necessary spinal manipulation chiropractic care. Treatment must be stopped if the patient shows signs that they are not improving or are regressing.

Before this date Medicare did not cover acupuncture. A person with lower back pain may get acupuncture as part of their Medicare plan. Medicare covers an additional 8 sessions if you show improvement.

Now under Medicare Part B acupuncture services performed on or after January 21 2020 are covered. Until January 2020 Medicare did not cover it in any circumstances and you will still pay 100 percent of the cost of acupuncture to address conditions other than low back pain. On January 21 2020 CMS announced Medicare Part B covers up to 12 acupuncture visits in 90 days for chronic lower back pain.

The fact it is now being covered is not a surprise as many other health insurances such as BlueCross BlueShield of Illinois have started to cover acupuncture since early 2017. After needling from the medical community in a sharply written January 21 2020 decision memo the Centers for Medicare and Medicaid Services CMS got right to the point in announcing Medicare will now cover acupuncture for chronic low back pain. With the opioid crisis in full swing Medicare has added acupuncture coverage in place as part of a growing effort to help people access nonopioid pain management.

No acupuncture is not covered by Medicare. It is an alternative therapy that has not been scientifically proven to be effective as an analgesic anesthetic or other therapeutic purposes per the Centers for Medicare and Medicaid Services.