To answer the question below. An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO.

What Is The Difference Between Hmo Ppo And Epo Health Plans Boost Health Insurance

And then theres the preferred provider wrinkle.

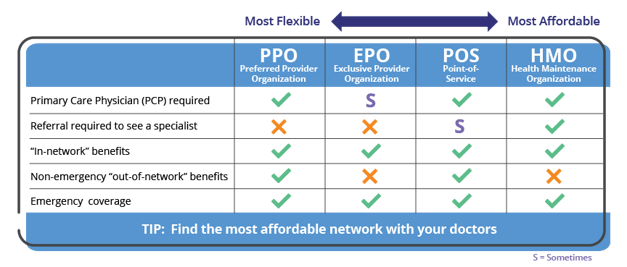

Difference between ppo and epo insurance plans. Theres no perfect health plan type. Then use the information from the video and from the article What Are the Differences Between HMO PPO EPO and POS Plans. POS and EPO plans are options provided by some employers and health insurers but theyre not nearly as common as HMOs PPOs and HDHPs.

Premiums are higher than HMOs but lower than PPOs. An Exclusive Provider Organization EPO is a lesser-known plan type. Although this feature can be a big help it can also be a wash financially by the time you pay all of your premiums for the year.

But if youre considering an EPO you should check approved in-network providers in. They may or may not require referrals from a primary care physician. On the other hand an EPO will typically have lower monthly premiums than a PPO.

Each one is just a different balance point between benefits vs. The PPO typically has a lower maximum out-of-pocket cost than an HDHP. EPO and PPO are essentially two different types of healthcare insurances.

Thats a lot of letters in one place. This reduces costs so your monthly payments will be lower. There are a number of different types of networks with HMO PPO EPO and POS being some of the most common.

Deductibles can vary widely as can co-pays. Exclusive provider organization plans EPO The two most common health plans have been generally HMOs and PPOs but HDHPs have become a lower-cost health insurance option for employers over the past decade. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans.

This may be an HMO PPO or EPO and is a classification for the type of network your plan offers. PPOs cover care provided both inside and outside the plans provider network. HDHPs make up about one-third of employer-sponsored plans and are seen as a lower-cost health insurance option for employers over the past decade.

With a PPO you will have access to out-of-state providers that are considered in-network. An HMO is a health maintenance organization a PPO is a preferred provider organization and an EPO is an exclusive provider organization. If youre looking for health insurance youve probably come across the acronyms HMO PPO POS and EPO.

Understanding the difference between PPO EPO HMO and POS is the first step towards deciding how to pick the health insurance plan that will work best for you and your family. EPO stands for Exclusive provider organizations while PPOs are Preferred provider organizations. PPOs are usually run by a team of doctors and health care organizations that charge a premium for their services from the customers and provide them with a third party insurance.

However if you need or want to go to a healthcare provider from outside this network the PPO will still help to pay for your treatment. EPO stands for exclusive provider organization and doesnt cover any out-of-network care. EPOs only cover care provided by the provider network.

A PPO plan gives you more flexibility than an EPO by allowing you to attend out-of-network providers. Fill out the table below on the types of plans available to you. But like HMO insurance youre not covered if you see out-of-network providers however as mentioned in the case of a medical emergency EPO insurance will cover some of the costs of out-of-network expenses.

Like HMOs EPOs cover only in-network care but networks are generally larger than for HMOs. A Blue Dental EPO plan only covers services from in-network PPO dentists. Heres what each stands for.

Like PPO insurance you can go directly to a specialist and bypass the need for a referral from your primary care physician. EPO health plans generally have lower monthly premiums co-pays and deductibles than non-EPO options. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO.

EPOs work along similar lines though they are more cost effective as. In a PPO the insurer has a network of healthcare providers that it prefers to work with. The main difference between PPOs and EPOs is in regard to flexibility which is indicated by the names of the two plans.

Exclusive provider organization plans EPO PPOs are the most common type of health plan in the employer-sponsored health insurance market while HMOs lead the way in the individual insurance market. However an HMO or PPO could potentially be cheaper depending on your individual situation and coverage needs. The main downside of a PPO is that youll pay higher monthly premiums.

The more a plan pays for out-of-network. Restrictions and between spending a lot vs.

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

Health Insurance 101 Bangor Maine Mabel Wadsworth Center

Health Insurance 101 Bangor Maine Mabel Wadsworth Center

Hmo Ppo Or Epo I Just Don T Know

Hmo Ppo Or Epo I Just Don T Know

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Pos Epo And Ppo Plans E D Bellis

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.