Group insurance is primarily paid for by the employer. Choose a group benefits plan based on your business needs.

Group Insurance Schemes How Does It Benefit Employees And Employers

Group Insurance Schemes How Does It Benefit Employees And Employers

More than 30000 small to midsize businesses choose the Chambers Plan to protect their employees with comprehensive group benefits including Health and Dental insurance making it Canadas 1 employee benefits plan for small business.

Company group insurance plans. Today more companies of all sizes offer their employees health insurance plans whether they cover the entire premium or not. Contrary to popular belief life insurance is affordable to every Filipino who wants to protect their future. A group insurance plan including an employee assistance program is the perfect way of ensuring that employees remain focused on their work to minimize absenteeism and facilitate return.

The members covered under the single insurance policy are collectively referred to as a Group. The insurance company will determine the final monthly cost for your group health insurance plan once your application has been reviewed and approved. Employees participating in the Group Life Insurance policy.

The future and success of an organization lie in the hands of its workers and their job results. Group term life insurance is a common part of employee benefit packages. This insurance plan is also referred to as corporate health.

Why group health insurance is important for your business. Group Insurance health plans provide coverage to a group of members usually comprised of company employees or members of an organization. Choosing effective sustainable health insurance coverage for your business helps build a solid foundation for balancing costs and prioritizing care for your employees.

The Chambers of Commerce Group Insurance Plan has been protecting Canadian firms for over 40 years. Groups can be of two types. It provides the same level of insurance coverage to all the members of the group eliminating the need for buying individual policies for each member.

Group disability insurance and group health and dental care insurance protect your investment when an employee becomes ill or is injured. UnitedHealthcare offers a wide range of group. In the past group health insurance plans for small businesses were more of a bonus than a staple benefit.

Group insurance is a type of insurance plan that covers a group of people under one single policy. Also known as corporate health insurance policy the insurance coverage under this health insurance policy usually includes accidental hospitalisation COVID insurance daily hospital benefit critical illness cover. The insurance company will assess your group using a number of criteria including the size and location of your company and the ages of your employees to arrive at the final monthly rate or premium.

These plans can be bought by organizations for providing cover to their members. However oftentimes employees will also make contributions toward the policy. Health insurance for employers.

The group health insurance coverage can be extended to the family members of the employees in some cases. Through group life insurance Sun Life can help companies and organizations provide affordable life insurance to their members. This is often offered as a valuable benefit for employees as the premium for the same is borne by the employer.

Protect your investment in your employees. With Group Life Insurance you pay the insurance company a premium for employees whom you wish to cover. With UnitedHealthcare youll find a wide range of group health insurance plans for large.

Many employers provide at no cost a base amount of coverage as well as an opportunity for the employee to purchase. Customizable group benefits plans For companies with more than 50 plan members Maximize benefits while containing costs with a customizable scalable and sustainable group plan to meet your business and employee needs. Many membership organizations offer group health insurance coverage or services to their members.

What is Group Insurance. 55 of small firms offer health benefits to at least some of their staff. Group Life Insurance policies are sponsored by your company for the benefit of your employees.

As a member of a group you may be eligible for discounts on your health insurance or access to a group health insurance planeven if unemployedbecause the group insurance is based on the membership in the group and not your employer. EmployeeGroup life insurance plans are appropriate for employers or companies who plan to have monthly insurance for their families. Group insurance is insurance that covers all eligible members of a pre-defined group such as all employees in a business organization.

Offering them life insurance benefits helps them feel valuable and comfortable in the shade of specific employersorganizations who take care of them. A Group Health Insurance is a type of health insurance plan that covers for a group of people who work under the same organization. For a small business health insurance is a critical factor in retaining and recruiting employees as well as maintaining productivity and employee satisfaction.

Group health members usually receive insurance at a. Group health insurance or GHI is a type of health insurance plan that provides coverage to a specific group of people such as employees of a company or members of an organization. Group Insurance plans cover a group of people with a single insurance policy.

Group life options for your organization. All the members of the group are covered against the same risk under a group insurance scheme. As part of the Affordable Care Act the health of your employees including pre-existing conditions no longer impact group.

For Companies With Less Than 3 Expatriate Employees Or Individual Expatriates We Can Also Source Individual Internati Health Insurance Plans Expat Insurance

For Companies With Less Than 3 Expatriate Employees Or Individual Expatriates We Can Also Source Individual Internati Health Insurance Plans Expat Insurance

Know About Group Insurance Scheme Definition Features Benefits

Know About Group Insurance Scheme Definition Features Benefits

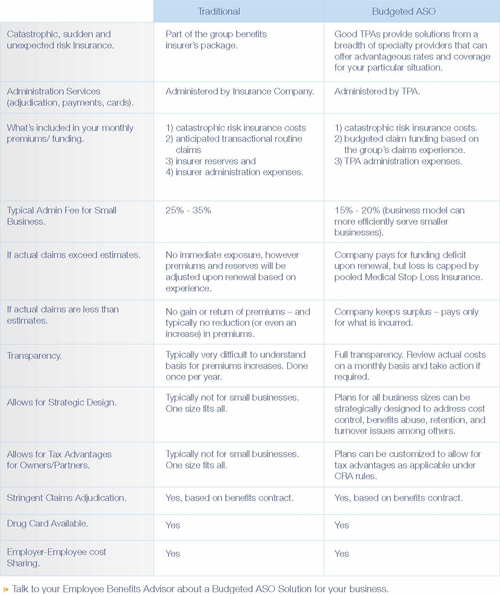

Aso Plans Vs Traditional Group Insurance Plans

Aso Plans Vs Traditional Group Insurance Plans

Group Insurance Plans Citadel Financial Wealth Group

Group Insurance Plans Citadel Financial Wealth Group

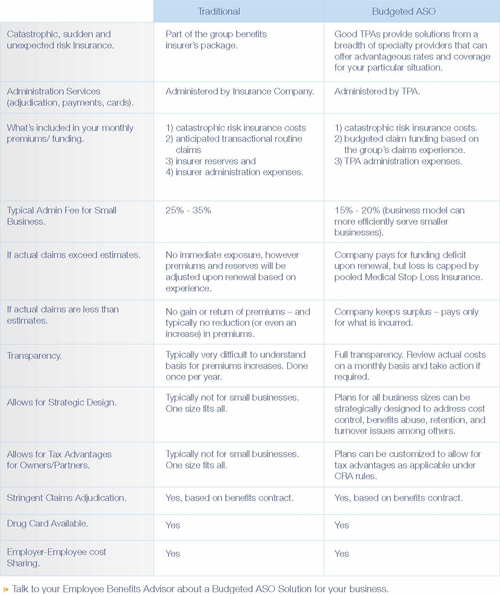

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Video Online Download

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Video Online Download

Ppt Texas Group Insurance Plans Powerpoint Presentation Free Download Id 7906912

Ppt Texas Group Insurance Plans Powerpoint Presentation Free Download Id 7906912

American Directory Of Group Insurance Judy Diamond Associatesjudy Diamond Associates Inc

American Directory Of Group Insurance Judy Diamond Associatesjudy Diamond Associates Inc

Employer Company Group Health Insurance Plans Don T Rely Entirely On It

Employer Company Group Health Insurance Plans Don T Rely Entirely On It

Group Insurance Schemes How Does It Benefit Employees And Employers

Group Insurance Schemes How Does It Benefit Employees And Employers

The Small Business Open Enrollment Guide Ehealth

The Small Business Open Enrollment Guide Ehealth

![]() Group Health Insurance Coverage Group Health Organization

Group Health Insurance Coverage Group Health Organization

Business Life Insurance Find Group Coverage Today Trusted Choice

Business Life Insurance Find Group Coverage Today Trusted Choice

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.