Your dental plan will refer you to a specialist if your dentist determines that you need one. About Medi-Cal managed care dental plans No cost to you and no co-payment Medi-Cal wants you and your family to be healthy and satisfied with your dental care.

Https Www Cda Org Portals 0 Pdfs Fact Sheets Dental Benefit English Pdf

2 Their dental plans work within a nationwide network.

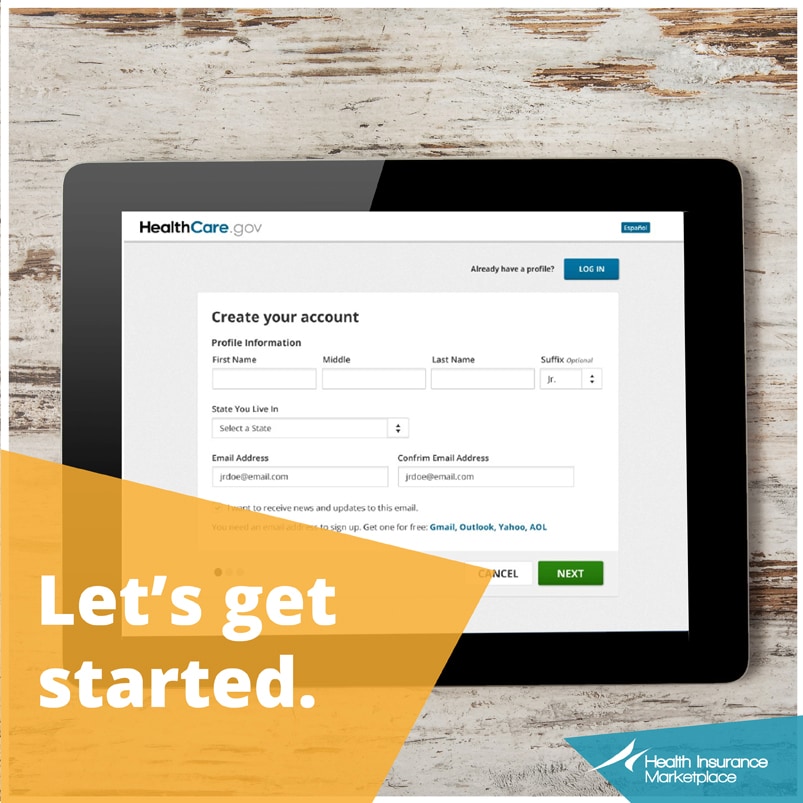

Which medi cal dental plan is best. Enter the appropriate information below to view a list of Dental Providers who may be accepting new Medi-Cal patients. The Medi-Cal Program currently offers dental services as one of the programs many benefits. Find out what you can expect from a dental.

This is not a guarantee they will be available to accept additional patients at the time you contact them. For a full list of dental plans go to the Medi-Cal Managed Care Dental Plan Directory. We compare dental insurance policies and explain whether you could be better off with the NHS or a dental payment plan.

Medical and dental plan directory. To learn about choosing a dental plan go to the Tips to help you choose a dental planpage. In other words there may be a SOC for both the health and dental.

Cigna is a global health service company with high marks for financial strength including an A rating from both AM Best and Standard Poors. The basic Gen Saver Dental plan is the cheapest option. You can choose the doctor or clinic for all your health care needs.

Diagnostic and preventive dental hygiene eg. About Medi-Cal managed care medical plans. In general the Covered California family and child dental plan design is comparable to dental plans found in the open market.

In addition there may be a Share of Cost SOC that might have to be paid for dental services. There is no charge for specialty dentists when your dentist. Extra benefits differ for each plan.

To compare medical plans and dental plans go to the Compare medical plans and dental plans. This website provides important information about the Medi-Cal Dental Program for members and providers. Member handbook Provider directory.

Delta Dental has an A Excellent rating from AM. Call your dentist or your dental plans 24-hour toll-free phone number. Emergency services for pain control.

If you cannot find a dentist in your area who is accepting new patients please contact the Medi-Cal Telephone Service. You can choose the dentist for your dental care needs. Medi-Cal managed care medical plans offer special care such as.

The rates are fairly comparable as well although it is difficult to exactly match the Covered California plan design because it is slightly different from the plans. MetLife is the best dental insurance provider for those seeking cover for their entire family. Moving up there is the Gen Basic Dental and then the Gen Plus Dental.

2 Delta Dental offers individual and group plans as well as plans through the Health Care Exchange Marketplace. Best which affirmed the financial strength rating and the issuer credit ratings for the company. You can choose the dentist for your dental care needs.

Similar to health insurance families cant enroll in Covered California dental plans outside of open enrollment. Under the guidance of the California Department of Health Care Services the Medi-Cal Dental Program aims to provide Medi-Cal members with access to high-quality dental care. Medi-Cal managed care dental plans have their own dentists and specialists.

A Dental PPO Plan and a Dental HMOManaged Care Plan. To learn about choosing a medical plan go to the Tips to help you choose a medical planpage. Use these guides to find out which insurance plans offer the most extensive cover and the biggest payouts as well as the pros and cons of dental insurance as explained by our experts.

The Fee-For-Service FFS Denti-Cal program allows the adult beneficiary to visit any dentist or clinic that is in the Medi-Cal dental program. Medi-Cal wants you and your family to be healthy and satisfied with your health care. For a full list of dental plans go to the Medi-Cal Managed Care Dental Plan Directory.

Medi-Cal Dental Program The Medi-Cal Dental Program covers a variety of dental services for Medi-Cal beneficiaries such as. The SOC can vary by county and can also include Medi-Cal health benefits. Medi-Cal managed care medical plans have their own doctors specialists clinics pharmacies and hospitals.

2021 MEDI-CAL DENTAL MEMBER AND PROVIDER OUTREACH PLAN PAGE 1 Goals and Objectives The 2021 Medi-Cal Dental Member and Provider Outreach Plan the plan is designed to help improve the health of Medi-Cal Dental members as well as improve the healthcare experience and lower healthcare costs by educating. Delta Dental offers plans designed to help families on a budget. For a full list of medical plans go to the Medi-Cal Managed Care Medical Plan Directory.

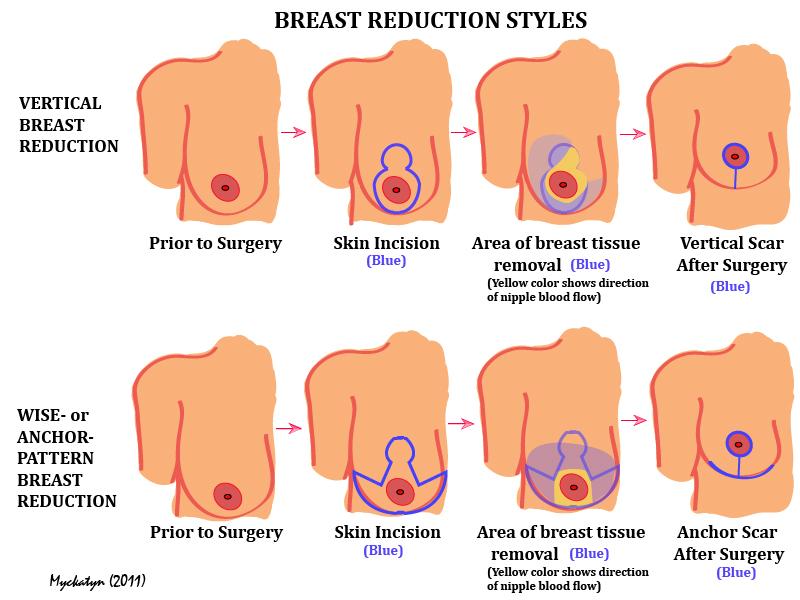

Root canal treatments anteriorposterior. Access Dental Plan. However anyone can enroll in a dental plan at anytime in the open market.

All plans offer the same standard benefits plus extra benefits. MetLife Dental Insurance offers two kinds of plans. The PPO and DHMO options are limited to just two plans but preventative care is covered.

Medi-Cal managed care dental plans have their own dentists and specialists. MetLife Dental offers several options from PPO plans with full-service dental for retirees to HMO plans. There is no charge for specialty dentists when your dentist refers you.

The Medi-Cal eligibility and along with the individuals identity will need to be verified with each office visit. The MetLife 2-9 Dental plan is the most popular offered as they pre-negotiate fees within the network of dentists for over 400 different procedures. Examinations x-rays and teeth cleanings.

Your dental plan will refer you to a specialist if your dentist determines that you need one. Doctors you can go to.