SISC - Self-Insured Schools of California - SISC is a Joint Powers Authority administered by the Kern County Superintendent of Schools Office. Page 1 of 7 Anthem Blue Cross Your Plan.

Anthem Blue Cross is the trade name for Blue Cross of California.

Sisc blue cross. ANTHEM BLUE CROSS ACCOUNT. SISC - Self-Insured Schools of California - SISC is a Joint Powers Authority administered by the Kern County Superintendent of Schools Office SISC - Self-Insured Schools of California SISC 2000 K Street Bakersfield CA 93301 6616364710. SISC ASO Blue Shield of California 100 Plan A 30 Copayment Benefit Summary Uniform Health Plan Benefits and Coverage Matrix THIS MATRIX IS INTENDED TO BE USED TO HELP YOU COMPARE COVERAGE BENEFITS AND IS A SUMMARY ONLY.

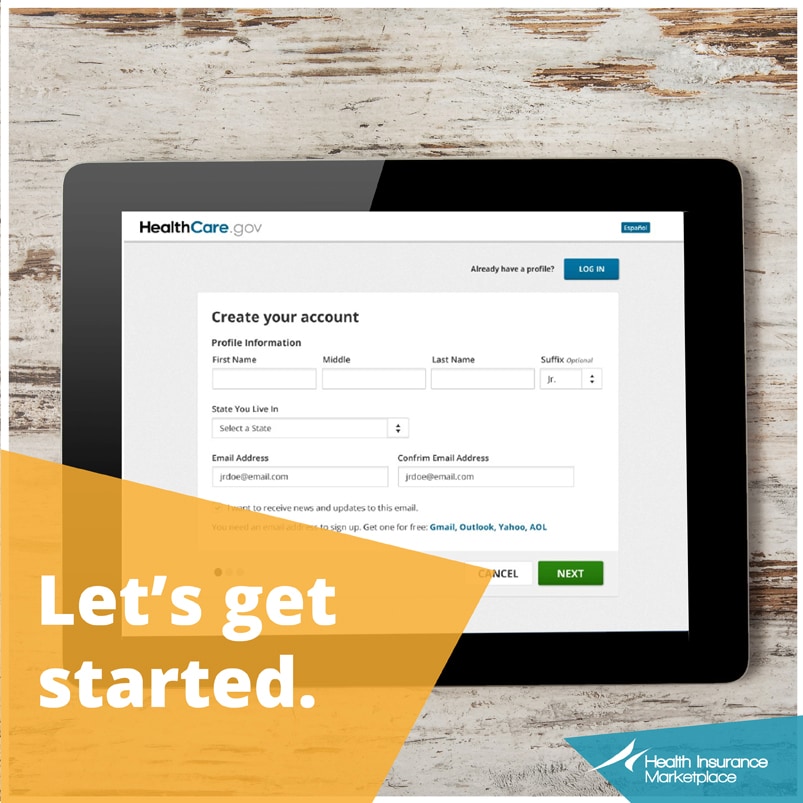

Enrollment in Anthem Blue Cross Cal MediConnect Plan depends on contract renewal. Anthem Blue Cross or Blue Shield PPO and HMO members. Our districts will tell you its our service that really differentiates us.

Anthem Blue Cross or Blue Shield PPO and HMO members Vida Health is offered to SISC employees covered under Anthem Blue Cross or Blue Shield PPO and HMO plans at no cost excluding 65 plans. And each year every plan PPO HMO and Kaiser for every member district has been single digits. SISC Anchor Bronze HSA Your Network.

Anthem Blue Cross of California Anthem is proud to be the benefit administrator of the SISC PPO plan. Over the past four years SISC renewals have averaged less than 5. 15 rader Blue Shield 65 Plus HMO Medicare Advantage CompanionCare Kaiser Senior Advantage.

You are not required to use a Global Core program provider but it can help keep your costs down. Be sure you know what kind of plan you. Anthem Blue Cross Cal MediConnect Plan Medicare-Medicaid Plan is a health plan that contracts with both Medicare and Medi-Cal to provide benefits of both programs to enrollees.

Most of these plans have bene ts for services you get from doctors who are both inside and outside our network of providers. We are public school employees just like you SISC was established in 1979. Vida Health is offered to SISC employees covered under Anthem Blue Cross or Blue Shield PPO and HMO plans at no cost excluding 65 plans.

Others only cover doctors who are in the network. Prudent Buyer PPO This summary of benefits is a brief outline of coverage designed to help you with the selection process. BLUE CROSS OF CALIFORNIA CA Other IDs.

Choose from a large network of board-certified doctors and licensed therapists. Anthem Blue Cross Anthem is proud to be the benefit administrator of the SISC PPO plan This plan is offered to school districts that are members of Self-Insured Schools of California SISC. Anthem Blue Cross All items listed below are required Legal Birth Certificate or Hospital Birth Certificate to include full name of child parents name childs DOB.

The Blue Cross Blue Shield Global Core program gives SISC PPO participants access to care across the United States and urgent care around the world. SISC III AND THE MEMBER ALSO AGREE TO GIVE UP ANY RIGHT TO PURSUE. THE PLAN CONTRACT SHOULD BE CONSULTED FOR A DETAILED DESCRIPTION OF COVERAGE BENEFITS AND LIMITATIONS.

Sign up online or download our app. Prudent Buyer PPO This summary of benefits is a brief outline of coverage designed to help you with the selection process. We have great people taking care of your people.

This plan is offered to school districts that are members of Self-Insured Schools of California SISC. Prudent Buyer PPO This summary of benefits is a brief outline of coverage designed to help you with the selection process. This summary does not reflect each and every benefit exclusion and limitation which may apply to.

HSA Members Per IRS guidelines SISC employees on HSA plans are responsible for payment until they have met their annual deductible. Anthem Blue Cross CA. SISC High Deductible Plan A HSA Compatible Plan Single Party Your Network.

HSA Members Per IRS guidelines SISC employees on HSA plans are responsible for payment until they have met their annual deductible. Anthem Blue Cross Your Plan. SISC 100-A 10 Anthem Classic PPO Your Network.

Page 1 of 7 Anthem Blue Cross Your Plan. Anthem Blue Cross offers a number of PPO plans.