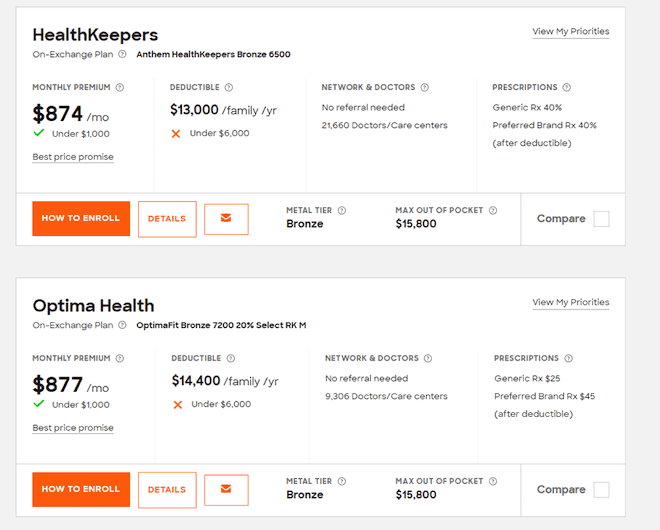

The four levels of health plansBronze Silver Gold and Platinumare differentiated based on their actuarial value. These categories show how you and your plan share costs.

How To Pick A Health Insurance Plan Money Under 30

How To Pick A Health Insurance Plan Money Under 30

Open Enrollment Is Here.

How do i choose a healthcare plan. Choosing a health insurance plan can be complicated. Think about how many services you and your family may use in a year. Here is a guide to choosing a plan on Healthcaregov.

Choosing between three major types of health plans comes down to personal preferences and choosing a plan accordingly can be cheaper in the long run. Many experts recommend high-deductible plans for healthy people who rarely. Compare types of health insurance plans Youll encounter some alphabet soup while shopping.

With these plans the insurance company will pay for a set portion of your charges and you pay the rest. Add up what your out-of-pocket costs may be for each service. Read the fine print when choosing among different health care plans.

This only applies to the new household member. Current enrollees cant change plans. The average percentage of healthcare expenses that will be paid by the plan.

Your Step-by-Step Guide to Choosing a Health Insurance Plan Step 1. You may also be able to compare plans online. Next Policygenius asks for your household income to see if you qualify for a federal tax credit.

When reviewing each plan. Next enter your zip code select your county and click Find Plans. In general lower premiums are associated with higher deductibles copays coinsurance and prescription drug costs.

Depending where you live you can either use the federal exchanges on. 6 Tips For Choosing A Health Insurance Plan 1 - Figure out where and when you need to enroll. Knowing just a few things before you compare plans can make it simpler.

How to Choose the Right Health Plan Match your consumption to your deductible. Plan categories have nothing to do with quality of care. Choosing a Health Insurance Plan.

Create a Marketplace account or log in To get a Marketplace account call the marketplace on 1-800-318-2596 TTY. Bronze Silver Gold and Platinum. Add up the cost of premiums for the year.

There are 4 categories of health insurance plans. Traditional plans that allow you to go to any doctor or specialist you choose without the need for a referral are called indemnity fee-for-service or point of service POS plans. Therefore whenever you need a specialist you.

If you have physicians and specialists you prefer call their offices to ask if they are in the. If your household size increases due to marriage birth adoption foster care or court order you can choose to add the new dependent to your current plan or add them to their own group and enroll them in any plan for the remainder of the year. That means a lower-premium health care plan may be a good choice for someone with few existing health care needs as they are less likely to require the care that will.

Find your health care style. Do I have the right to go to any doctor hospital clinic or pharmacy I choose. For people who are already enrolled in an ACA.

Also ask a lot of questions such as. If you want to find a health insurance policy with Policygenius heres how it works. The 4 metal categories.

Choosing a health insurance plan to some extent comes down to your risk tolerance. This is the monthly payment you make to your insurer for your health care plan. These plans provide the most flexibility as they do not set restrictions on the providers you can use and generally do not require that you select.

If youre married andor have children think about what your family needs from a healthcare plan. Say you have a high-deductible plan and youre otherwise healthy but have an unexpected medical event. Health management organizations HMOs are essentially low-cost but low-choice health plans.

2 - Review plan options even if you like your current one. Choose your health plan marketplace Most people with health insurance get it through an employer. Check the maximum amount you have to pay for each plan.

Consider your familys needs. You choose a primary care physician PCP who coordinates all of your health care needs. Because coverage can change from year to year its helpful to know what plan s work better for your circumstances.