Does Blue Cross Blue Shield Cover Drug Rehab and Alcoholism Treatment Services. Available in all 50 states Anthem Blue Cross Blue Shield BCBS offers both domestic and international health insurance policies and is.

Effective Bcbs Blue Cross Blue Shield Drug Rehab Coverage American Addiction Institute

Effective Bcbs Blue Cross Blue Shield Drug Rehab Coverage American Addiction Institute

The more nuanced answer is that Blue Cross Blue Shield insurance coverage extends to inpatient rehab for the majority of people they insure but there are restrictions in most cases.

Bcbs drug rehab. Understanding your plan is important before entering a treatment program and can prevent unwanted costs. Find BlueCross and BlueShield Treatment Centers in Georgia get help from Georgia BlueCross and BlueShield Rehab for BlueCross and BlueShield Treatment in Georgia. BCBS owns 36 different insurance providers across the United States that make up the Blue.

Anthem covers a variety of behavioral therapy and mental health treatments. Substance Use Resource Center Blue Cross Blue Shield. Drug Alcohol Rehab With Empire BCBS Insurance At Aspire Health Network we can help people just like you find a substance abuse rehab facility that helps those trying to find a drug and alcohol addiction treatment center that will accept your Empire Blue Cross Blue Shield BCBS health insurance for the type and duration of substance abuse treatment services you need.

Blue Cross Blue Shield is a very common insurance provider that is accepted at many drug rehab facilities including us at American Addiction Institute of Mind and Medicine. For example a large percentage of those insured by BCBS have an HMO. The Substance Use Resource Center is a publicly-available national resource designed to support people seeking substance use treatment and recovery services.

Withdrawal symptoms vary depending on the substance how long the person has been using the average dose used the individuals physiology etc. 1 Blue Cross Blue Shield BCBS Health Plans provide coverage to one. Blue Cross started in 1929 as a plan to make healthcare affordable for Baylor University hospital patients.

Use 24-hour helpline to Find Rehabs That Accept Your BCBS Policy. If youre reading this page then chances are you or a loved one are battling with addiction have a Blue Cross Blue Shield policy and are looking for help. Some insurance plans cover Blue Cross Blue Shield alcohol rehab or drug rehab.

However the amount of coverage and services covered will vary by plan. Because BCBS contains so many individual companies it is common for. Alcohol and drug rehab programs and addiction treatment services are covered by Blue Cross Blue Shield plans.

1 These two plans spread rapidly and merged in the 1940s. This resource is open to everyone regardless of their insurance status. A high number of rehabilitation facilities across the country accept BlueCross BlueShield BCBS insurance for all types of substance abuse treatment services.

However the extent of the coverage depends on the patient and their insurance plan. The simple answer is yes Blue Cross Blue Shield rehab coverage includes inpatient drug rehab. Blue Cross Blue Shield is a subsidiary of Anthem Inc one of the leading health insurance providers in the US.

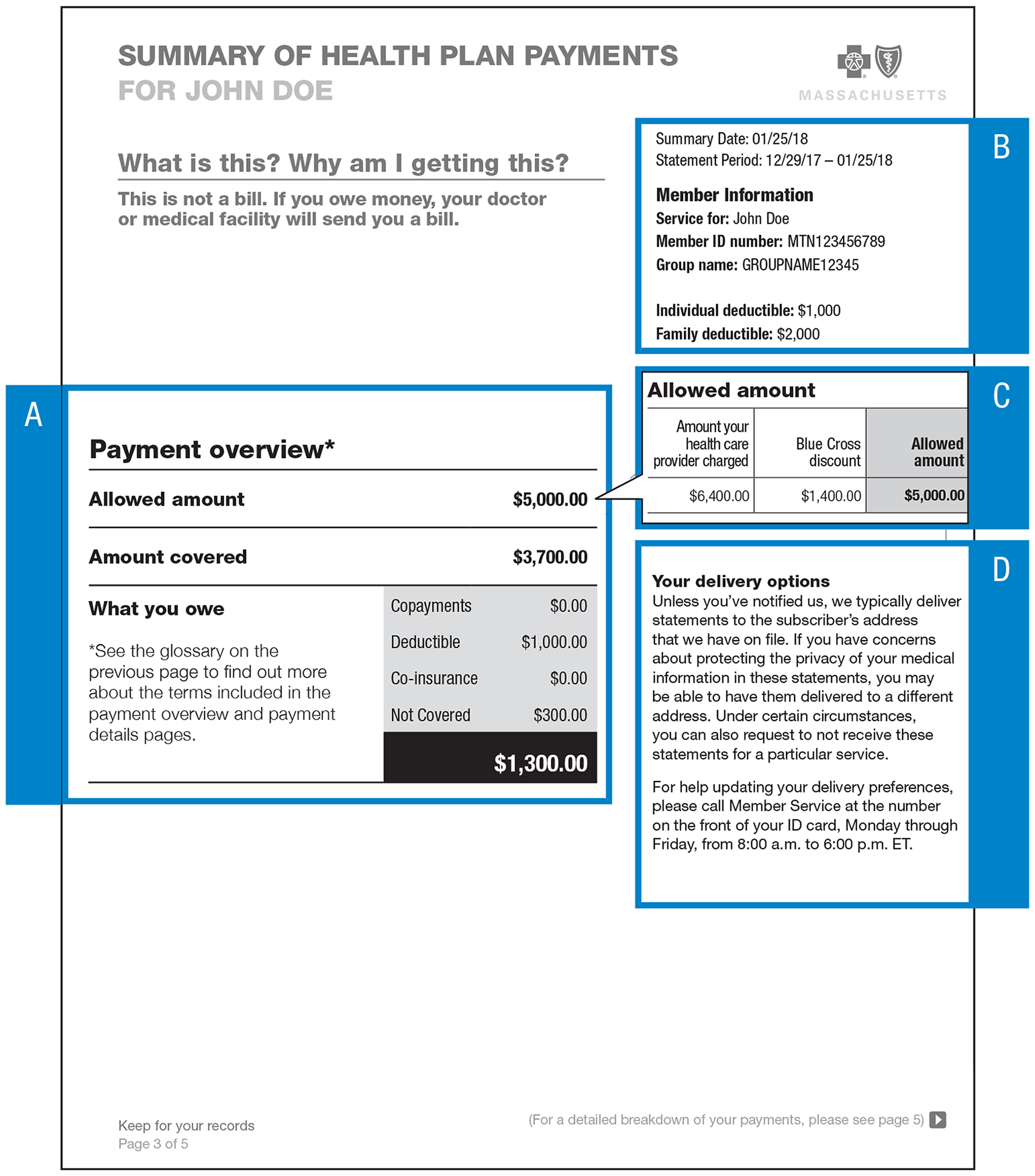

What all is covered by your Blue Cross Blue Shield medical insurance can vary depending on what state your plan is from and the individual policy plan that you have. Using your Blue Cross Blue Shield insurance to help pay for a drug or alcohol rehab program can ease the financial stress of treatment. One of the main concerns for people considering alcohol and drug treatment is the overall cost.

Individuals using their Blue Cross Blue Shield insurance plan to pay for the cost of rehab will enjoy greatly reduced costs and may even see the entire stay covered by BCBS. The Substance Use Resource Center connects individuals as. Does Anthem BCBS Cover Drug Rehab.

The short answer is yes but coverage plans and tiers may vary. Blue Cross Blue Shield does generally cover drug rehab. Blue Cross Blue Shield has been providing millions of people with insurance coverage for over 80 years.

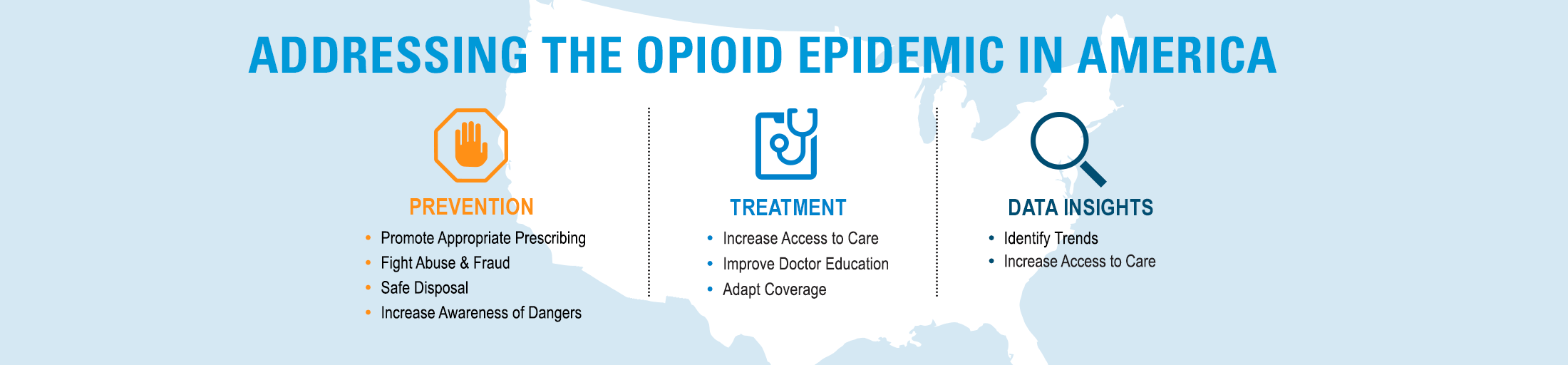

Since 2017 when President Donald Trump declared the Opioid Epidemic a National Crisis there has been an increase in addiction resources provided to BCBS Members. While we help people nationwide with many different types of BlueCross BlueShield plans. These resources are in place to assist members in identifying and finding help for substance abuse problems.

BCBS drug rehab coverage provides for inpatient and outpatient programs either partially or in full. They may offer coverage for luxury private or executive treatment plans depending on your policy. During the detox phase your body adjusts to the lack of alcohol or other substances to which it had become dependent on.

BCBS Covers Substance Abuse Mental Health Treatment For A Better Life. Click Here for a confidential benefits check or call 866 578-7471 to speak to a addiction specialist. Does Blue Cross Blue Shield cover drug rehab services.

1 Blue Shield had a similar start offering health services to workers in exchange for a monthly payment. Find BlueCross and BlueShield Treatment Centers in Memphis Shelby County Tennessee get help from Memphis BlueCross and BlueShield Rehab for BlueCross and BlueShield Treatment in.

/https://www.thestar.com/content/dam/thestar/life/2017/01/31/dont-worry-you-can-still-get-an-iud-in-canada-if-you-have-insurance/copper-iud-photo.jpg)