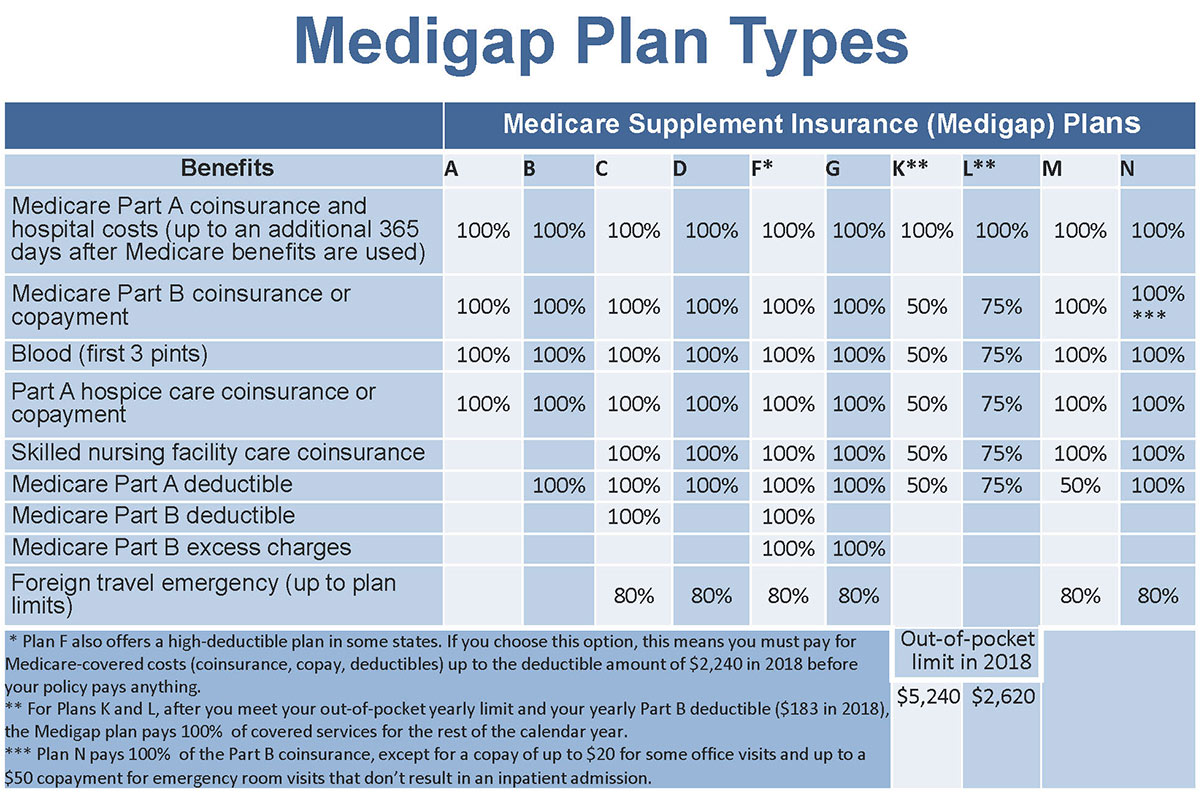

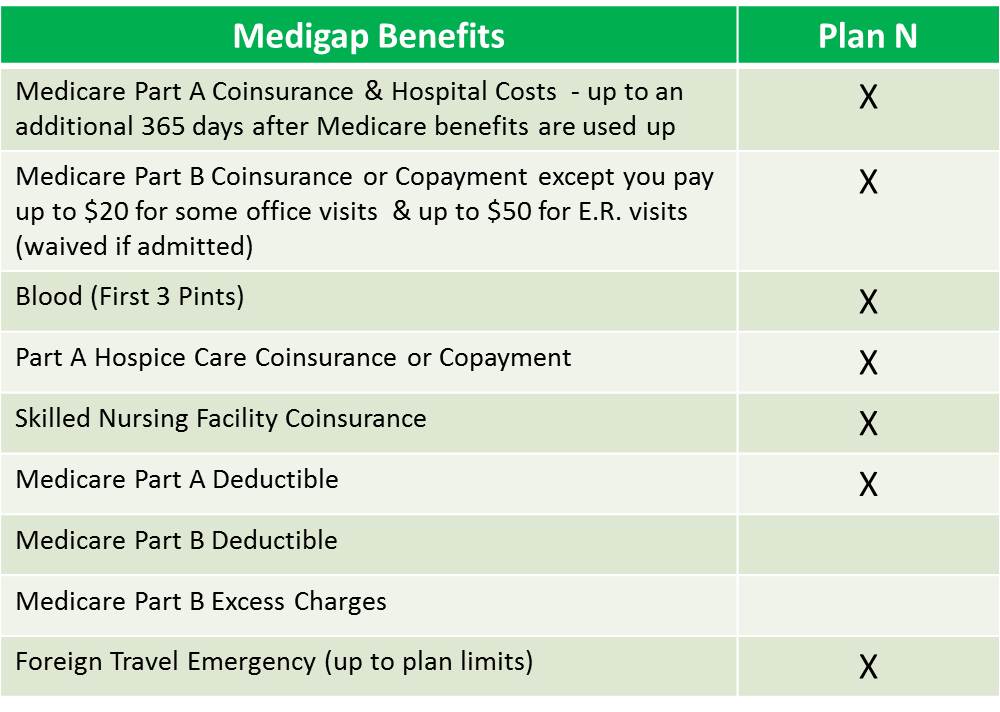

All of these packages include vision coverage except the Premium Plus Dental Plan and some cover other additional benefits such as support resources for older adults. 500 1000 or 1250.

Https Www Mtda Com Documents Indvanthempresentation Pdf

Anthem Blue Cross and Blue Shield is a Medicare Advantage plan with a Medicare contract.

Anthem senior premium plus dental. Senior Premium Plus Dental 25 43 38 61 56 1848 3148 4666 About the dental benefits. This information is not a complete description of benefits. Anthem will pay an allowance toward.

Anthem Extras Packages or Premium Plus Dental can be purchased with one of our Medicare Supplement plans but we do not require membership in these plans to enroll. PREMIUM PLUS DENTAL ONLY includes. EN 1662001ANSI ISEA Z87 1-2015.

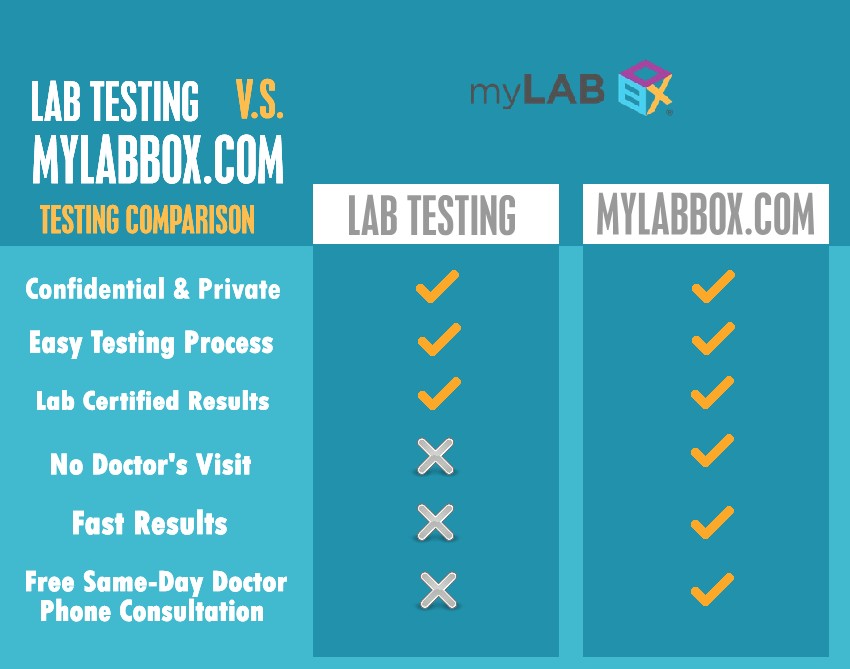

Enrollment in Anthem Blue Cross and Blue Shield depends on contract renewal. Comprehensive dental More robust vision plan SilverSneakers Travel Assistance. Our plans cover preventive care like regular cleanings exams and X-rays and also procedures like fillings crowns and root canals.

These packages come in a range of levels from those that focus on routine care to those that pay for procedures you dont have regularly such as fillings periodontal services root canals extractions crowns bridges and dentures. Ted gets a crown from an out-of-network dentist who charges 1200 for the service and bills Anthem for that amount. Standard Premium Premium Plus DENTAL.

If you currently have or are enrolling in a Medicare Advantage plan please see our Optional Supplemental Benefit plans which are similar to Anthem. The next package is called premium plus. To be eligible for enrollment you must be 65 years of age or older.

Senior Premium Plus Dental Only Senior Premium Plus Dental with Vision Senior Premium Dental with Vision Senior Standard Dental with Vision Dental coverage Network Dental Blue 200 Dental Blue 200 Dental Blue 200 Dental Blue 200 500 1000 1250 1250 Annual maximum benefit per member per benefit year Annual deductible No deductible 501 501 501 100 covered when dentist. Network of Dentists Dental Blue 100 network. Anthem is a registered.

Premium Plus Package covers all your diagnostic and preventive dental care. Preventive dental coverage for fillings periodontal services root canals and extractons Standard vision plan SilverSneakers in most states PREMIUM PLUS - our most robust package includes. Dental benefits range from basic to more comprehensive.

Premium Plus 1148 Disposable Face Shields. Anthem Blue Cross and Blue Shield is a DSNP plan with a Medicare contract and a contract with the state Medicaid program. Find affordable dental insurance plans that are easy to smile about with Anthem.

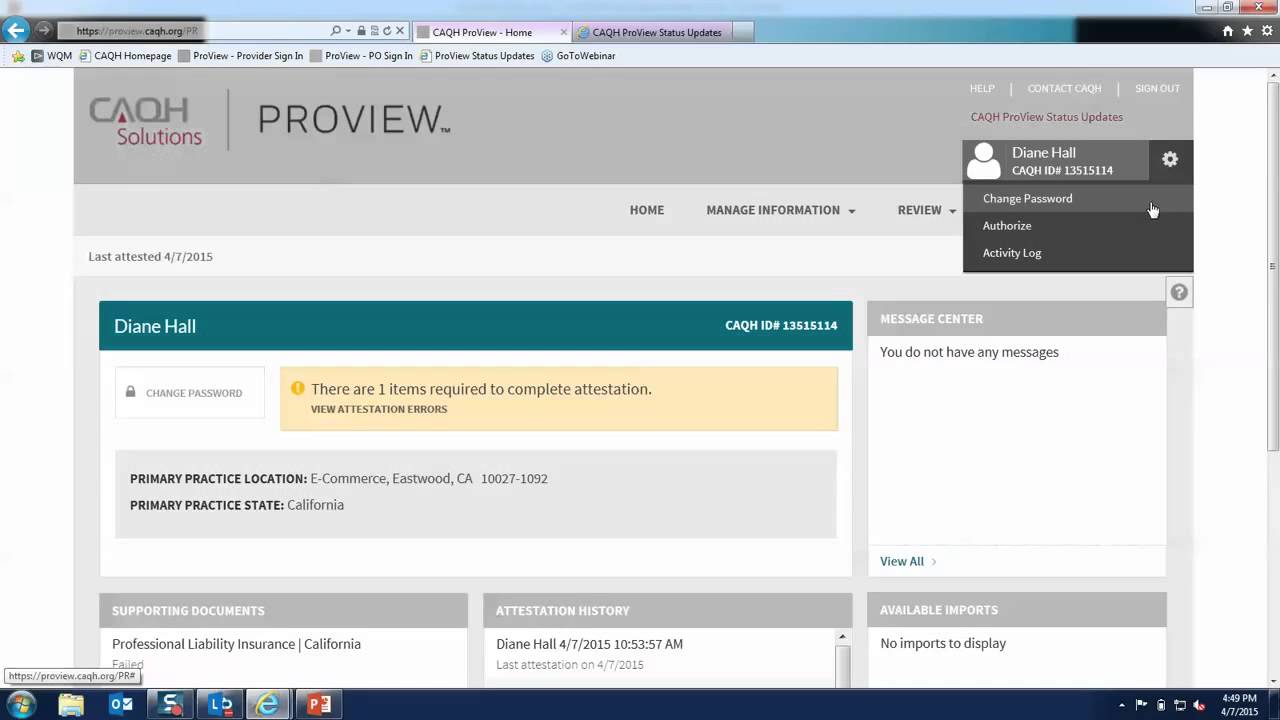

Secure Employer Access to Claims. HMO products underwritten by HMO Colorado Inc. Anthem Extras Packages or Premium Plus Dental can be purchased with one of our Medicare Supplement plans but we do not require membership in these plans to enroll.

Lightweight and comfortable with no pressure on temples. Serving all of Virginia except for the City of Fairfax the Town of Vienna and the area east of State Route 123. Senior Premium Plus Dental with Vision Senior Premium Plus Dental only.

Alle Kategorien Apex Finder Applitiersysteme Anmischhilfen Einmalkanülen Kanülensammler Einmalmundspülbecher Masken Mechanische Kühlsysteme Polierbürsten Polierer Poliernäpfe Polymerisationslampen Prophy Angles Seide Nahtmaterial Sterilisation Turbinen. 50 of crowns dentures and bridges. All plans utilize the Dental Blue 100 network and have in-network and out-of-network benefits at the same level though there could be balance billing with out-of-network providers.

Anthem Blue Cross and Blue Shield is the trade name of Anthem Health Plans of Virginia Inc. If you have serious dental problem it is recommended that you pick this package so that you can avoid more dangerous dental problems in the future. With the package you can get a lot of dental benefits.

It means that this Anthem dental insurance for seniors. You will get comprehensive dental treatments. Premium Plus the most robust package featuring comprehensive dental a more robust vision plan SilverSneakers and medical coverage for those who encounter a medical emergency while traveling In.

Annual Maximum Benefit Options. Annual Deductible 0 to 50. Dental Prime and Complete Login.

Plus learn about the importance of coverage for your whole family and our dental plan options that cover children orthodontics and dentures. Anthem Life - Compassi. Senior Premium Plus Dental Only Dental Blue 200 1250 501 100 covered when dentist is in your plan 80 you pay 203 50 you pay 504 50 you pay 504 504 Not included Not included Not included Not included Not included 41 9 You may choose traditional or disposable lenses instead of eyeglass lenses.

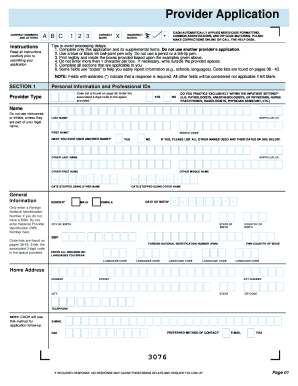

Anthem Extras Packages Dental Understanding costs for out -of-network services Here is an example of how the math could work for a Premium Plus member who receives a crown from an outof- -network dentist. Premium Plus Dental Plan Dental Only Dental care is important to your overall health To be eligible for enrollment you must be 65 years of age or older. Anthem Blue Cross and Blue Shield is the trade name of.

Protection against droplets and splatters optically clear plastic shield. The dentists in the network are all experts in the field. Enrollment in Senior Care Plus depends on contract renewal.

Independent licensee of the Blue Cross and Blue Shield Association. Available in some states. 80 of minor restorative services after a 6-month waiting period.

Contact the plan for more information. Limitations copayments and restrictions may apply. Rocky Mountain Hospital and Medical Service Inc.

Some plans include vision coverage for Medicare-eligibles. Anthem Extras Packages are not available to members of Medicare Advantage plans. Anthem Life Resources Anthem Life Resources.

Senior Care Plus is a Medicare Advantage organization and a stand-alone Prescription Drug Plan with a Medicare contract. PREMIUM - our medium package includes. Routine Cleanings Exams X-rays 100 covered when using a contracted dentist 2 cleanings per year Fillings 80 coverage Premium Premium Plus packages.

Benefits formulary pharmacy network premium. Plans and Services Plans and Services.